COT: Dollar short reduced; Investment metals see strong demand ahead of FOMC

Key points:

- Positions and changes made by speculators in commodities and forex in the week to Septermber 17

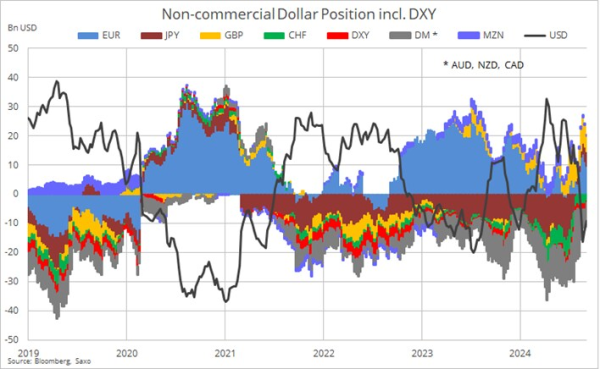

- Counter to the prevailing trend of USD weakness, speculators continued to cover short positions; biggest yen long since 2016

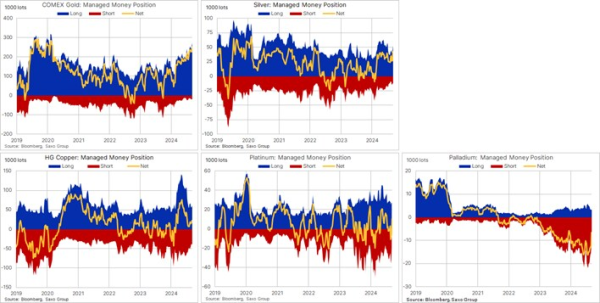

- Gold and silver length reached fresh cycle highs ahead of last week's bumper FOMC rate cut

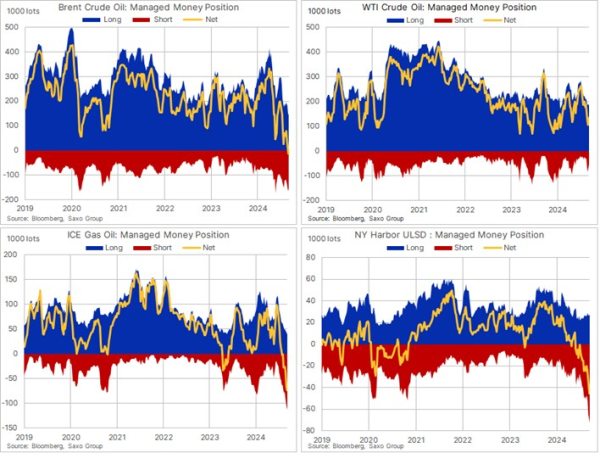

- Energy bounce-back hurting the first-ever recorded fund short with focus on Brent and diesel

- Sugar and coffee in demand as poor weather in Brazil threatens production

Forex:

Counter to the prevailing trend of USD weakness, speculators opted for more USD short covering ahead of last Wednesday’s FOMC meeting. Overall, the gross short against eight major IMM currency pairs was reduced by 29% to USD 9.2 billion, primarily driven by long liquidation in EUR and GBP, and fresh short selling of AUD. Speculators bought JPY for an 11th consecutive week, and during this time it has swung from the biggest short in 17 years to the biggest long since 2016. While the pace slowed, traders nevertheless continued to add length ahead of last week’s FOMC and BOJ meetings. Elsewhere, out-of-favour MXN saw a 70% reduction in the net long to an 18-month low.

Commodities:

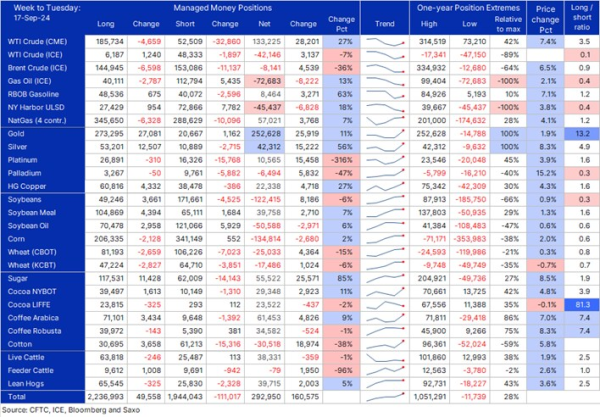

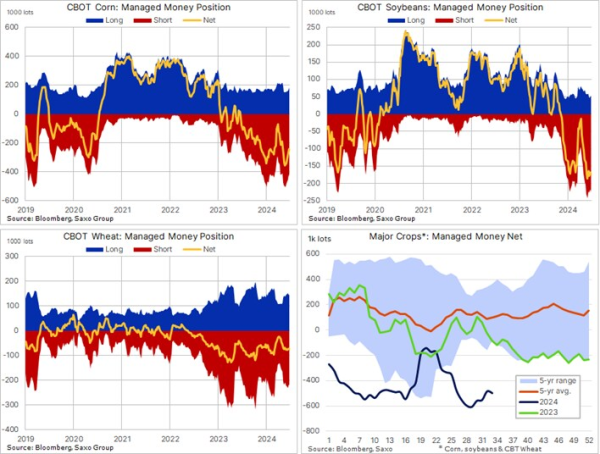

The latest reporting week to 17 September, which ended the day before the US Federal Reserve started its long-awaited rate-cutting cycle, saw broad support for commodities, with the Bloomberg Commodity Index rising 4%. The combination of a softer USD and the prospect of lower funding costs were the overall supportive drivers, while specific developments supported the individual sectors.

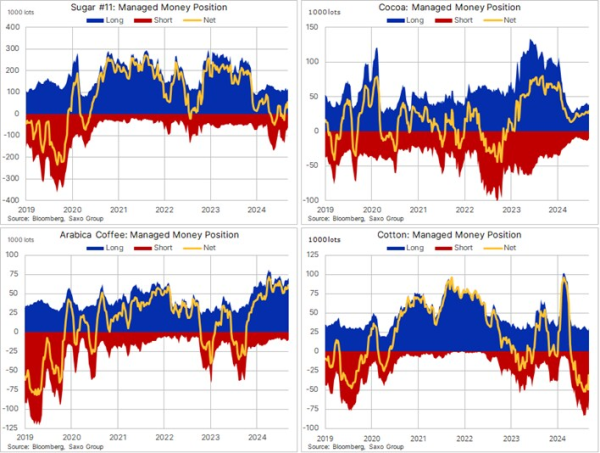

Examples include the softs sector, where sugar was heading for its biggest weekly jump in 16 years while coffee prices spiked, both in response to weather worries in Brazil. The industrial metal sector found support from the general risk-on sentiment ahead of the US rate cut and signs of an improved demand outlook in China, leading to rising premiums on imported copper while inventories on the SHFE have started to fall. The recent sell-off across the energy sector, most notably in crude and diesel, ran out of steam, thereby forcing a part reversal of recent short selling which, in the previous week, drove the overall total exposure in six major crude and fuel product futures to a record low, reflecting a market where investors had started to price in a US recession, thereby turning more negative on the outlook for growth and demand than during the Great Financial Crisis in 2008 and the pandemic in early 2020.

On an individual contract level, buyers focused on WTI, gold, silver, platinum, sugar, and coffee, while a limited number of contracts saw net selling, most notably continued short selling in the two diesel contracts.

What is the Commitments of Traders report?

The COT reports are issued by the U.S. Commodity Futures Trading Commission (CFTC) and the ICE Exchange Europe for Brent crude oil and gas oil. They are released every Friday after the U.S. close with data from the week ending the previous Tuesday. They break down the open interest in futures markets into different groups of users depending on the asset class.

Commodities: Producer/Merchant/Processor/User, Swap dealers, Managed Money and other

Financials: Dealer/Intermediary; Asset Manager/Institutional; Leveraged Funds and other

Forex: A broad breakdown between commercial and non-commercial (speculators)

The main reasons why we focus primarily on the behavior of speculators, such as hedge funds and trend-following CTA's are:

- They are likely to have tight stops and no underlying exposure that is being hedged

- This makes them most reactive to changes in fundamental or technical price developments

- It provides views about major trends but also helps to decipher when a reversal is looming

Do note that this group tends to anticipate, accelerate, and amplify price changes that have been set in motion by fundamentals. Being followers of momentum, this strategy often sees this group of traders buy into strength and sell into weakness, meaning that they are often found holding the biggest long near the peak of a cycle or the biggest short position ahead of a through in the market.

Recent commodity articles:

20 Sept 2024: Commodity weekly: Commodities boosted by bumper rate cut

20 Sept 2024 Video: Gold or silver, which metal will perform the best

17 Sept 2024: With gold reaching new heights, silver shows potential

16 Sept 2024: COT: Record short Brent and gas oil positions add upside risks to energy

11 Sept 2024: Crude slumps amid technical selling and recession fears

10 Sept 2024: US Election: will gold win in all scenarios

9 Sept 2024: COT: Crude long cut to 12-year low; Dollar short more than doubling

5 Sept 2024: Can gold overcome the 'September curse'?

4 Sept 2024: Wheat rises on European crop worries

3 Sept 2024: Chinese economic woes drag down crude oil and copper

2 Sept 2024: COT: Commodities see broad demand as the USD slumps to a net short

30 Aug 2024: Commodities sector eyes fourth weekly gain amid softer dollar and Fed expectations

27 Aug 2024: Month-long sugar slide pauses amid concerns of Brazil's supply

27 Aug 2024: Libya supply disruptions propel crude prices higher

26 Aug 2024: COT: Funds boost metals investment as dollar long positions halve amid weakness

23 Aug 2024: Commodities Weekly: Metal strength counterbalancing energy and grains

22 Aug 2024: Persistent supply contraints keep cocoa prices elevated

21 Aug 2024: Weak demand focus steers crude towards key support

19 Aug 2024: Resilient gold bulls drive price to fresh record above USD 2500

19 Aug 2024: COT Buyers return to crude as gold stays strong; Historic yen buying

16 Aug 2024: Commodities weekly: Gold strong as China weakness drags on other markets

9 Aug 2024: Commodities weekly: Calm returns to markets, including raw materials

8 Aug 2024: Sentiment-driven crude sell-off eases, allowing traders to focus on supply risks

7 Aug 2024: Limited short-selling interest observed during copper's recent aggressive correction

6 Aug 2024: Video: What factors are fueling the current market turmoil and gold's response

5 Aug 2024: COT: Broad commodities sell-off gains momentum; Forex traders seek JPY and CHF

5 Aug 2024: Commodities: Position reduction in focus as volatility spikes

2 Aug 2024: Widespread commodities decline in July, with gold as the notable exception