Debt repayment tops India Inc’s use of QIP proceeds in 2024; capex second priority

India Inc will spend almost half of the capital raised through qualified institutional placements (QIPs) in 2024 to reduce debt and make balance sheets lean, with capital expenditure and inorganic growth initiatives emerging as the next major focus areas for fundraising, according to a Moneycontrol analysis of 67 QIP documents (excluding BFSI companies) filed with stock exchanges.

2024 has been a record year for QIP fundraising, with 77 companies raising Rs 96,320.83 crore so far, as per data from primary market tracker Prime Database.

Also Read: Varun Beverages to tap markets for Rs 7,500 cr QIP in November

“QIP is a bull market product. Companies make use of the bull market to dilute equity at typically high valuations,” said Pranav Haldea, Managing Director, Prime Database, commenting on the record QIP fundraising this year.

Of these, excluding financial services companies, 67 corporates raised a total of Rs 77,749.39 crore (net of transaction fees paid to advisors).

Of these, excluding financial services companies, 67 corporates raised a total of Rs 77,749.39 crore (net of transaction fees paid to advisors).

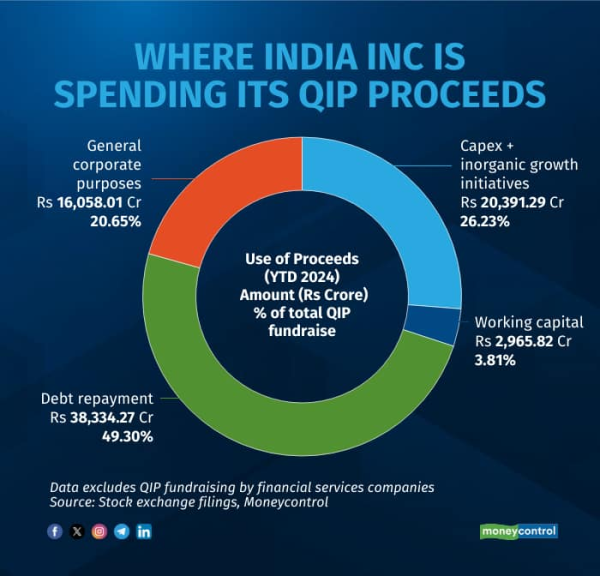

Data shows that Rs 38,334.27 crore, or 49.3 percent of the QIP funds, were used by corporates to pare down their debts, continuing with the trend of deleveraging of balance sheets seen since the Covid pandemic.

“Debt repayment remains the primary use of QIP proceeds because it allows companies to improve their financial health by reducing leverage and the burden of interest expenses. By diluting equity to pay off debt, businesses can balance their capital structure, strengthening their balance sheet and enhancing their resilience against market fluctuations. Reducing debt also lowers interest obligations, which positively impacts the P&L,” said Prashant Rao, Director & Head - Equity Capital Markets, Anand Rathi Investment Banking.

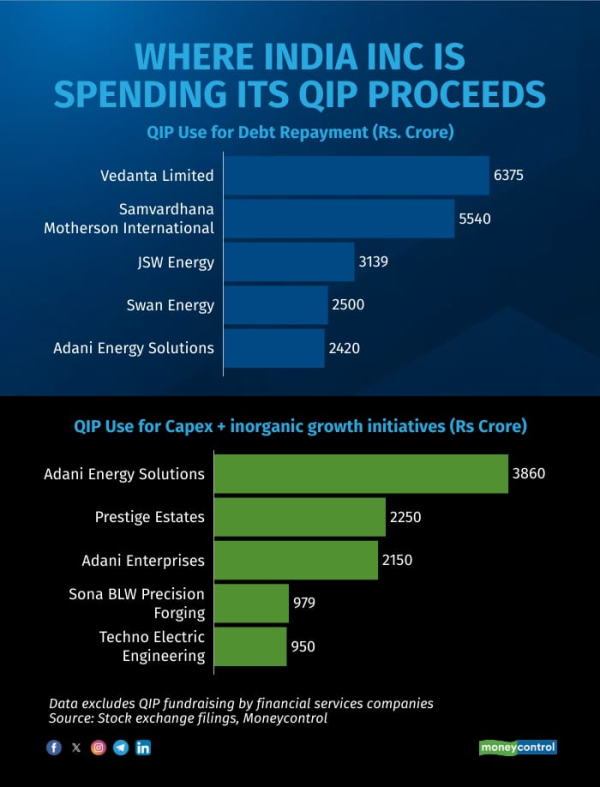

Major companies that tapped the QIP route to raise money to repay their lenders include Vedanta Ltd (Rs 6,375 crore), Samvardhana Motherson International (Rs 5,540 crore) and JSW Energy (Rs 3,139 crore).

Story continues below AdvertisementRemove AdArka Mookerjee, capital markets partner at law firm JSA, added that from a regulatory point of view, one of the biggest reasons for debt repayment as the main use of QIP proceeds is the traceability of utilisation of funds raised.

“Monitoring of QIP fund usage as well as increased disclosure requirements of stock exchanges are playing a role in finalisation of objects. Debt repayment remains a viable mode for all companies to free up internal accruals for growth or expansion,” he said.

After debt repayment, around Rs 20,391.29 crore raised from QIPs was specifically earmarked for organic growth initiatives such as capital expenditure and inorganic growth initiatives like acquisitions, comprising about 26.23 percent of all QIP proceeds.

After debt repayment, around Rs 20,391.29 crore raised from QIPs was specifically earmarked for organic growth initiatives such as capital expenditure and inorganic growth initiatives like acquisitions, comprising about 26.23 percent of all QIP proceeds.

Companies that raise money for capex include Adani Energy Solutions (Rs 3,860 crore), Prestige Estate (Rs 2,250 crore) and Adani Enterprises (Rs 2,150 crore).

Anand Rathi’s Rao said there has been some growth in QIP capital raising for capex purposes this calendar year, although it remains moderate.

He pointed out that a significant portion of QIP money has been allocated towards working capital requirements.

Also Read: QIP issuances by real estate developers hit Rs 12,801 crore in Jan-Sept 2024, second highest after renewable energy

“This shift towards working capital investment ultimately supports business growth as it provides liquidity to manage operations, potentially leading to more sustainable expansion. This trend reflects a balanced approach by companies, focusing on immediate operational needs while selectively pursuing capex and growth opportunities,” said Rao.

Commenting on the outlook for QIP activity, Rao said while recent short-term corrections or events like the US elections may cause temporary market disruptions, Indian markets are poised for strong long-term growth. “The Indian economy’s substantial growth potential is expected to drive increased activity in equity markets in the near future,” he said.