DAX Index News: US Labor Data and PMI Reports to Dictate DAX Market Direction

Market Overview

On Wednesday, August 21, the DAX gained 0.50%, reversing a 0.35% loss from the previous day, to close at 18,449.

Wednesday: DAX Market Movers

- Auto stocks were among the best performers, with Mercedes Benz Group and BMW advancing by 1.48% and 1.09%, respectively.

- Tech stocks also advanced on speculation about the possibility of multiple 2024 Fed rate cuts.

- Infineon Technologies gained 1.52%, while SAP rose by 0.31%.

German Private Sector PMI in Focus

Private sector PMIs for Germany may influence buyer demand for DAX-listed stocks.

Economists forecast Germany’s HCOB Services PMI to drop from 52.5 in July to 52.3 in August. A larger-than-expected fall could fuel speculation about a September ECB rate cut as services accounts for over 70% of the German economy. A more dovish ECB rate path could lower borrowing costs, possibly boosting consumption, company profits, and stock prices.

On Wednesday, ECB Governing Council member Fabio Panetta raised bets on a September rate cut, reportedly saying,

“I think it’s reasonable to expect that from here on we will be going into a phase of easing monetary conditions because inflation is falling and the world economy is slowing down.”

However, investors should also consider the Manufacturing PMI and trends for the employment and price subcomponents within the composite PMI.

Softer input price and employment trends, alongside subdued demand across the manufacturing sector, may bolster the case for an ECB rate cut.

Expert Views on Eurozone Inflation and the ECB

Pictet Wealth Management Head of Macroeconomic Research Frederik Ducrozet commented on the wage growth figures for the Eurozone, stating,

“National data look consistent with a drop in negotiated wage growth in Q2 (due Thursday), including large declines in Germany and France. Still a lot of noise in a bumpy process, but this should seal the deal for an ECB rate cut at the 12 September GC meeting.”

On Thursday, the ECB Monetary Policy Meeting Minutes may reinforce expectations of a September rate cut.

FOMC Meeting Minutes Hint at September Fed Rate Cut

After the European markets closed on Wednesday, the FOMC Meeting Minutes fueled speculation about a September Fed rate cut.

FOMC Committee members viewed the current monetary policy stance as restrictive, possibly restraining economic growth. Additionally, Committee members saw the risks to achieving the Fed’s employment and inflation goals continue to move into better balance.

The Meeting Minutes hinted at a September Fed rate cut as Fed Chair Powell’s speech at the Jackson Hole Symposium loomed.

Expert Views on the Fed Rate Path

Wall Street Journal Chief Economics Correspondent Nick Timiraos remarked on the Meeting Minutes, saying,

“The Powell Fed is at a crossroads. The debate over when to cut is over, and the conversation around how fast to go is heating up. A soft landing is tantalizingly close because the economy has hewed closer to an optimistic scenario Fed officials outlined.”

US Market Trends

On Wednesday, August 21, the US equity markets ended the session in positive territory as investors reacted to the FOMC Meeting Minutes. The Nasdaq Composite Index gained 0.57%, while the S&P 500 and the Dow advanced by 0.42% and 0.14%, respectively.

US Economic Calendar

On Thursday, August 22, US labor market data and Services PMI figures will be pivotal for market risk sentiment.

US Initial Jobless Claims

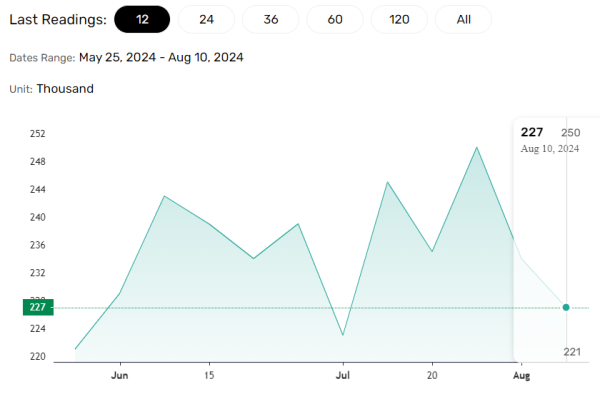

Economists predict initial jobless claims to rise from 227k in the week ending August 10 to 230k in the week ending August 17.

A weaker labor market could affect wage growth and disposable income, possibly dampening consumer spending and inflation. Softer inflation could raise investor bets on a 50-basis point September Fed rate cut. A more dovish rate path could boost demand for DAX-listed stocks. However, an unexpected spike in initial jobless claims (+250k) could retrigger US recession fears, possibly causing a flight to safety.

Expert Views on the US Labor Market

Wall Street Journal Chief Economics Correspondent Nick Timiraos remarked on the US Bureau of Labor Statistics revisions, stating,

“BLS revisions show the economy added 818,000 fewer jobs than previously reported over the 12 months ended March. That would lower monthly payroll gains (initially +246K) by 68K a month, on average. This means job growth was +1.4% in March 2024, versus previously reported +1.9%. This revision of -0.5% to the employment level is the largest since 2009.”

US Services PMI Crucial for the Economy

Economists expect the S&P Global Services PMI to decline from 55.0 in July to 54.0 in August. Slower service sector activity could support investor bets on a September Fed rate cut as it contributes over 70% to GDP.

Investors should also consider the employment and price subcomponents. Downward trends in job creation rates and input prices may bolster expectations of a September Fed rate cut.

However, a PMI fall below 50 would signal a sector contraction, likely negatively impacting DAX-listed stocks.

Near-Term Outlook

Near-term DAX trends will hinge on US labor market data and the private sector PMIs. Weaker figures could fuel bets on ECB and FED rate cuts, likely driving demand for DAX-listed stocks. Conversely, a sharp decline in Services PMIs and a spike in jobless claims may rekindle recession fears, negatively impacting the DAX.

In the futures markets, the DAX and the Nasdaq Mini were down by 14 and 10 points, respectively.

Investors should stay alert, with the Services PMIs, US labor market data, and the Fed in focus. Monitor the news wires, the economic calendar, and expert commentary to manage trading strategies.

Stay informed with our latest news and analysis to manage your risks effectively.

DAX Technical Indicators

Daily Chart

The DAX hovered above the 50-day and 200-day EMAs, confirming the bullish price trends.

A breakout from 18,500 could give the bulls a run at 18,750. A return to 18,750 could signal a move to the all-time high of 18,893.

Services PMIs, US labor market data, and central bank comments require consideration.

Conversely, a DAX break below the 50-day EMA could bring the 18,000 handle into play. A fall through 18,000 may give the bears a run at the 17,615 support level.

The 14-day RSI at 59.11 indicates a climb to the all-time high of 18,893 before entering overbought territory.