Could a blockade of the Strait of Hormuz drive oil prices above $100?

The conflict in the Middle East has been the most important issue in recent days after the escalation experienced last Tuesday, when Iran, in response to the Israeli invasion of Lebanon, launched a missile attack on Tel Aviv. The situation at the moment is one of tense calm awaiting Israel's response. Netanyahu seems to be receiving strong pressure to attack key points in Iran's economy and it is not ruled out that he could make a decision in the next few hours.

In this scenario, one of the main focuses of attention for the market is oil, which has been impacted by the growing tension in the area. In recent months, the price of a barrel has suffered from disagreements between OPEC members, the fall in global demand and the possible victory of Donald Trump in the next elections. However, instability in the Middle East has once again boosted the price of oil: after the Iranian attack on Tuesday, the price of oil rose by more than 4%, a trend that continued the following day, when it rose by another 2%.

Behind these increases lies a fear: a possible blockage of the Strait of Hormuz, one of the most important oil transport hubs in the world. But what role does this strait play and how can it affect the price of oil?

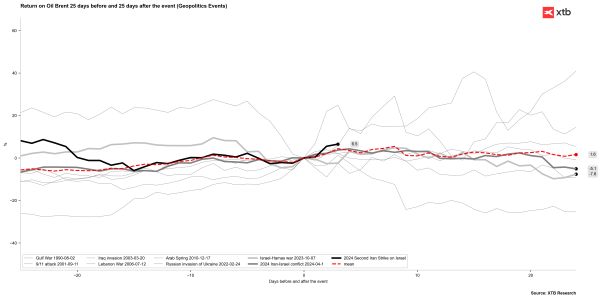

Brent crude prices have increased by over 6% since the beginning of the current conflict between Israel and Iran. Historically, the impact of such events has been limited due to a lack of escalation. However, the possibility of Israeli retaliatory actions this weekend cannot be ruled out, which could lead to a larger shock in the financial markets. Source: Bloomberg Finance LP, XTB

What is the Strait of Hormuz?

The Strait of Hormuz is one of the most important and strategic maritime passages in the world and one of the most important hubs for oil transport on a global scale. Located between Oman and Iran, and just three kilometers long, this strait connects the maritime passage of the Gulf countries (Iran, Kuwait, Saudi Arabia, Bahrain, Qatar and the United Arab Emirates) with the Arabian Sea and other regions beyond and serves as a junction between Middle Eastern oil producers and key markets in Asia Pacific, Europe and North America.

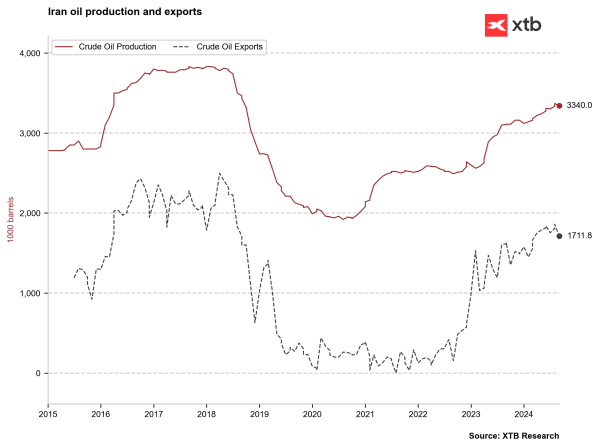

Iran is responsible for only about 3 million barrels per day of production and 1.7 million barrels per day of exports. The key question regarding oil is whether the Strait of Hormuz, which handles 20% of the world's oil supply, will be blockaded. Source: Bloomberg FInance LP, XTB

Why is the Strait of Hormuz so important for oil production?

The Strait of Hormuz is one of the main maritime trade routes on a global scale. In fact, it is estimated that this strait is responsible for around 11.1% of the world's maritime trade. In the case of oil, however, this influence is even greater. According to the latest data from the IEA (International Energy Agency), it is estimated that approximately 30% of total world oil trade passes through this area, although between January and October 2023 this figure rose to almost 40%.

According to data from the US Energy Information Administration (EAI), around 21 million barrels of oil per day passed through the Strait of Hormuz in 2022, equivalent to 21% of global consumption of petroleum liquids. Between 2022 and the first half of 2023, the flow of oil through this channel accounted for more than a quarter of the total oil traded by sea in the world. And if the volumes of oil, crude oil and condensate that passed through the Strait of Hormuz between 2020 and 2022 are added, the total number of barrels rises to more than 2.4 billion barrels per day, figures that highlight the enormous weight that this enclave has in the global crude oil trade.

The Strait of Hormuz is the main export route for oil from Iran, Saudi Arabia, Iraq, the United Arab Emirates, Kuwait and Qatar. These exports are mostly directed to Asia, and in particular to China, Japan and India, although after the war in Ukraine and sanctions against Russia, the Strait has also gained weight in European crude oil imports: specifically, it is estimated that around 5% of the oil flow that passes through the Strait of Hormuz is now directed to Europe, which is equivalent to approximately 900,000 barrels per day. Before the Russian-Ukrainian conflict, these imports were equivalent to around 700,000 barrels per day, which means that Europe has increased its oil imports by approximately 25%.

In addition to oil, the Strait of Hormuz also plays a significant role in the transport of other raw materials, such as propane or natural gas. In the case of propane, it is estimated that around 31% of world trade passes through this area, while in the case of natural gas, this figure represents around 20%. A blockade in this area could therefore have serious consequences not only for oil, which has already suffered the first price increases, but also for trade in other raw materials.

What would happen if the Strait of Hormuz were to be blocked?

Iran has threatened to block the Strait of Hormuz on several occasions in recent years, doing so in 2011, 2012 and 2016. However, to date, the strait has not been subject to any significant blockade, except for the one in 1984, at the height of the Iran-Iraq war.

A possible blockade of Hormuz, however, could have very significant consequences for global trade. Specifically, it is estimated that if the Strait of Hormuz were to be blocked, the price of oil could even reach between approximately 150 and 200 dollars.

In this scenario, however, it is difficult to predict how the price of oil will evolve: everything depends on Israel's response to Iran's attack. At the moment, we believe that the possibility of the conflict easing is limited, although we have already seen this in April and a year ago in October: the response from both sides was limited, which reduced the initial increases experienced by crude oil.

Currently, the price of oil is around $75 per barrel, after the increases suffered after the escalation of the conflict in the Middle East. However, there is a possibility that crude oil will spiral downwards to $60, thanks to increased production in OPEC countries or the increase in electric vehicles in China. The Strait of Hormuz will play a key role in determining how oil will evolve in the coming days.

The risk of significantly higher prices given the current market fundamentals is low. However, a blockade of the Strait of Hormuz would change the game. While the market is not yet overly concerned about this scenario, a weekend surprise cannot be ruled out. Currently, there are only 8 open interest contracts for the $100/barrel October WTI option. Nevertheless, the prices of these options have risen to their highest levels since mid-August. Source: Bloomberg Finance LP