Crude Spikes on Iran-Israel War Fears

Middle East Tensions Soaring

Oil prices soared higher yesterday with crude futures rising by almost 8% as fears of a broader war emerging in the Middle East ratcheted higher. Reports of a heavy Iranian missile attack on Israel, in response for the recent killing of the Hezbollah leader, were seen as a dangerous escalation in the conflict. With Israel currently conducting a ‘limited’ ground invasion of Lebanon, the threat of a new, direct, conflict with Iran risks throwing the wider region into dangerous turmoil. Both Israel and Iran have promised further attacks on the back of yesterday’s violence.

Volatility Risk

Against this backdrop, oil prices are spiking higher as traders navigate huge supply risks. Given the amount produced in the region, a wider war could have serious repercussions for the market. As such, traders will be monitoring incoming headlines closely with news of any further escalation in violence likely to drive oil prices much higher near-term with high volatility risk seen.

EIA Data Due

Away from the Middle East, focus today will be on the latest set of EIA inventory figures. The data is expected to show a fresh draw of 1.5 million barrels, on the back of the prior week’s 4.5 million barrel draw down. If confirmed, or particularly if we see a deeper drawdown, this should bolster the current bullish sentiment in crude.

Technical Views

Crude

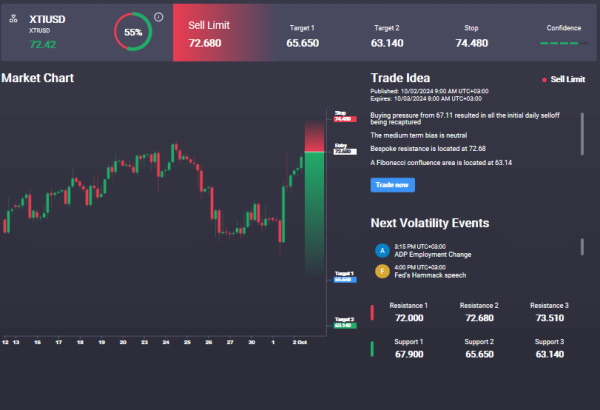

For now, the 67.45 level continues to hold as support for crude, though bulls are yet to break back above the 72.61 level. Near-term, this is the key upside pivot with a break higher seen opening the way for a test of 77.64 next. While the current range persists however, the prior downward trend suggests a move to 63.83 next. Notably, we have a sell order in the Signal Centre today at 72.68 suggesting a preference to fade the current strength and target a reversal lower.