COT: Broad commodities sell-off gains momentum; Forex traders seek JPY and CHF

Key points:

- Positions and changes made by speculators in commodities, forex and bonds in the week to July 30

- Big speculative flows in fx sees the dollar long jump despite continued demand for JPY and CHF

- Record leveraged fund short across the US bond yield curve amid continued and potentially challenging focus on basis trades

- Broad selling across commodities with the bulk of the net long being held in gold

Forex:

The week to July 30 saw big speculative flows across the board, overall giving an ill-timed boost to the dollar long just before a dovish FOMC meeting, and weak US data helped send the greenback and bond yields sharply lower. Overall, the gross dollar long against eight IMM currency futures rose by USD 6 billion to USD 16.5 billion, thereby partly reversing a four-week period of net selling.

All the major currencies saw big changes with heavy selling of EUR, GBP, CAD (record short), AUD, and NZD being only partly offset by another week of JPY short covering and safe haven demand for CHF.

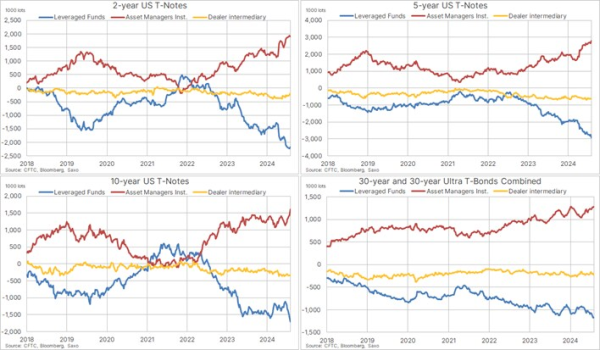

Bonds:

All across the US yield curve we have seen some major moves recently, from three months to the longest duration beyond 30 years; traders have responded to deteriorating economic data by sending yields lower and rate cut expectations sharply higher. Into this increased volatility leveraged funds held a record short position across the US yield curve in the week to July 30, just days before the mentioned movements in yields and rate expectations.

It is clear for everyone to see that leveraged funds do not hold a naked short position of this magnitude, estimated to be worth around USD 555 million per one basis point change. Instead, the record short position is signalling no end to the so-called basis trade which is a relative value trade where hedge funds exploit the small price difference between cash Treasuries and futures contracts, by selling the bond future, and subsequently go "long", or buy the cash bond, with the trade being funded in overnight repo markets and highly leveraged. Recently, the Bank of England joined other central banks in warning about the inherent risks associated with such a large position, saying: "Sharp increases in volatility in market interest rates could lead to increases in margin required on the futures positions, or hedge funds may find it harder to refinance their borrowing in the repo market."

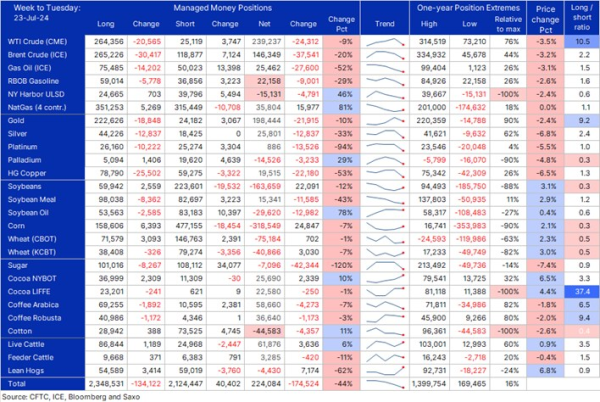

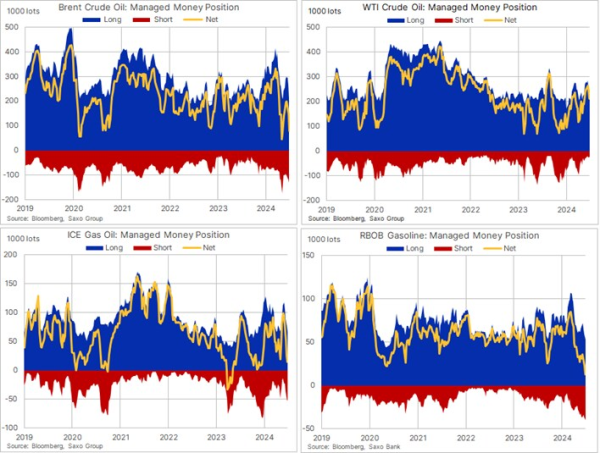

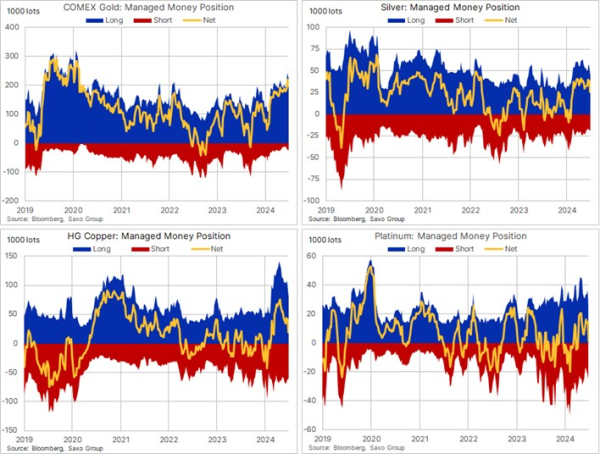

Commodities:

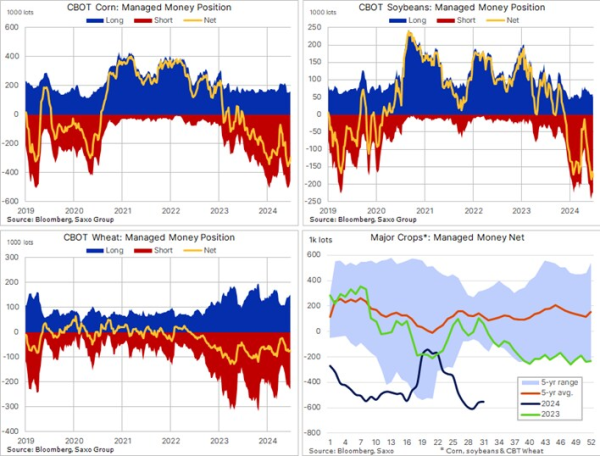

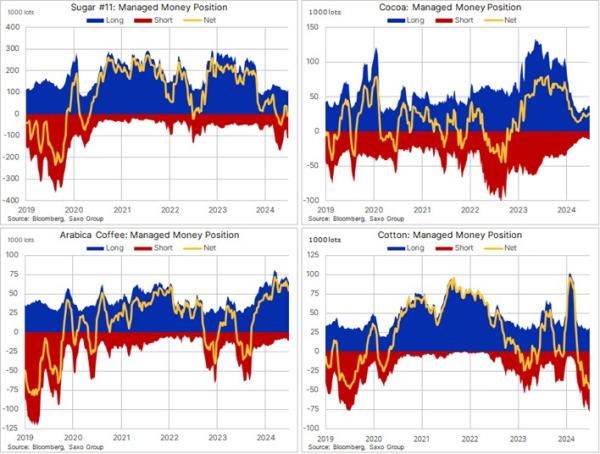

A sea of red across the commodities sector in the reporting week drove the Bloomberg Commodity Total Return index down by 2% with all sectors suffering setbacks, led by grains, energy, and industrial metals. Overall, this weakness helped drive bullish bets held by leveraged funds to near a five-year low with net short positions held in grains and platinum group metals, while the long interest was concentrated in a few major commodities. In nominal terms, the gold long remains by far the biggest at USD 46 billion followed by crude oil (WTI and Brent) in a distant second at USD 22 billion with coffee (Arabica and Robusta) in third position at USD 6 billion, while on the short side funds hold a USD 19 billion position in grains.

What is the Commitments of Traders report?

The COT reports are issued by the U.S. Commodity Futures Trading Commission (CFTC) and the ICE Exchange Europe for Brent crude oil and gas oil. They are released every Friday after the U.S. close with data from the week ending the previous Tuesday. They break down the open interest in futures markets into different groups of users depending on the asset class.

Commodities: Producer/Merchant/Processor/User, Swap dealers, Managed Money and other

Financials: Dealer/Intermediary; Asset Manager/Institutional; Leveraged Funds and other

Forex: A broad breakdown between commercial and non-commercial (speculators)

The main reasons why we focus primarily on the behavior of speculators, such as hedge funds and trend-following CTA's are:

- They are likely to have tight stops and no underlying exposure that is being hedged

- This makes them most reactive to changes in fundamental or technical price developments

- It provides views about major trends but also helps to decipher when a reversal is looming

Do note that this group tends to anticipate, accelerate, and amplify price changes that have been set in motion by fundamentals. Being followers of momentum, this strategy often sees this group of traders buy into strength and sell into weakness, meaning that they are often found holding the biggest long near the peak of a cycle or the biggest short position ahead of a through in the market.

Recent commodity articles:

14 June 2024: Commodity weekly: Energy sector gains counterbalance metal consolidation

13 June 2024: Oil prices steady amid divergent OPEC and IEA demand projections

10 June 2024: COT: Brent long cut to ten-year low; metals left exposed to end of week slump

3 June 2024: COT: Crude length added before OPEC+ meeting; gold and copper see profit-taking

31 May 2024: Commodity weekly: Strong month despite late decline in crude and fuel

27 May 2024: COT: Gold and crude see increased demand as dollar longs plummet

24 May 2024: Commodity weekly: agriculture surges, metals fall on fading rate cut hopes

23 May 2024: Podcast: 2024 is heavy metals

22 May 2024: Crude oil struggles near two-month low

17 May 2024: Commodity weekly: Metals lead broad gains

16 May 2024: Gold and silver rally as soft US data fuels market optimism

15 May 2024: Copper soars to record high, platinum breaks out

14 May 2024: COT: Crude long slump; grain purchases surge

8 May 2024: Fund selling exacerbates softening crude outlook

8 May 2024: Grains see bumpy start to 2024 crop year

6 May 2024: COT: Commodities correction spurs muted selling response

3 May 2024: Commodity weekly: Grains boost, correction in softs and energy

2 May 2024: Copper's momentum-fueled rally halts amid weakening fundamentals