Chinese Yuan’s Double Whammy - Dollar Strength and Yen Weakness

What happened?

- The People’s Bank of China (PBoC) set its USDCNY reference rate (the mid-point at which the onshore yuan is permitted to trade) at its highest since March 1.

- This followed a similar move on March 22, when the USDCNY midpoint was fixed above 7.10.

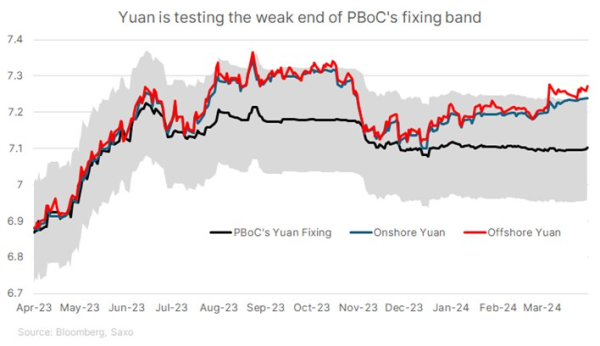

- PBoC’s USDCNY midpoint determines the band in which onshore yuan (CNY) is allowed to trade. The trading band is set at +/- 2%, meaning the yuan could appreciate or depreciate by a maximum of 2% from the midpoint during a single trading day.

- Setting a higher midpoint means PBoC is allowing the yuan to trade weaker.

- This prompted yuan to fall today. USDCNH rallied to 7.2831 and USDCNY touched 7.2405.

- This prompted intervention to support the yuan, conducted through Chinese State Banks selling USDCNY.

- Following a similar move of higher fixing earlier on March 22, we wrote this article where we discussed that the yuan bears have continued to test the patience of China authorities.

- As seen in the chart below, offshore yuan has been trading weaker than the band steadily since March 22, while onshore yuan trades close to the weak end of the band.

- USDCNH however retreated today after an initial jump to 7.28, as yuan was supported by intervention

- China’s Q1 GDP came out strong on the headline at 5.3% YoY (vs. 4.8% expected and 5.2% prev), but details were weak

- Industrial production and retail sales for March much weaker than expected, suggesting that more stimulus will be needed.

What does it mean?

- On the economy, key driver is still external demand, consumption and property sector remain key challenges.

- In order to drive exports, Chinese authorities will need to keep yuan stable-to-weak, rather than let it strengthen.

- Meanwhile, unrivalled dollar strength is putting pressure on yuan and making it difficult for Chinese authorities to defy gravity.

- Yen weakness is another reason why China cannot let yuan strengthen. Weaker Japanese yen makes Japanese exports more competitive in export markets relative to China. CNHJPY is key to monitor for this, and a break above 21 is a red flag.

Could we see a yuan devaluation?

- In August 2015, China devalued the yuan in a move that rippled through global markets, as policy makers stepped up efforts to support exporters and boost the role of market pricing. The central bank cut its daily reference rate by 1.9 percent, triggering the yuan’s biggest one-day drop since China ended a dual-currency system in January 1994. The People’s Bank of China called the change a one-time adjustment and said its fixing will become more aligned with supply and demand.

- It is worth considering whether another such move may be likely, given the pressure on the Chinese economy and export being a key engine driving growth for now. Domestic price pressures also remain at bay, suggesting a weaker currency wouldn't hurt consumers too much.

- However, Chinese policymakers are trying to steer global consumers away from the notion that made-in-China is simply cheaper, hence more attractive. Authorities also likely want to avoid exacerbating capital outflows, and hurting investor and consumer confidence further. This could mean a competitive devaluation is avoided. However, steadily higher midpoint fixings for USDCNY can make the yuan weakness more orderly.

Spillover effects of a weaker yuan

- Risk-reward remains titled towards further weakness in Chinese yuan after it has traded steadily for four months.

- USDCNH could rise towards 7.30 if weak CNY fixings continued.

- CNHJPY is likely to revert to sub-21 handle.

- Positioning for a weak yuan in light of the US election risk is also interesting, especially as it provides a positive carry.

- A weaker yuan could add further fuel to the dollar fire, and make dollar gains more durable.

- This could be negative for emerging Asia currencies such as KRW and THB.

- Commodity and China-dependent AUD may also be at risk if yuan weakness extends further.

- A spike in yuan volatility would also likely disrupt carry trades – where investors borrow in low-yielding currencies to invest in higher-yielding ones, typically in emerging markets. An ideal funding currency is one with low volatility and relative stability – both of which are satisfied by the yuan, but that may not be the case for much longer.

-----------------------------------------------------------------------

Other recent Macro/FX articles:

16 Apr: Global Market Quick Take - Asia

12 Apr: Riding the Fed-ECB Policy Divergence

12 Apr: Global Market Quick Take - Asia

11 Apr: ECB rate decision: How to trade the event

9 Apr: CAD vulnerable as market underprices dovish Bank of Canada risks

9 Apr: US inflation report: How to trade the event

8 Apr: Macro and FX Podcast: NFP, CPI, ECB and Japan

8 Apr: Weekly FX Chartbook: US CPI, geopolitics and dovish pivots from ECB and Bank of Canada in focus

3 Apr: Chinese yuan bears are undeterred by PBoC’s grip

25 Mar: Macro & FX Podcast: Swiss central bank surprises; PCE and China

25 Mar: Weekly FX Chartbook: The return of US exceptionalism

22 Mar: Swiss National Bank’s bold move will kickstart the G10 rate cut cycle

20 Mar: Thematic Podcast: Japan's route to abolish negative interest rates

20 Mar: Japan’s exit from negative rates: Implications for the economy, yen and stocks

19 Mar: FOMC rate decision: How to trade the event

18 Mar: Macro & FX Podcast: Central bank meetings all over

18 Mar: Weekly FX Chartbook: Heavy central bank focus as FOMC, BOJ, BOE, SNB, RBA meet

14 Mar: FOMC vs. BOJ: Who moves the Yen?

12 Mar: Dampening equity sentiment could test GBP resilience

11 Mar: US inflation report: How to trade the event

6 Mar: Bitcoin fever is running high, again

5 Mar: FX & Macro Podcast: US jobs data, China's "Two Sessions" & Super Tuesday

28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

23 Feb: Nvidia momentum spills over to FX markets

21 Feb: Central bank divergence on the radar: Hawkish RBNZ, Dovish BOC and SNB

15 Feb: Swiss Franc’s bearish view gets more legs

14 Feb: Sticky US inflation could make dollar strength more durable

9 Feb: Japanese Yen is throwing a warning

8 Feb: FX 101: USD Smile and portfolio impacts from King Dollar