CleanSpark gains 7%; what does the Bitcoin halving mean for mining companies? 📌

The Bitcoin halving will take place in just a few hours. On one hand, for investors in the cryptocurrency market, this could be positive news as the supply of new Bitcoin entering the market will be halved in the long term. On the other hand, this is bad news for companies involved in Bitcoin mining.

Bitcoin's computational power has grown so large that companies engaged in it professionally can count their revenues in tens of millions of dollars. The Bitcoin halving is a very important event for them and it is hard to find similar examples in regular business. Overnight, potential company revenues from each block drop by half, since each subsequent block rewards will be cut in half. Therefore, companies must gather sufficient financial reserves to maintain liquidity after the halving.

CleanSpark (CLSK.US) is one of such companies. CleanSpark focuses on managing data centers for mining Bitcoins, mainly using low-emission energy. The company has been performing better than its competition in recent weeks, which may indicate that investors see greater potential in it after the halving. The upcoming Bitcoin haliving poses both a challenge and an opportunity for miners like CleanSpark. Reduced block rewards mean that only the most efficient operations will thrive post-halving.

In recent quarters, CleanSpark has conducted a series of significant investments and secured its financial position by accumulating a large cash position. Recently, the company:

-

Expanded its operations with significant acquisitions of Bitcoin mines in Mississippi and Georgia. The company concluded final agreements to acquire three ready-to-operate BTC mining facilities in Mississippi for $19.8 million.

-

The company is expanding its operations in Dalton by acquiring a third mining facility, which is currently under construction, for an initial payment of $3.4 million.

Summary of results from the last quarterly report:

- Revenue: $73.8 million

- Net income: $25.9 million

- Adjusted EBITDA: $69.1 million

- Total current assets: $181.7 million

- Total mining assets: $484.0 million

- Total assets: $862.7 million

- Current liabilities: $42.4 million

- Total liabilities: $52.2 million

- Debt: $14.5 million

In the competitive landscape, CleanSpark has successfully outpaced Riot Platforms in terms of realized hashrate and currently remains only behind giants like Marathon Digital and Core Scientific.

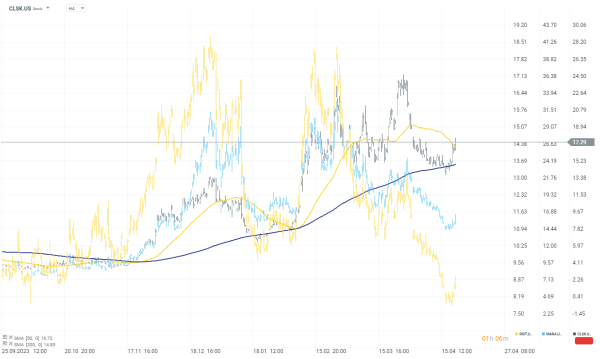

CleanSpark (H4 interval)

The company's shares have recently fallen nearly 45% from mid-March highs. However, as we can see on the chart, its competitors (RIOT.US, MARA.US) have fared even worse during this period. Today, thanks to a rebound in the price of Bitcoin, companies from this sector are bouncing back.

Source: xStation 5