GOMarkets Evan Lucas

FX – The Uncertain Peak: Assessing the Current State of Inflation and Interest Rates

As April draws to a close, the global economy stands at a pivotal juncture, grappling with the resurgence of inflationary pressures that refuse to retreat. In fact, it feels as though the inflation genie has re-emerged, asking, “Oh, you want more?” This r...

5 months agoInside the Fed

Let us open with this: “It’s unlikely that the next policy rate move will be a hike. I’d say it’s unlikely,” – US Chair Jay Powell This verbatim quote puts a lid on the movements seen in bond and interbank markets that might have overacted to recent data...

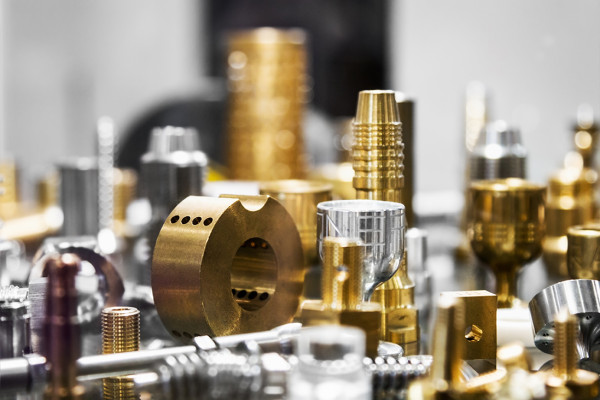

5 months agoFuture metals: are we seeing the 2000s again?

Plenty has been made of the drive towards nickel and lithium as “future metals” as the world’s “electrification” takes hold. This “electrification” has been nicknamed the “volt revolution” and when you get these kinds of technological leaps – what’s appea...

5 months agoDeja vu of 2023

Market action and underline breath of the last two and half weeks has been extreme and rather eye opening. The S&P 500 has made 38 record all time highs in 2024 so far, however since its most recent peak on July 16 it has traded lower ever since. Now...

2 months agoDo you catch a falling knife?

We all know the market term ‘don’t catch a falling knife’. And in the current market conditions why would you? But with indices, the likes of the magnificent 7, industrials and banks doing so well in 2024 people are asking where’s the value? And that is w...

2 months agoUS trading thematics Part 3: More than the Trump trade

We’ve held off making comments about the events of what happened last weekend. Everyone has seen it, everyone knows the horrible scenario that it was but it is probably also meant that we have missed really key economic and fundamental trading reasons U.S...

2 months agoUS trading thematics Part 2: Data Confirming

Will June be the turning point? The market thinks it is – and its reaction to the CPI data not only signalled how it will trade in the coming months. It also showed that traders are primed to rotate to even more bullish positions. Because from the market’...

2 months agoUS trading thematics: Part 1 “When Powell talks”

Over the coming 48 hours and then over the coming 2 weeks, Fed speak and US data is going to be some of the best trading opportunities in 2024. It’s been a pretty low-vol year despite several events that would under normal circumstances be triggers for mu...

2 months agoOne of two ways: Trading Australia’s CPI data

Australia’s second quarter CPI due out on the 31st of July could go one of two ways so let’s dive into how it will move and how to trade it. First way – Coming in line or below Currently 24 of the 30 surveyed economists see inflation coming in line or bel...

2 months agoHold tight: trading the RBA

With core CPI missing expectations and some slight deceleration in other areas such as retail sales an overall service economic activity. The RBA is likely to hold tight and not raise rates on Tuesday. We say this with some confidence, based on the commun...

2 months agoJackson Hole Symposium – When doves try

Jackson Hole Symposium – When doves try Market pricing of the Federal Funds rate currently sits at 93 basis point of easing by year-end. Let us put that into perspective it was 110 basis points of easing at the peak of excitement, yet despite the increase...

1 month agoJackson Hole leaves a hole heap of questions about employment

We now have a post-Jackson Hole set of questions – will the data stick up to what was preached. Reviewing the reactions to Jackson Hole treasury yields declined on a ramp up in bets around the Federal Funds rate after Federal Reserve Chair Jerome Powell’s...

1 month agoThat’s a wrap – The ASX earning season

So FY24 earnings are now done and from what we can see the results have been on the whole slightly better than expected. The catch is the numbers that we’ve seen for early FY25 which suggested any momentum we had from 2024 may be gone. So here are 8 thing...

1 month agoThe FX: Has the Fed dropped the ball?

We have been discussing Sahms’ law for the last few weeks. This is the regression indicator that signals the possibility of recession. For those that can’t remember, Sahms’ recession indicator is when the three-month moving average of the unemployment rat...

1 month ago