Chart of the day - USDJPY (15.04.2024)

Today, the Japanese yen is again the weakest currency among the G10, falling to new record lows. At the time of publication, losses on the JPY range from 0.5% to even 0.9% for most major currency pairs. USDJPY is up 0.50% to 153.800. Last week's gains on USDJPY were driven by a significant strengthening of the dollar. However, today the dollar has slowed its gains, while the yen has accelerated its declines, continuing the rise on the USDJPY pair.

Last week, Japanese Finance Minister Shunichi Suzuki emphasized that authorities are closely monitoring the yen's decline and the underlying factors of these movements, highlighting Tokyo's readiness to counter any excessive fluctuations. Suzuki stressed the importance of stable exchange rates that reflect economic fundamentals and indicated that Japan would take appropriate actions against excessive volatility, not ruling out any options.

However, the market has already become immune to the numerous verbal interventions by Japanese officials in recent times. Although the potential for intervention remains, its impact is limited due to the lack of a specific action plan from the BoJ and the government. The persistent weakness of the yen poses a serious challenge for the Japanese economy, impacting import costs and household expenditures.

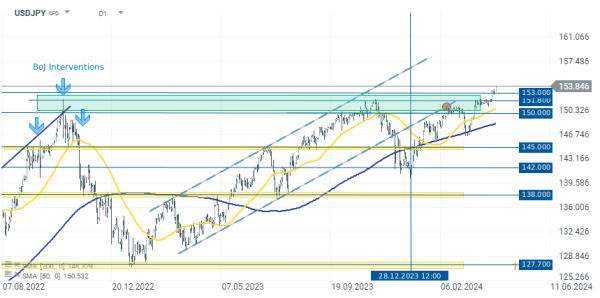

USDJPY (D1 interval)

The USDJPY rate is dangerously close to the 154.000 level. The rise on the currency pair accelerated when it broke through the last resistance level around 151.800. Below this level, we observed consolidation in recent weeks, and its final breakthrough suggests the strength of the bulls and the potential for further increases. The area around the 151.000-152.000 zone has been tested three times over the past 3 years. Currently, the next growth range could be the 154.000-155.000 level. However, in case of a pullback, the aforementioned resistance level of 151.800 should be kept in mind.

Source: xStation 5