COT: Commodities correction spurs muted selling response

Key points:

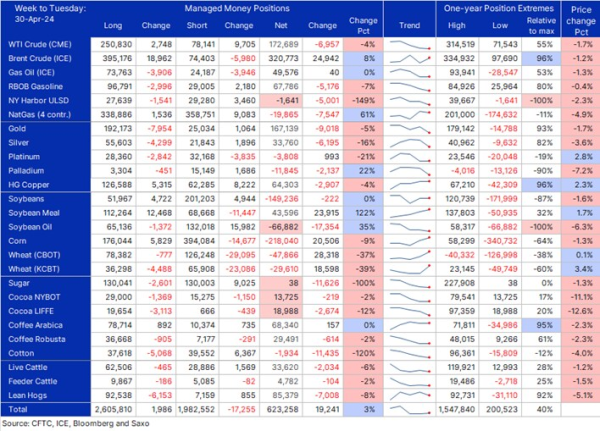

- Commitment of Traders report highlighting futures positions and changes made by speculators across forex and commodities during the week to 30 April

- Emerging profit taking on dollar long positions ahead three-day slump

- Buying of grains offsetting reductions elsewhere, most notably in metals and softs

COT on forex

Weeks of dollar strength that recently lifted the non-commercial dollar long position against eight IMM futures to near a five-year high showed signs of running out of momentum during the reporting period to 30 April. Despite gaining 0.5% on the week, traders opted – wisely as it turned out – to reduce their dollar long exposure, overall resulting in a 10% reduction to USD 29.4 billion, primarily driven by broad short covering, led by CAD, JPY and AUD.

COT on Commodities

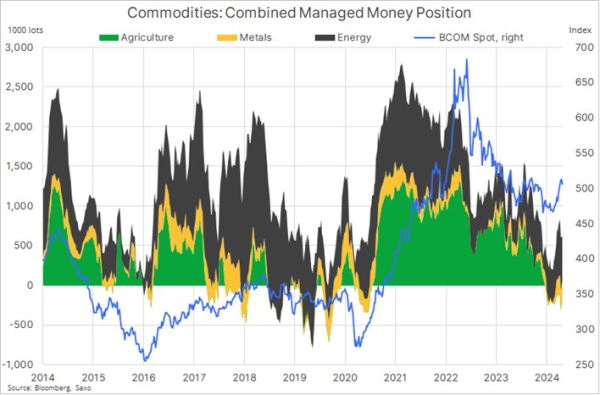

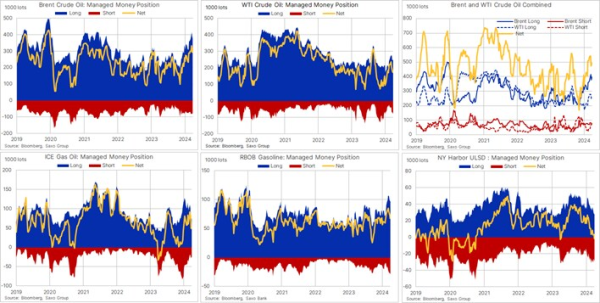

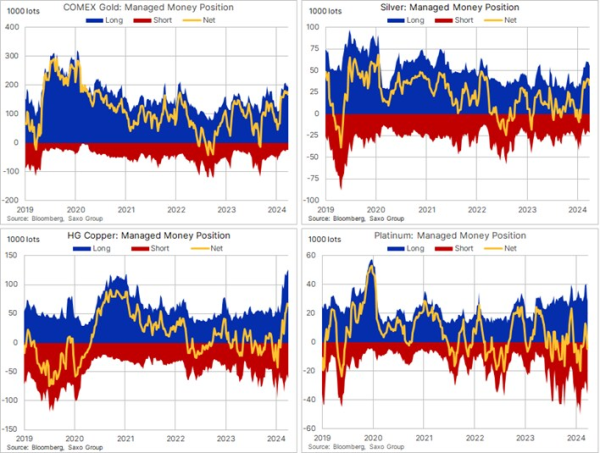

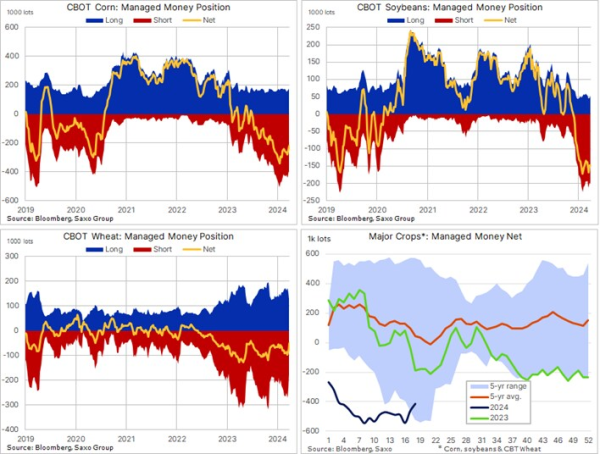

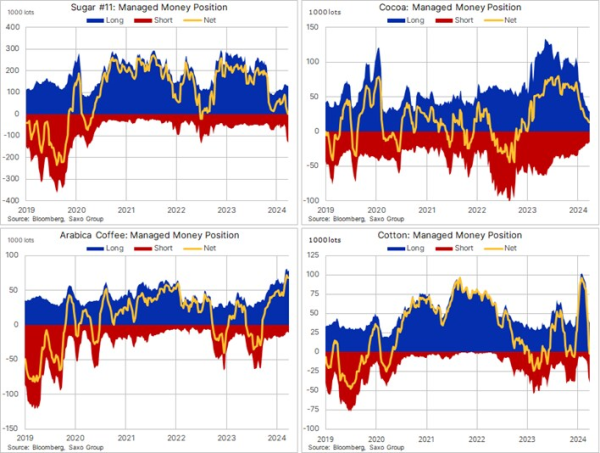

In the latest Commitment of Traders (COT) report, covering the week ending 30 April, several notable trends emerged amidst market fluctuations. This week was characterized by a 1.1% setback in the Bloomberg Commodity (BCOM) total return index, marking a contrast to the robust 10% surge in prices witnessed since late February. The downturn was widespread, with the exception of industrial metals, which saw a modest uptick of 1.9%. On an individual contract basis, we find that 21 out of the 26 commodity futures tracked in the update experienced downward movement, with the most notable exceptions being platinum, copper, and wheat. Managed money accounts such as hedge funds and CTAs responded relatively muted to these developments with net selling of metals and softs being offset by strong short-covering demand for grains while the energy sector saw a mixed response.

Brief commodity correction running out of steam

The mentioned correction in the Bloomberg Commodity TR index which tracks the performance of 24 major commodity futures evenly split across energy, metals and agriculture, has so far been relatively shallow, having bounced after only managing a 38.2 Fibo retracement of the 10% run-up from late February until early last week. A correction of this, so far, limited magnitude is categorized as a weak correction within a strong uptrend. It is also worth noting that the index on Friday saw the 50-day simple moving average trade above the 200-day, potentially a sign of growing positive momentum. Finally, it’s worth pointing out that the recent correction has been cushioned by a recovering grains sector, and it highlights the merits of holding a broad exposure to commodities, where prices are dictated by multiple factors from supply and demand developments, macroeconomic data, central bank decisions, geo-political events, weather developments, and not least momentum and its impact on speculators behavior.

What is the Commitments of Traders report?

The COT reports are issued by the U.S. Commodity Futures Trading Commission (CFTC) and the ICE Exchange Europe for Brent crude oil and gas oil. They are released every Friday after the U.S. close with data from the week ending the previous Tuesday. They break down the open interest in futures markets into different groups of users depending on the asset class.

Commodities: Producer/Merchant/Processor/User, Swap dealers, Managed Money and other

Financials: Dealer/Intermediary; Asset Manager/Institutional; Leveraged Funds and other

Forex: A broad breakdown between commercial and non-commercial (speculators)

The main reasons why we focus primarily on the behavior of speculators, such as hedge funds and trend-following CTA's are:

- They are likely to have tight stops and no underlying exposure that is being hedged

- This makes them most reactive to changes in fundamental or technical price developments

- It provides views about major trends but also helps to decipher when a reversal is looming

Do note that this group tends to anticipate, accelerate, and amplify price changes that have been set in motion by fundamentals. Being followers of momentum, this strategy often sees this group of traders buy into strength and sell into weakness, meaning that they are often found holding the biggest long near the peak of a cycle or the biggest short position ahead of a through in the market.

Commodity articles:

3 May 2024: Commodity weekly: Grains boost, correction in softs and energy

2 May 2024: Copper's momentum-fueled rally halts amid weakening fundamentals

26 April 2024: Commodity weekly: Sticky inflation and adverse weather focus

23 April 2024: What drives the gold and silver correction ?

19 April 2024: Commodity weekly focus on copper, gold, crude and diesel

17 April 2024: Copper rally extends to near two year high

16 April 2024: Crude oil's risk premium ebbs and flows

12 April 2024: Gold and silver surge at odds with other market developments

10 April 2024: Record breaking gold highlights silver and platinum's potential

5 April 2024: Commodity market sees broad gains, enjoying best week in nine months

4 April 2024: What's next as gold reaches USD 2,300

3 April 2024: Q2 Outlook: Is the correction over?

3 April 2024: Cocoa: A 50% farmgate price boost a step in the right direction

Previous "Commitment of Traders" articles

29 April 2024: COT: Gold bulls stand firm despite recent correction

22 April 2024: COT: Declining momentum may signal shift toward consolidation

15 April 2024: COT: Hedge funds propel multiple commodities positions beyond one-year highs

8 April 2024: COT: Speculative interest in metals and energy gain momentum

2 Apr 2024: COT: Gold and crude longs maintained amid strong underlying support