Countdown to the most anticipated earnings this season – Nvidia

Countdown to the most important earnings this season – Nvidia - Wednesday August 28th

Nvidia's earnings will not only affect Nvidia's share price, but all technology stocks, as Nvidia's revenue and outlook for the future set the tone for the general growth within the IT sector, as well as the speed of society's adoption of artificial intelligence.

If you look at the market's expectations for the result on Wednesday, they are a little bit higher than what Nvidia itself has announced. Right now, the market expects $28.6 billion in revenue, which is a growth of 112% compared to the same quarter last year and 10% compared to Q1 2024.

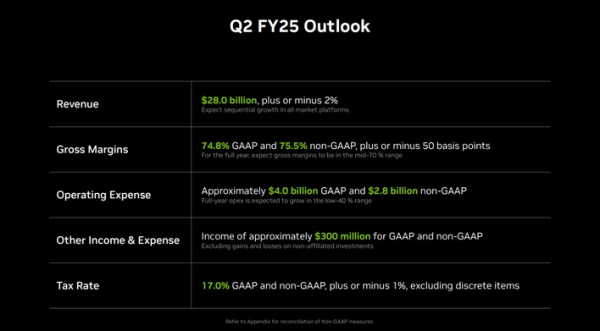

As shown below, Nvidia itself has announced that they expect revenue of approx. $28 billion and a gross margin of 75.5% (non-GAAP). Here, the market expects 75.6%, i.e. only a small bit higher than the official expectations.

It seems that Nvidia's expectations and the market's expectations are more or less the same, and therefore we do not expect any major surprises on the financial results for the 2nd quarter.

The most important figure to keep an eye on in the numbers on Wednesday evening will be Nvidia's expectations for revenue and gross margin in the 3rd quarter.

If you look at the market's expectations right now, a turnover of $31.6 billion is expected in Q3 and a gross margin of 75.4%. If Nvidia's own expectations deviate from this, it could mean large price move for the stock.

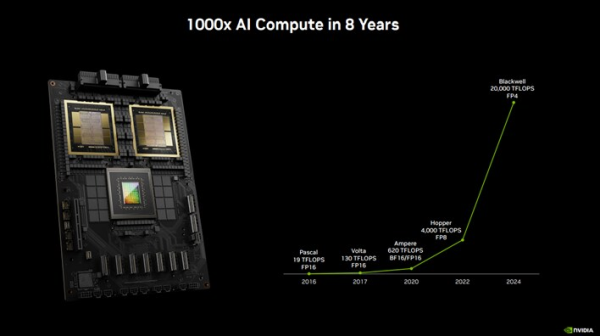

Another important factor to keep an eye on in Nvidia's accounts, and especially the subsequent accounting call, will be news about Nvidia's new AI chip (GPU) called Blackwell.

As shown below, "Blackwell" is the next generation of Nvidia's very popular "Hopper" GPU used to make calculations for artificial intelligence.

Nvidia has announced to several large customers, incl. Microsoft, that the launch of the more efficient Blackwell chip will be delayed at least 3 months due to a design flaw. This most likely means that Nvidia will not seriously mass-produce their new chip before Q1 2025, when it was previously planned to be launched towards the turn of the year.

Since the Blackwell chip will drive a large part of sales in the coming years, news about possible design flaws and delivery delays will be very important to how the stock will fare.

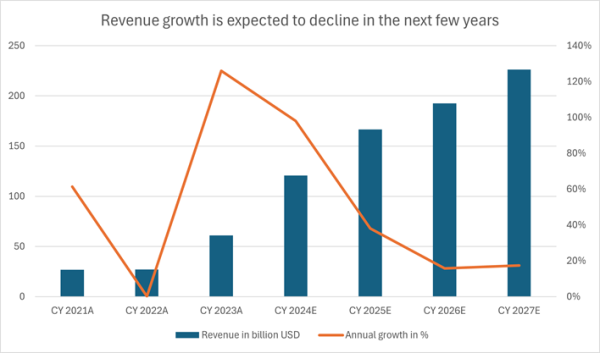

As shown below, in the last few years, Nvidia has managed to grow their revenue significantly due to the high demand for the company's GPU chips, which are mainly used for calculations in the development of artificial intelligence.

Annual growth has been very high in 2023, and expected in 2024 to be around 100%. In the coming years, the growth rate, as shown below, is expected to fall slightly to a level of approximately 40% in 2025, and 20% in 2026 and 2027. However, this must still be considered a high level of growth, and therefore as an investor you must be aware that there are high expectations for Nvidia's growth in the coming years.

Should Nvidia experience a year like 2022 in which there was zero growth, the share could fall significantly. As I said, it is not what was expected, but the risk of a so-called "Cisco moment" is still present if several large IT companies such as Meta and Microsoft choose to invest less in their data centers and infrastructure for a period in the future to develop artificial intelligence.