Aaron Hill

Financial Analyst

Happy Fed Day!

Markets and economists forecast that the FOMC will leave the Fed funds target range unchanged at 5.2...

8 months agoEUR/USD Ahead of Euro Area Inflation Release

ECB Dovish StanceRecently, the ECB adopted more of a dovish stance.ECB President Christine Lagarde noted that the eurozone’s economy is in a disinflationary process and added that inflation is ‘making good progress’. Lagarde added that they are confident...

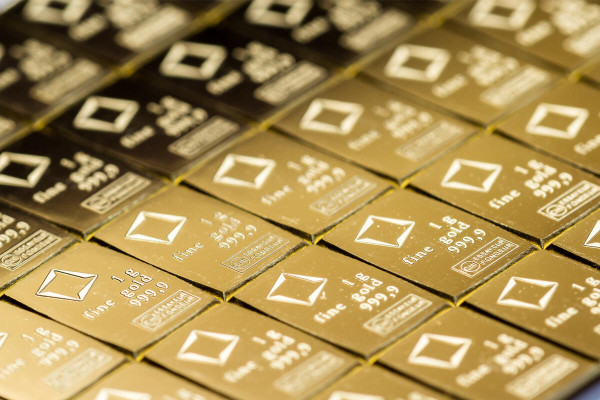

6 months agoIs There Any Stopping Gold?

The spot price of gold (XAU/USD) concluded another week in positive territory, adding +4.3% and refreshing record pinnacles at $2,330/ounce amid expectations of lower rates this year, geopolitical tensions and speculative buying.There’s no denying that th...

6 months agoUSD/JPY On the Verge of Hitting Multi-Decade Highs

You will recall that the Bank of Japan (BoJ) increased its Policy Rate to +0.00%/0.10% in March, pulling the rate out of negative territory. While many, including the Research Team at FP Markets, expected the Japanese yen (JPY) to rally on the back of thi...

6 months agoECB and US CPI in the Headlights This Week

Last week ended with the US Employment Situation Report. Markets witnessed a monster beat for employment growth; the US economy added more than 300,000 jobs in the month of March versus a median estimate of 210,000 (prior data: small downward revision fro...

6 months agoKey Event Risk of the Week: Markets Eyeing US CPI Inflation

Market ConsensusYear on yearHeadline: Estimate: 3.4%; Previous: 3.2% (Estimate Range: 3.5% High; 3.1% Low)Core: Estimate: 3.7%; Previous: 3.8% (Estimate Range: 3.8% High; 3.5% Low)Month on monthHeadline: Estimate: 0.3%; Previous: 0.4% (Estimate Range: 0.5...

6 months agoWeek Ahead: Data from the US, UK and Canada in Focus

It was quite the week!Top of the bill last week, of course, was the stronger-than-expected US CPI inflation print, which, immediately following the release, underpinned the dollar and US Treasury yields, as well as pushed spot gold (XAU/USD) and US equity...

6 months agoGBP/USD on the Radar This Week

Sterling ended the week considerably lower against the US dollar, recording its largest one-week decline since July 2023 (-1.5%).In light of the slew of UK economic data on the docket this week—wages, CPI inflation and retail sales—this will be a particul...

6 months agoS&P 500 on Track to Snap Five-Month Bullish Phase

The S&P 500 finished another week in negative territory, shedding -1.6% (-2.5% MTD). While it is clear that this market remains the domain of buyers, 90% of the upside in March has been reclaimed, and evidence is building for a deeper correction.Deepe...

6 months agoDeeper Correction Likely for XAU/USD This Week

Another week, another record high for the precious metal.The spot price of gold (XAU/USD) refreshed all-time highs at $2,431 last week, strengthened by expectations of US rate cuts, safe-haven demand amid geopolitical tensions in the Middle East and centr...

6 months agoUK CPI Inflation Data Ahead: Sterling Hovering North of Key Support

Following today’s mixed bag of employment and wages data, tomorrow’s attention is directed to the March UK CPI inflation release, scheduled to air at 7:00 am GMT+1.Estimates Suggest Further DisinflationBoth headline and core (excludes food, energy, tobacc...

5 months agoWeek Ahead: US GDP and PCE Numbers Take Centre Stage

The path for future interest rates in the US remains uncertain, with some Fed officials even talking about the possibility of rate hikes if inflation continues to increase. From six rate cuts to less than two (-39bps), the hawkish repricing in the swaps m...

5 months agoDollar Index In View Ahead of Data

Ahead of this week’s US GDP first estimate print and the PCE Price Index numbers, the US Dollar Index will likely be a watched market.Buyers remain firmly at the wheel. YTD, we are nearly +5.0%, with April on track to close higher for a fourth consecutive...

5 months agoWTI Oil in Focus This Week

Amid tensions in the Middle East, potentially disrupting oil supplies, the oil complex is an interesting market to keep an eyeball on at the moment. As of writing, escalation between Iran and Israel has been limited following attacks from both sides earli...

5 months ago