CME Group shares near 52-week highs driven by Citi recommendation 📈

Shares of Chicago-based Chicago Mercantile Exchange Group (CME.US), which runs futures exchanges such as the CME, CBOT, and NYMEX, have been on a strong upswing; the company's stock price had been somewhat stagnant until recently, but has risen nearly 15% in recent weeks, reaching record levels since April 2022. The target price today was raised by Citigroup analysts, to $250 per share, up from $240 previously, while maintaining a Buy recommendation. Recently, CME itself indicated that it is very pleased with investor activity in new products, including those based on Bitcoin, and expects a positive contribution to earnings, from them.

- The bank indicated that the CME is reporting significant growth in trading volumes, with total average daily volume (ADV) for Q2 at 28.3 million, up 27% year-on-year; ADV fees were up 37% year-on-year. Activity is increasing across the exchange's portfolio, from agricultural commodities to interest rate and index contracts.

- Citi says that with current geopolitical uncertainty, upcoming elections and the direction of Federal Reserve policy, the outlook for CME remains good. The company's diversified asset portfolio and deep liquidity are seen as key advantages that allow it to maintain a significant market advantage. On the other hand, there is some pressure from rival FMX, backed by BlackRock and Citadel, but the negative aspect resulting from this is already expected to be captured in the current share price.

- CME Group achieved a record international ADV of 8.4 million contracts in the last quarter; competing with the LME in contracts for raw materials used in car batteries (cobalt and lithium) and alloy contracts. RBC Capital analysts have been somewhat less optimistic recently, pointing to the risk of FMX 'taking' market share.

Source: xStation5

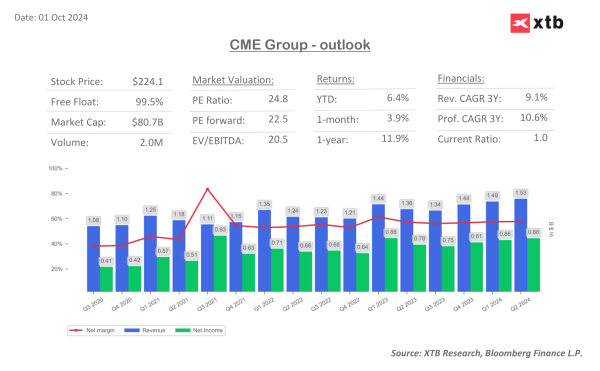

CME Group financial valuation dashboards

CME shares are valued at a relatively small premium to the S&P 500 average (p/e around 24 and 22 p/e forward), while historically the ratio has tended to remain higher, while the company is currently seeing improved net profits and benefiting from higher market volatility, which implies increasing hedging demand and overall trading activity. The main threat comes from FMX, which is likely to 'gobble up' some of the trading activity related to bonds and interest rates, starting this fall.

Source: XTB Research, Bloomberg Finance L.P._917cb5e835.png)

Source: XTB Research, Bloomberg Finance L.P.