InstaForex Marek Petkovich

Oil at $100 per barrel: How soon?

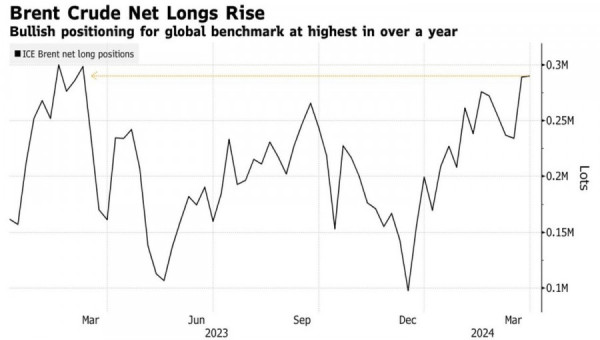

The dam has burst - and the elements can no longer be stopped. After breaking out of the consolidation range of $75-84 per barrel, Brent is growing like wildfire. Since the beginning of the year, the North Sea grade has already gained 14% thanks to increa...

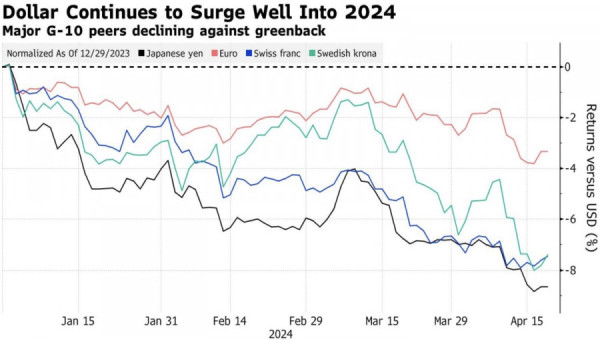

6 months agoThe dollar has laid out its trump cards, it's now the euro's turn

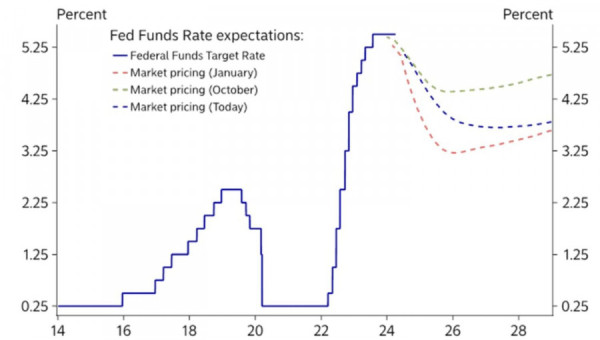

Tug of war. This is what the doves and hawks of the ECB are engaged in. This is what EUR/USD is involved in. On the side of the U.S. dollar are fewer expected rate cuts to the federal funds rate in 2024 than investors anticipate, a stronger U.S. economy,...

6 months agoDollar spreads its wings

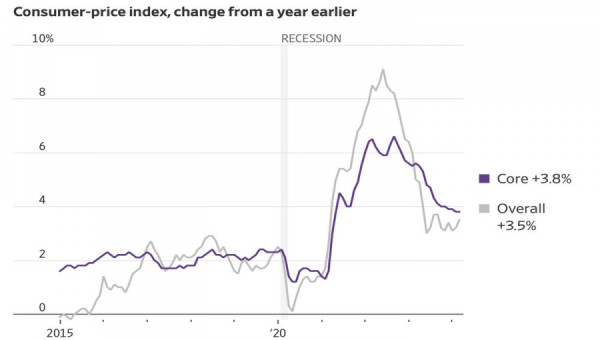

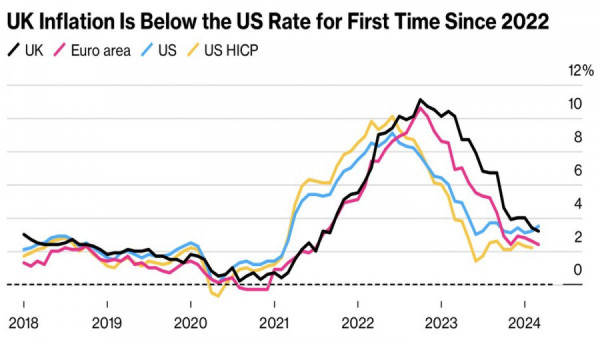

The EUR/USD fell after the U.S. inflation report showed that consumer prices picked up for the third consecutive month. The Consumer Price Index rose 0.4% from the previous month and the all-items index was up 3.5% over the last 12 months, both exceeding...

6 months agoWill gold undergo a correction?

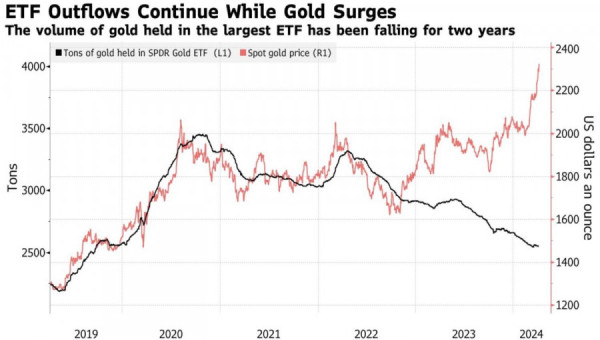

If everyone is selling, someone is buying. Capital outflow from gold ETFs amid a strong dollar and rising yields of U.S. Treasury bonds is gaining momentum. However, the precious metal doesn't tire of rewriting historical highs and has surged 18% since mi...

6 months agoECB threw a lifeline to the euro

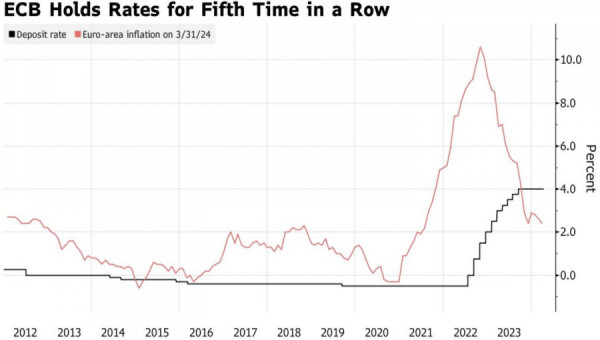

The European Central Bank (ECB) decided not to kick the fallen euro and kept the deposit rate at 4% at the fifth consecutive Governing Council meeting. This did not come as a surprise to the financial markets as the day before, only 1 out of 62 Bloomberg...

6 months agoBitcoin will thrive during supply crisis

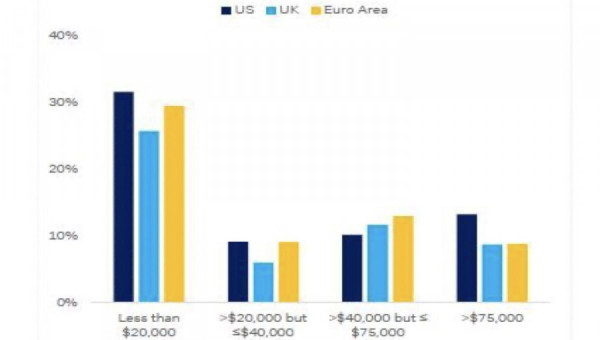

What will happen with Bitcoin? The answer to this question depends on whether you have this cryptocurrency in your wallet or not. According to a survey of 3,600 consumers conducted by Deutsche Bank, by the end of this year, BTC/USD quotes will fall below...

6 months agoEuro will return to parity

From 1.20 to parity. The euro started 2024 from the $1.10 mark after an impressive 5.6% rise in the fourth quarter. Among the bulls on EUR/USD, there was euphoria associated with expectations of 6-7 rate cuts by the Federal Reserve. It was believed that t...

6 months agoThe dollar has not reached its potential

What is permissible for Jupiter may not be permissible for a bull. In the updated forecasts of Wall Street Journal experts, the figure of 2.2% for the U.S. GDP in 2024 is mentioned. European Central Bank specialists surveyed believe that the eurozone econ...

6 months agoWill the euro manage to save itself?

The euro managed to find its footing thanks to positive macro data from Germany, doubts among European Central Bank officials about monetary policy easing, and revisions by major banks to forecasts regarding the scale of the ECB's rate cut cycle. The clos...

5 months agoWill the euro take a risk?

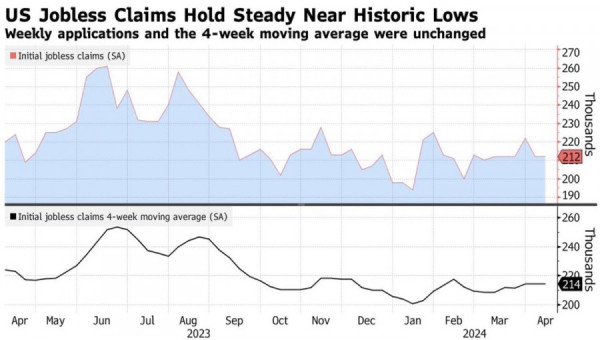

The IMF raises its GDP forecast for the US economy for 2024 by a significant 0.6 percentage points, to 2.7%. Goldman Sachs highlights the US as the only G10 nation where inflation is accelerating, suggesting potential for continued growth in the USD. Amer...

5 months agoThe dollar is in control

The more we hear positive news from the US economy, the more the market becomes convinced that EUR/USD is moving towards parity. Societe Generale says that if the Federal Reserve does not lower the federal funds interest rate in 2024, the currency pair wi...

5 months agoThe dollar is armed

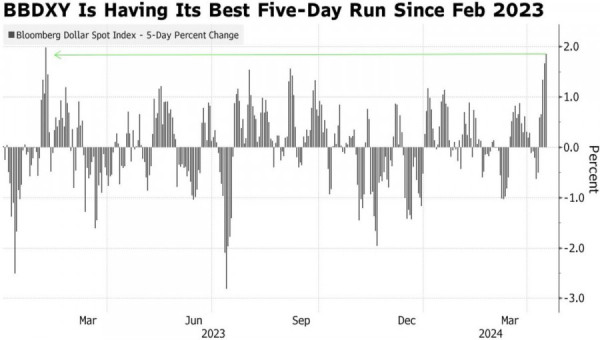

Highest yields and demand for safe haven assets. These are the two key ingredients for a stronger USD in 2024. At the beginning of the year, few believed that the USD index could rise. By the end of April, only a few bears are sticking to their forecasts....

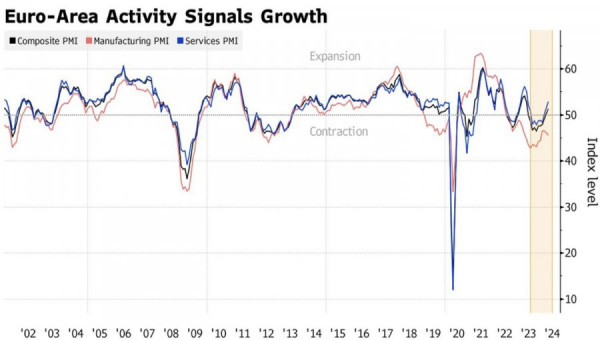

5 months agoThe euro miscalculated its strength

The bulls attacked the EUR/USD pair after the eurozone Purchasing Managers' Index (PMI) data rose to nearly year-long highs. However, the pair failed to move significantly higher. The euro is too vulnerable, while its main opponent, the US dollar, is too...

5 months agoWill the dollar get stabbed in the back?

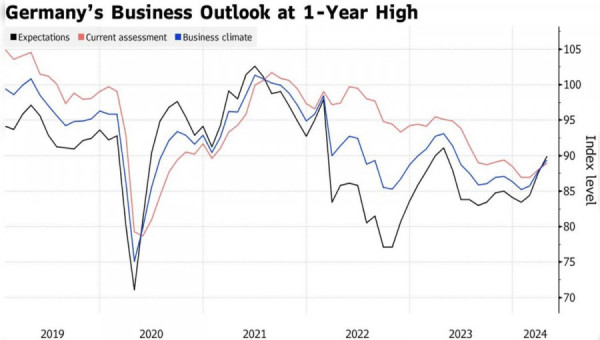

The situation is a mixed bag, and even the U.S. doesn't call the shots. Europe has brought good news for two consecutive days. First, Eurozone business activity rose to a 11-month high, then the IFO German Business Climate Index continued to brighten. How...

5 months ago