Daily Market Report: Expert Technical & Fundamental Insights – 25.10.2024

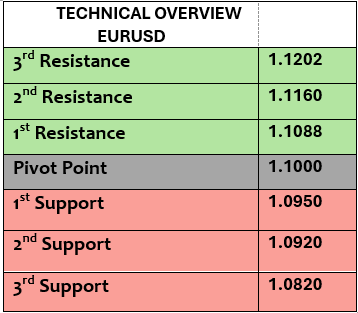

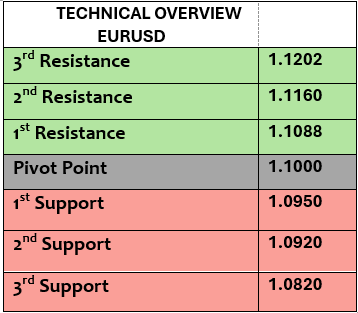

EURUSD

EURUSD is trying to recover even if it is still down by -0.41% in a week, little changed today at $1.0822. PMI numbers in services & manufacturing from EZ were mixed in October, weaker services & higher manufacturing, however the composite PMI remained below 50 which somehow means contraction.

Traders started buying from the last support, targeting $1.0836 which is doable, then $1.0870 (1H chart). Such a technical correction is highly probable, however the 1H trend index remains bearish for now.

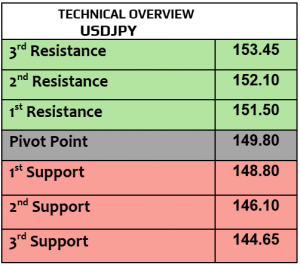

USDJPY

Tokyo’s inflation fell to 1.8% in October, weaker than September of 2.1%, that’s good news for BoJ as the bank will not remain under pressure to raise the rates anytime soon. USDJPY traded slightly weaker today at 151.72, still up by more than 1.3% in a week. In the meantime, the traders must keep an eye on the performance of the US 10Y bonds’ yields, higher yields will keep the Yen under pressure.

Traditional behavior by day traders started after 1H RSI was overbought, further correction to 151.75 (executed now) then 151. Trend index is bearish.

GBPUSD

What happened to the Pound this week? GBPUSD is still down by -0.63% on a weekly basis, trading a little changed today at $1. 2964.All PMI numbers from the UK came weaker than the estimates in October, services & manufacturing, that’s not good news for BoE. BoE’s governor Bailey raised concerns about persistent inflation even if the UK inflation kept falling. In other words, BoE may not be in hurry to cut the rates.

Mixed sentiments persisted, bearish trend index in 15 minutes, but the forecasts show more bullish bets than bearish ones. $1.2950 is the target for day-traders (done this morning ) then $1.2990.

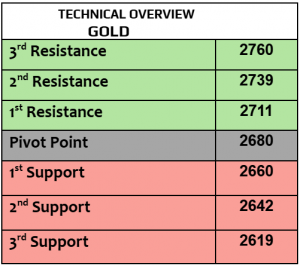

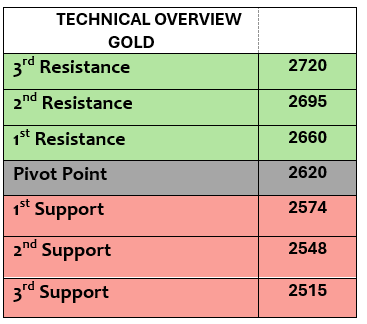

Gold

Gold is on the way to the third consecutive weekly gains, trading weaker today at $2726 per ounce. The strength in USD & higher US bond yields weighed on gold in the last two days, however the trend remained bullish. Be careful in your risk exposure as the markets’ sentiments may change quickly, favoring stronger USD.

As the chart shows, correction started from $2760 (major resistance) , $2714 is support then $2702 ( speculation) . According to the forecasts poll, 34% for bullish & 33% for bearish.

Silver

Silver fell today & traded at $33.43 per ounce amid aggressive volatility this week. All eyes will remain on China’s economic developments & if China’s government decides to support the economy by another 10 trillion Yuan as the market’s participants still expect. Buying silver on assumption is a risky game, so be careful.

Markets’ sentiments became mixed. Price action is edging lower to $33.10 then $32.50 . Technical channel remained positive (above the pivot) but the daily trend is bearish.

Oil – WTI

Crude oil prices are on track for weekly gains, WTI traded slightly higher today at $70.30PB, Brent $74.54PB. There are positive signs from the US that the refinery processing reaching its highest seasonal level in six years which means better demand. Global growth outlook had a negative impact in oil markets, mainly from China & EZ, China is the World’s second biggest oil consumer.

While the weekly forecasts were mostly bullish, volatility was low. Price action has the potential to target $72 again. Keep in mind, $69.70 & $69.30 are support levels.

DAX

DAX futures traded slightly weaker today at 19422 after closing higher on Thursday by 0.3%, supported by better PMI numbers in October than before in September. IFO numbers from Germany in economic expectations & business climate will be due later today. Yesterday, Merck fell -2.2%, Siemens -0.9% & Deutsche Bank lost -2.4%.

Technically speaking, the hourly trend index is bullish now, with low volatility. 19315 is support, 19570 is an important resistance. Trading could stay in sideways bias for today.

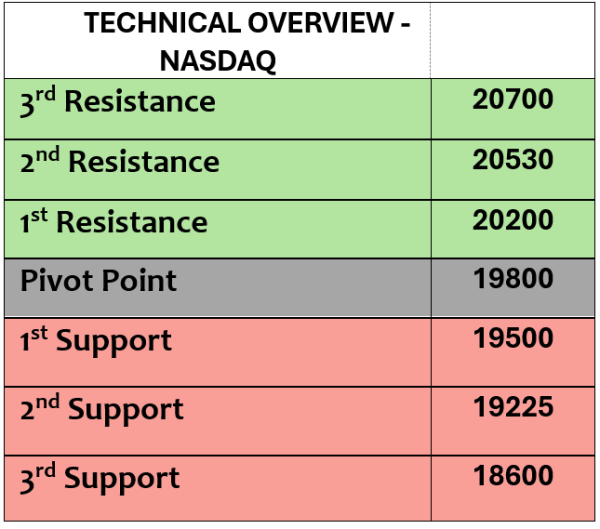

Nasdaq

US stock futures were little changed today after mixed closing on Thursday, Dow Jones fell by -0.33%, Nasdaq gained 0.76% & SPX 0.21%. Tesla shares surged by 21.9%, adding over $100 billion in market value after posting strong profits in Q3. Both services & manufacturing PMI numbers in the US were stronger in October than before, and the US initial jobless claims fell to 227K in the last week. Durable goods orders & Michigan sentiments index will be released later today.

Be careful as 15M index is bullish, but 1H trend index is strongly bearish. Price action is still showing signs of low progress to 20420. 19960 is support.

BTCUSD

Bitcoin & other major cryptocurrencies fell today, BTC traded at $67561, still on track for weekly loss by -1.1%, Eth is down today by -1.7%, Cardano -1.5% and Solana is falling by -1.8%. As there are no major developments nor big news in the crypto market, sentiments will follow the global market trend & US presidential election. Bitcoin is still up by 3.8% monthly.

The market poll still shows 50% bullish, 25% bearish, with bullish bias. Such an attitude is supported by 1H RSI that keeps advancing & targeting $67900 (that’s exactly what happened yesterday, next target is $68800. $66700 is support.