COCOA rallies 5% despite higher farm-gate prices and supply revival in Brasil

Cocoa prices came back above $10,000 a ton, leading to huge short positioning liquidation. Price rally is still driven by concerns about shrinking global cocoa supplies, but in general risk-appetite among speculators is high, leading to strong positioning on some commodities such cocoa and in last days, also copper. West African cocoa suppliers may default on supply contracts, as the worst supply shortage in 40 years persist.

- As for now, still lower cocoa production in the Ivory Coast, the world's largest producer, is the biggest trend driver. Last data from the country showed that farmers shipped 1.3 MMT of cocoa to ports from October 1 to April 7, down by 27.8% YoY.

- Ecom Agroindustrial expects Ivory Coast 2023/24 production (until September) will fall -21.5% YoY (to an 8-year low of 1.75 MMT). Even higher future supply expected from Brasil didn't stop surge in cocoa prices. The reason of it it's probably due to long period of time needed for Brasil production revival.

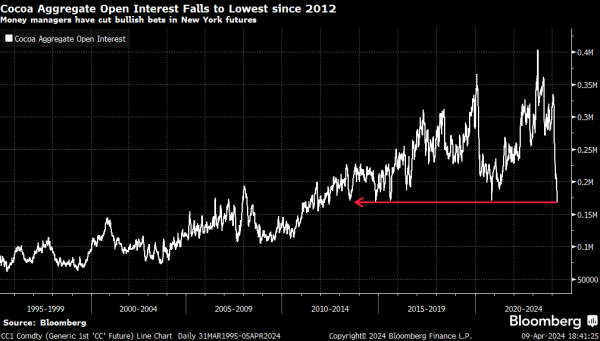

Fund managers cut cocoa bullish positions, but prices are surging despite that. Source: Bloomberg

Fund managers cut cocoa bullish positions, but prices are surging despite that. Source: Bloomberg

Complicated market

- Ghana's Cocobod said on March 25 that harvest will be only 422,500 MMT to 425,000 MT. It's only half of the country's first forecast and a 22-year low. Reasons of it are weather conditions and disease attacking crops. Also, low cocoa exports from Nigeria (world's fifth-largest producer) are bullish. Nigeria's Feb cocoa exports fell -18% YoY to almost 26,100 MT.

- Projections for the Ghana mid-crop, starting in July, have been cut to 25,000 MT compared with an earlier forecast of 150,000 MT. Ivory Coast cocoa regulator said on March 7 that it expects the Ivory Coast mid-crop, which officially starts in April, to fall -33% to 400,000 MT from 600,000 MT last year. In addition, projections for Nigeria's mid-crop have been reduced to 76,500 MT from an earlier estimate of 90,000 MT.

- Ivory Coast government wants to boost farm-gate prices for cocoa producers by 50% for mid-crop beans. Also Ghana boosted farm-gate prices by 58% for the rest of the 2023/24 season. The hike in the prices that governments pay to cocoa farmers should encourage growers hoarding cocoa to deliver more beans to market, which could temporarily ease tight supplies. Despite this fact, ICE cocoa inventories held in U.S. ports fell to a 3-year low of 4,054,349 bags on March 18.

- Despite higher farm-gate prices, a global deficit is expected to extend into 2023/24 since current production is insufficient vs demand. El Nino event in 2016 caused a drought that fueled a rally in cocoa prices to a 12-year high. Market will play out scenario of such risk again.

Source: xStation5