Crude Breaks Key Support Level

Crude Fall Deepens

Oil prices remain under pressure this week with crude futures falling to their lowest level since December 2023. The move comes despite ongoing weakness in the US Dollar and reflects a refocusing of the market’s attention on US recessionary risks. Weaker data out of the US this week, particularly the JOLTS job openings number yesterday looks to be spooking traders again ahead of tomorrow’s NFP release. Last month, global markets were seen tanking as a heavily weaker set of NFP figures as US recessionary fears balloon among investors. Current price action likely reflects some hesitation ahead of tomorrow’s data and the risk of similar market reaction if further weakness is seen.

EIA Data Up Next

Ahead of that data, traders will today receive the latest EIA inventories report. The data is expected to reflect a further 0.6-million-barrel draw in crude stores, following a -0.8-million-barrel reading over the prior week. Given the backdrop, today’s data is unlikely to move the needle much in crude unless we see a meaningful surprise. Given the current weakness in crude prices, any upside surprise would likely have the biggest impact, amplifying the current selling. Earlier this week, however, the API reported a sizeable 7.3-million-barrel draw. If a large downside reading is echoed by the EIA today, this could help underpin crude ahead of tomorrow’s headline US data.

Technical Views

Crude

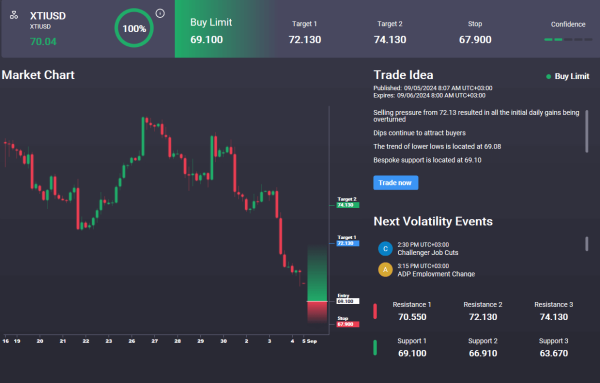

The sell off in crude has seen the market breaking down through the 72.61 level support. Price is now testing the bear channel lows and with momentum studies bearish, focus remains on further downside for now with 67.45 the next big support and 63.83 sitting as a deeper level to watch. Interestingly, we have a buy limit in the Signal Centre today set at 69.10 suggesting a preference to fade the current weakness and play for a rebound move higher.