Cryptos Year Ahead 2024: Spot ETF approval and Bitcoin halving take centre stage

Phenomenal year for cryptocurrency markets; 2024 could be even better

Approval of spot-Bitcoin ETFs expected to spur institutional demand

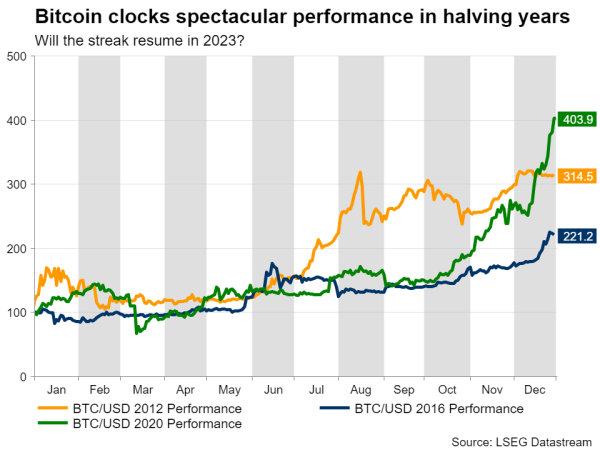

Bitcoin has shined in each halving year, will the streak extend?

Cryptos licked their wounds in 2023

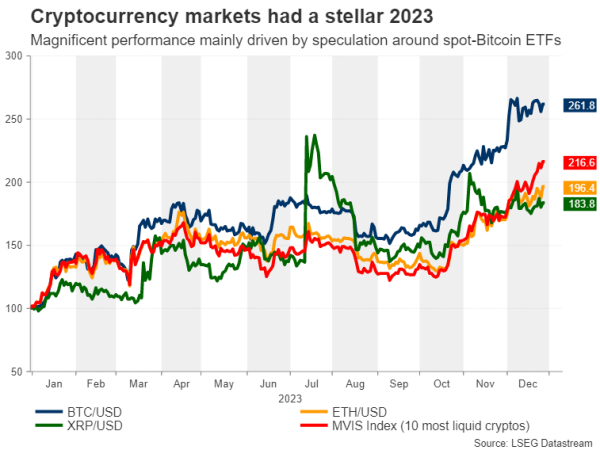

After a catastrophic 2022, which was characterised by recurring blowups and cases of fraud within the crypto industry, this year has been a spectacular one for digital coins. Bitcoin has been one of the best performing assets globally, appreciating more than 150% year-to-date, while Ethereum has also gained a stunning 96% so far.

In a more general note, the increasing demand for cryptocurrencies is also evident by the massive surge in the crypto market capitalisation, which jumped from a tad below $800 billion on January 1 to $1.67 trillion on December 29.

The main catalysts behind cryptos’ 2023 stellar performance have been the increasing bets of interest rate cuts by central banks next year and regulatory approval of spot-Bitcoin ETFs. Adding the largely anticipated Bitcoin halving event and Ethereum’s Dencun upgrade to the equation, crypto investors are bracing for an eventful year.

ETF approval could open institutional floodgates

Even if cryptocurrencies had a solid start to the year, the buzz around the impending approval of spot-Bitcoin ETFs moved the needle and accelerated the advance in the second half of 2023. Investors had been hesitant to restate their trust in the sector following a series of systemic failures. But those fears started to wane when big Wall Street names such as BlackRock, Fidelity and others filed applications for spot-Bitcoin ETFs.

The expressed interest by traditional financial institutions to be significantly involved in the crypto industry has given the sense that we are headed towards a stricter and more transparent regulatory framework, which could allow institutional investors to increase their crypto exposure. In that sense, all eyes will fall on the SEC’s upcoming decision, with analysts pointing at January 10 as the most probable date.

However, as the regulatory clearance is fully priced in, risks are asymmetrically tilted to the downside. Moreover, spot ETFs might not draw new capital to the sector as companies that sought crypto exposure might have already achieved it through existing products such as futures ETFs.

Halving years have been great for Bitcoin; Ethereum upgrades eyed

Another landmark event scheduled to occur in April 2024 is Bitcoin’s fourth halving, which will slice mining rewards in half. In theory, when the supply of a product is reduced but demand stays at the same levels, its price should appreciate. For Bitcoin, history seems to be aligning with the fundamentals as the king of cryptos has experienced massive gains in the past three halving event years, especially in the period following the event.

Without price appreciation, supply could get even tighter as mining costs will essentially double per each coin produced, leading miners with elevated operational expenses to exit the market. Again though, the magnitude of any fluctuation in Bitcoin’s price will lie on whether the impact of halving has been already fully priced in.

Turning to Ethereum, the leading altcoin could capitalise from developments in Bitcoin as the peremptory approval of a spot-Bitcoin ETF would open the door for a similar Ethereum product. Meanwhile, the Dencun upgrade expected to occur in the first quarter of 2024 will significantly improve Ethereum’s network and optimize its gas fees.

Verdict

In a nutshell, cryptocurrencies are anticipated to benefit from a mixture of macroeconomic and idiosyncratic developments next year. However, the aggressive rally we saw in 2023 seems to have been fuelled by the anticipation of all the above, leaving scope for disappointment in case expectations are not met.