InstaForex Pati Gani

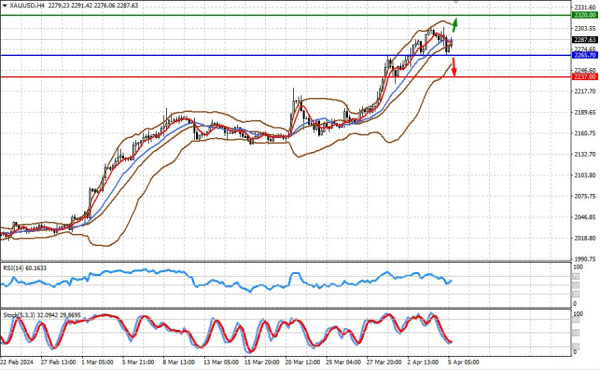

XAU/USD: what are odds of further growth after US NFPs

Today, the focus of the markets is the publication of data on the number of new jobs for March in the US economy. The labor market is expected to create 212,000 new jobs in March following 275,000 in February. Unemployment could have remained at the same...

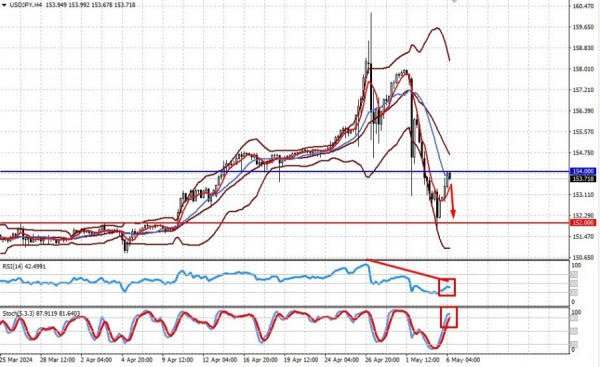

6 months agoWhy stock markets grow but USD weakens in light of poor US NFPs. USD/JPY could sink again, gold could rise

The government data on the US labor market published on Friday interrupted the victorious pace of robust employment in the US economy since the end of last year. Strong NFPs previously became one of the reasons for the Federal Reserve's actual refusal to...

5 months agoSlowdown in US inflation could put moderate pressure on USD. EUR/USD and GBP/USD could grow modestly following US inflation data

The highlight of the day will be the release of US consumer inflation data. The overwhelming majority of markets believe that the red-hot CPI will give the Federal Reserve the green light to start cutting interest rates. According to the consensus forecas...

1 month agoXAU/USD: gold to lose in value in US inflation stays flat or rises

Today, all markets without exception are focused on the release of US inflation data, which will help market participants understand whether the Fed's rate cut on September 18 will be a one-time event or the start of a cycle of monetary easing. Currently,...

1 month agoThe Dollar's Gradual Decline Is Likely to Continue (Expected Rise in EUR/JPY and WTI Oil Prices)

The U.S. dollar remains under significant pressure following the Federal Reserve's decision to lower interest rates by a half point, but this is not the only problem on the Forex market.As anticipated, the Fed's unprecedented 0.50% rate cut has triggered...

3 weeks agoXAU/USD: downward correction invites traders to buy?

Since early Monday, the US dollar has been picking up steam while gold is trading lower in parallel. The question is whether we should expect a further decline in the price of the yellow metal. Apparently, no. Its corrective decline may be seen by the mar...

3 weeks ago