Dax Index News: ECB, Fed Rate Paths in Focus as Markets Await Earnings – Forecast Today

DAX Hits New High Before Retreating

On Tuesday, October 15, the DAX slipped by 0.11, partially reversing a 0.69% gain from the previous session, closing at 19,486. Significantly, the DAX climbed to an all-time high of 19,634 earlier in the day.

Investor bets on ECB rate cuts in October and December drove the DAX to a new high.

Tech Stocks Hit by Weak Earnings

Siemens Energy tumbled by 4.01% in a broad-based energy sector sell-off, while Deutsche Bank slid by 2.57% on news of a block sale.

Infineon Technologies and SAP saw losses of 1.84% and 0.83%, respectively, as investors reacted to weak earnings from ASML.

Auto stocks also ended the session in negative territory, with BMW falling 1.26%, while Mercedes-Benz Group declined by 0.85%.

German Wholesale Prices and Economic Sentiment in Focus

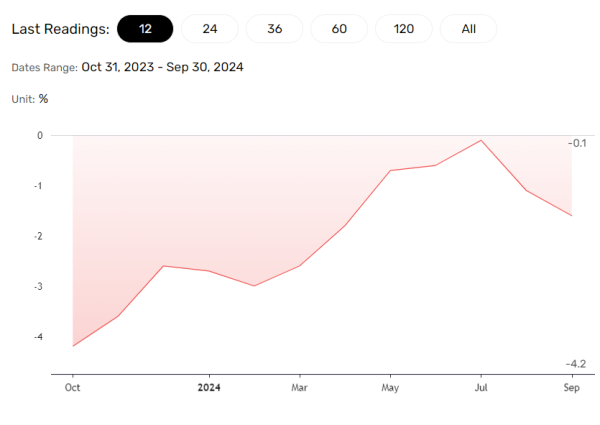

On Tuesday, German wholesale prices sent a gloomy image of Germany’s demand environment. Wholesale prices unexpectedly declined by 1.6% year-on-year in September after a 1.1% fall in August.

Wholesalers may cut prices as demand wanes, signaling a softer inflation outlook while supporting multiple Q4 2024 ECB rate cuts.

However, better-than-expected sentiment toward the German economy offered modest relief despite ongoing economic troubles.

Experts Views on the Euro Area Economy and ECB Rate Path

European Macroeconomic Specialist at Oxford Economics, Daniel Kral, commented on Euro area data, stating,

” While industrial production in the Eurozone is likely to grow in August (data out next week), the underlying picture is weak. Demand remains weak relative to inventories with the ratio moving the wrong way recently. Interest rates can’t come down soon enough for EU industry.”

ECB Chatter in Focus as the ECB Decision Looms

On Wednesday, October 16, investors should track ECB commentary. Insights into inflation, the economic outlook, and the ECB rate path may influence DAX-listed stocks. Crucially, rising expectations for October and December ECB rate cuts could push the DAX toward 19,750.

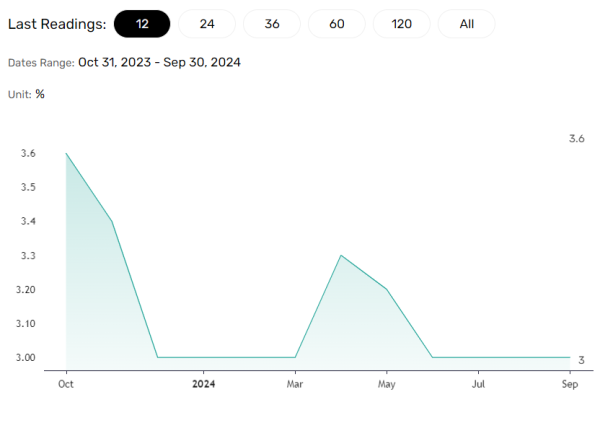

Consumer Inflation Expectations and the Fed Rate Path

On Tuesday, US consumer inflation expectation figures likely contributed to the DAX’s losses. Inflation expectations unexpectedly remained at 3.0%, suggesting consumers may increase spending on expectations that inflation will unlikely soften. Indications of higher spending and inflation could reduce bets on multiple Q4 2024 Fed rate cuts.

US Market Trends

On Tuesday, US Equity Markets reversed their gains from the previous session. ASML triggered a tech sector rout after reporting disappointing earnings and a weaker outlook for 2025.

The Nasdaq Composite Index declined by 1.01%, while the Dow and the S&P 500 ended the session down 0.75% and 0.76%, respectively.

Fed Rate Path in Focus

On Wednesday, investors should track FOMC member speeches. Insights into the economic outlook, the labor market, inflation, and the Fed rate path could influence the DAX.

Fed support for rate cuts in November and December amid expectations of a soft US landing could send the DAX toward 19,750. Conversely, calls to delay rate hikes due to sticky inflation could drive the DAX below 19,500.

Beyond the economic calendar, investors should also consider earnings results.

Near-Term Outlook

In the near term, trends will likely depend on Euro area inflation-related data, the ECB monetary policy decision, and corporate earnings.

Weaker inflation and speculation about October and December ECB rate cuts could drive demand for DAX-listed stocks. Nevertheless, weak corporate earnings could weigh on investor sentiment.

On Wednesday, the futures indicated a mixed opening, with the DAX down 38 points, while the Nasdaq mini rose by 43 points.

Investors should stay alert, with central bank chatter, corporate earnings, and China in focus. Stay informed with our latest news and analysis to manage your risks effectively.

DAX Technical Indicators

Daily Chart

The DAX remains well above the 50-day and 200-day EMAs, confirming bullish price trends.

A breakout from October 15’s all-time high of 19,634 could give the bulls a run at 19,750. Furthermore, a breakout from 19,750 may signal a move toward the 20,000 level.

Investors should consider China stimulus updates and central bank commentary, which may influence near-term market sentiment.

Conversely, a fall through 19,350 could indicate a drop toward 19,000.

The 14-day RSI at 64.34 indicates a climb to 19,750 before entering overbought territory.