DE40 gains ahead of FOMC minutes

- European gains slightly ahead of FOMC Minutes

- China's Ministry of Commerce launched an anti-subsidy investigation into dairy products imported from the European Union

General market situation:

Wednesday's session on European stock markets is proceeding in a slightly better mood. Germany's DAX is currently gaining 0.4% on an intraday basis. At the same time, France's CAC40 is adding 0.4%. Investors' attention turns today to the FOMC Minutes, which may outline the direction of future monetary policy in the US. In Europe itself, there is a lack of significant corporate news.

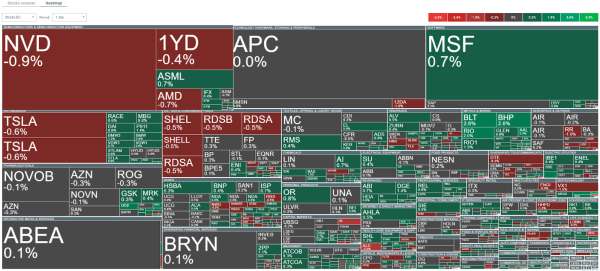

Volatility seen today in the broad European market. Source: xStation

DE40 is trading nearly 0.4% higher during Wednesday's session. The index broke above the key resistance level set by the 50-day EMA (blue curve on the chart). Breaking through this zone could, in theory, open the way for further increases towards the historical peaks at 19,000 points. On the other hand, however, it is worth bearing in mind that the scale of the recent rebound is sizable, which may lead investors to book some of the gains. In this aspect, a relatively important support zone may be the previously mentioned 50-day EMA and 100-day EMA (purple curve on the chart). Source: xStation

News:

Brookfield Asset Management is asking banks to lay out some €9.5 billion in debt for a potential acquisition of Spanish pharmaceuticals manufacturer Grifols SA (GRF.ES). The Toronto-based investor has asked banks to pour money into refinancing Grifols' existing debt, which includes loans and high-yield bonds. The company's shares are currently gaining more than 5%

Dairy companies are losing ground today after China's Ministry of Commerce today launched an anti-subsidy investigation into goods imported from the European Union.

Other news coming out of individual companies in the DAX index. Source: Bloomberg Financial LP