COT: Energy and metals selling cuts hedge funds length to four-month low

Key points:

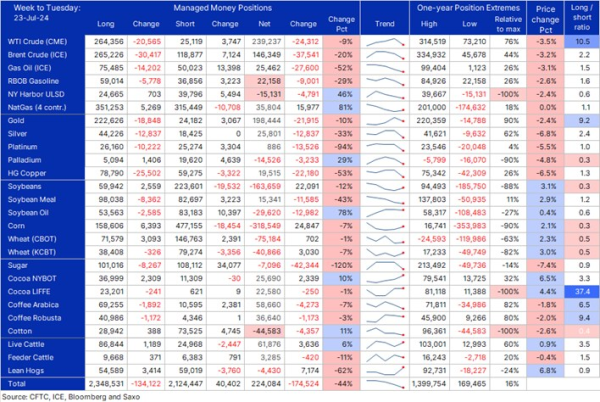

- Positions and changes made by speculators in commodities and forex in the week to July23

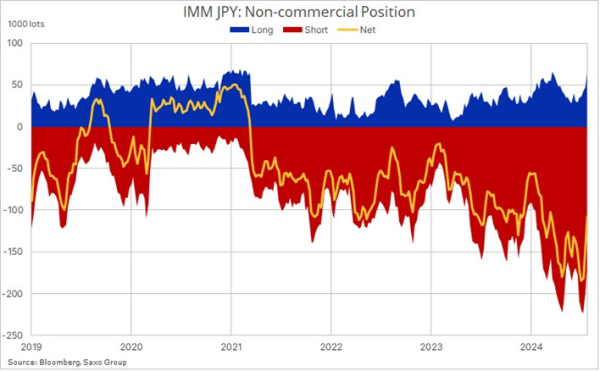

- A notable collapse in the dollar long led by demand for EUR, GBP and not least JPY

- Commodity sector sees technical selling amid fading risk appetite and China demand concerns

- Recent in-demand commodities suffering the biggest setback led by crude, silver and copper

Forex

In forex, the aggregate dollar long versus eight IMM currency futures has seen a notable collapse during the past three weeks, down 58% to a four-month low at USD 10.4 billion. Driven in part by demand for euros and sterling, and not least short covering supporting the Japanese yen which has strengthened amid a major unwinding of carry trades in the belief the Bank of Japan is about to hike rates and tweak its bond purchases. In the latest reporting week to 23 July, the buying of the mentioned currencies helped offset continued selling of CAD ahead of last Wednesday's rate cut and Aussie weakness amid weaker commodity prices on China demand concerns.

Commodities

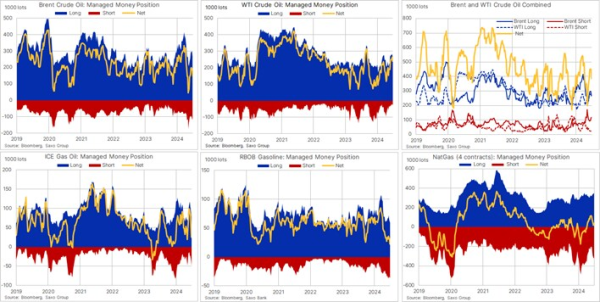

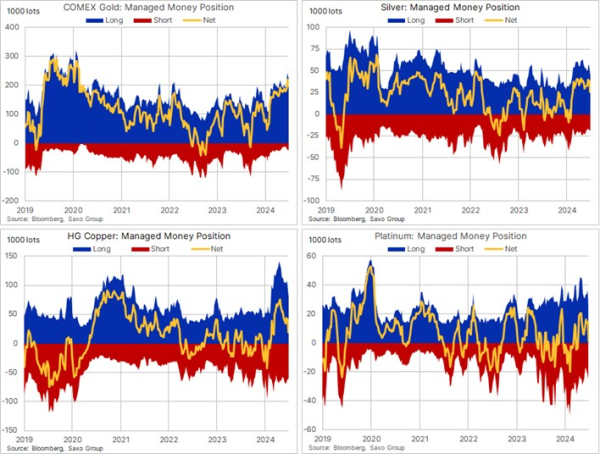

The commodities sector is heading for a monthly loss of 4%, bringing the year-to-date gains in the BCOM Total Return index back to near zero. Traders and investors holding elevated longs have been hurt by the recent loss of risk appetite across equity markets, as well as the unwinding of short yen carry trades, with energy and industrial suffering the most amid ongoing concerns about demand in China. Meanwhile, rising rate cut expectations and multiple geopolitical concerns, including the US election, continue to underpin gold which trades higher on the month, albeit well below the recent record high near USD 2500.

In the latest reporting week to 23 July, the BCOM TR index fell 2%, led by industrial (-5.7%), and precious metals (-3.5%) as well as energy (-2.3%). Meanwhile, the agriculture sector was mixed with losses in softs being offset by gains in grains and livestock. Hedge funds, responding to this ongoing price weakness, made a fifth consecutive weekly reduction in the net longs held across 26 major commodity futures contracts, last week by 44% to a four-month low at 175k contracts.

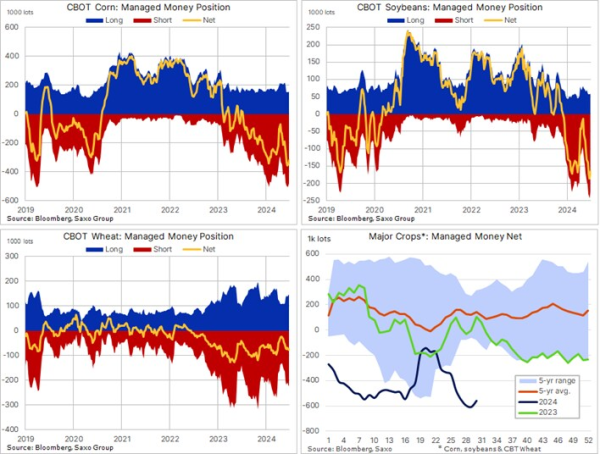

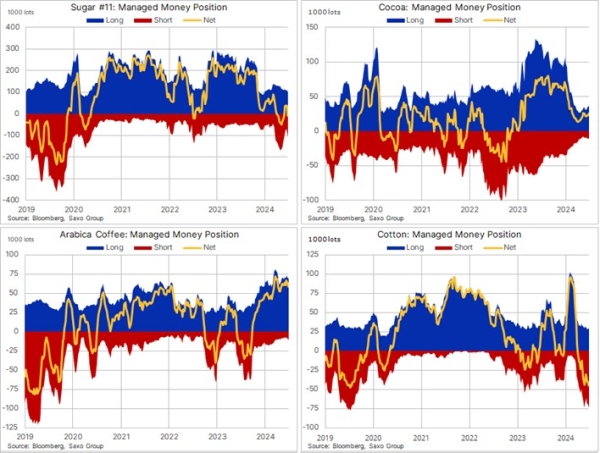

The mentioned general loss of risk appetite this past month has hurt commodity investments, especially across those contracts that up until recently had seen strong demand, most notably the energy sector led by crude oil, and the metals where recent strong demand for silver and copper, and to some degree also gold left them all exposed as prices fell and the technical outlook deteriorated. Elsewhere, the grains sector remains heavily shorted amid pre-harvest selling pressure while weather-related concerns have supported long positions in cocoa and more recently also coffee.

What is the Commitments of Traders report?

The COT reports are issued by the U.S. Commodity Futures Trading Commission (CFTC) and the ICE Exchange Europe for Brent crude oil and gas oil. They are released every Friday after the U.S. close with data from the week ending the previous Tuesday. They break down the open interest in futures markets into different groups of users depending on the asset class.

Commodities: Producer/Merchant/Processor/User, Swap dealers, Managed Money and other

Financials: Dealer/Intermediary; Asset Manager/Institutional; Leveraged Funds and other

Forex: A broad breakdown between commercial and non-commercial (speculators)

The main reasons why we focus primarily on the behavior of speculators, such as hedge funds and trend-following CTA's are:

- They are likely to have tight stops and no underlying exposure that is being hedged

- This makes them most reactive to changes in fundamental or technical price developments

- It provides views about major trends but also helps to decipher when a reversal is looming

Do note that this group tends to anticipate, accelerate, and amplify price changes that have been set in motion by fundamentals. Being followers of momentum, this strategy often sees this group of traders buy into strength and sell into weakness, meaning that they are often found holding the biggest long near the peak of a cycle or the biggest short position ahead of a through in the market.

Recent commodity articles:

14 June 2024: Commodity weekly: Energy sector gains counterbalance metal consolidation

13 June 2024: Oil prices steady amid divergent OPEC and IEA demand projections

10 June 2024: COT: Brent long cut to ten-year low; metals left exposed to end of week slump

3 June 2024: COT: Crude length added before OPEC+ meeting; gold and copper see profit-taking

31 May 2024: Commodity weekly: Strong month despite late decline in crude and fuel

27 May 2024: COT: Gold and crude see increased demand as dollar longs plummet

24 May 2024: Commodity weekly: agriculture surges, metals fall on fading rate cut hopes

23 May 2024: Podcast: 2024 is heavy metals

22 May 2024: Crude oil struggles near two-month low

17 May 2024: Commodity weekly: Metals lead broad gains

16 May 2024: Gold and silver rally as soft US data fuels market optimism

15 May 2024: Copper soars to record high, platinum breaks out

14 May 2024: COT: Crude long slump; grain purchases surge

8 May 2024: Fund selling exacerbates softening crude outlook

8 May 2024: Grains see bumpy start to 2024 crop year

6 May 2024: COT: Commodities correction spurs muted selling response

3 May 2024: Commodity weekly: Grains boost, correction in softs and energy

2 May 2024: Copper's momentum-fueled rally halts amid weakening fundamentals