Deposits are the focal point but its intra-bank borrowings that need scrutiny

In the last few months, slow growth in bank deposits has been a talking point amidst policymakers and bankers. The RBI Governor in monetary policy of August 2024 mentioned that “bank deposits trailing loan growth” is a risk for the banking system. In RBI’s Board Meeting in the same month, the Finance Minister urged banks to innovate to bridge gap between deposits and credit. This development of deposits growth being lower than credit growth has led to several questions. What are the implications of this trailing deposit growth on the banking system? What can policymakers and banks do to improve the situation?

Post-1991, deposit growth often lagged credit growth

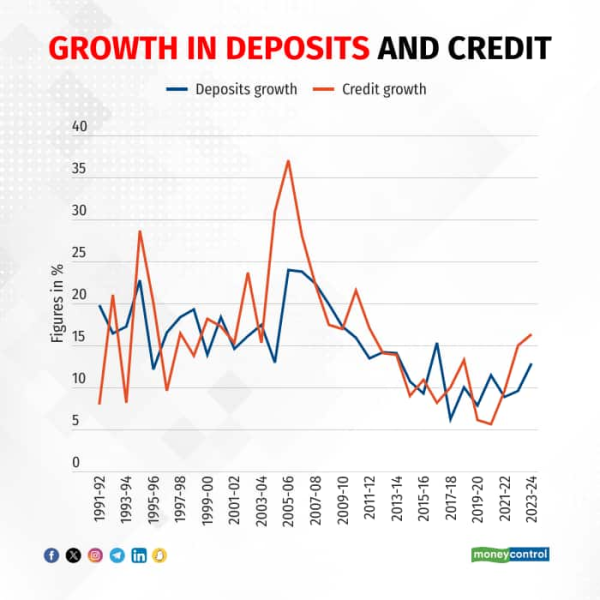

Before answering the questions, let us see the trends of credit and deposit growth. We focus on trend post 1991 reforms as before 1991, the interest rates were administered by the government. In the 33-year period, the credit growth exceeds deposit growth in 17 years. So, it is not as if this is the first time the credit growth is exceeding the deposit growth. This time the credit growth has exceeded deposit growth for three successive years, similar to 2004-07 where credit growth exceeded deposit growth significantly.

Given this fact that credit growth has been higher than deposit growth for most part of last 33 years, why is it a worry this time around?

RBI Governor Shaktikanta Das in a July 2024 speech, had mentioned “It goes without saying that there will always be some gap between the two, but credit growth should not run ahead of deposit growth by miles”. We have seen that credit growth has exceeded deposit growth by miles in the past too. So what is the problem now?

In order to answer this question, we need to understand two theories of bank intermediation.

Role of banks in credit multiplier

The first theory which is taught in most textbooks is that banks first get deposits and then they lend these deposits as loans. In India’s case, banks also need to keep certain percentage of deposits as reserves and investments under Cash Reserve Ratio and Statutory Liquidity Ratio.

# So say, Bank A get Rs 100 as deposits, they keep Rs 18 as investments under SLR and Rs 4.5 as CRR. Bank A can now lend the remaining Rs 77.5 as credit.

# The new loan of Rs 77.5 in turn becomes a deposit for Bank B and then Bank B creates more loans in the system. Thus we have a loan cycle where more loans are created which we also call as the credit/money multiplier process.

Credit and deposits, the chicken-and-egg situation

The second theory is that banks actually create credit first which are recorded simultaneously as deposits on the liabilities side of bank’s balance sheet. This alternate theory was brought to the light by Bank of England research in 2014.

# Under this, Bank A creates new money of Rs 100 comprising loan of Rs 77.5 and reserves and investment of Rs 22.5. This new money is recorded as Rs 100 as deposits. The customer of Bank A will spend the money which will become deposits in Bank B.

# In this model, however, Bank B is not dependent on deposits from Bank A to create loans. It can create loans on its own.

Active and passive views of deposit creation

There are major differences in these two views of banking. In the first view, banks create money via deposits, in the second view money is created via credit. The first view positions bank as passive creators of money which wait for deposits whereas second view positions bank as aggressive creators of money. The banks do not play any major role in a financial crisis under the first view, whereas banks are the key reasons behind a financial crisis under the second view.

Which of the two theories do we believe in? Since 2014, the second view has become more acceptable amidst central bankers and bankers. RBI Governor Das in the same July speech noted “It is, of course, recognised that almost every loan creates a new deposit in the borrower’s name or adds to his or her account balance. In other words, money begets money in the banking system.”

Based on the second view, the banks are giving loans and making investments but an equal amount is not showing as deposits. Why would this be the case?

Where’s the leakage?

One explanation being given is that people are withdrawing their deposits and investing in capital markets. This is because interest rate on bank deposits is lower than returns in stock markets. It has also become easier to invest in markets due to digitalization. As a result, there has been a surge in retail investments in stock markets and mutual funds. But then this stock market investment will eventually show up as deposits. If an investor invests in stock markets or mutual funds, the investor’s deposits are transferred to deposits of the broker/asset management company, leaving the overall deposits unchanged.

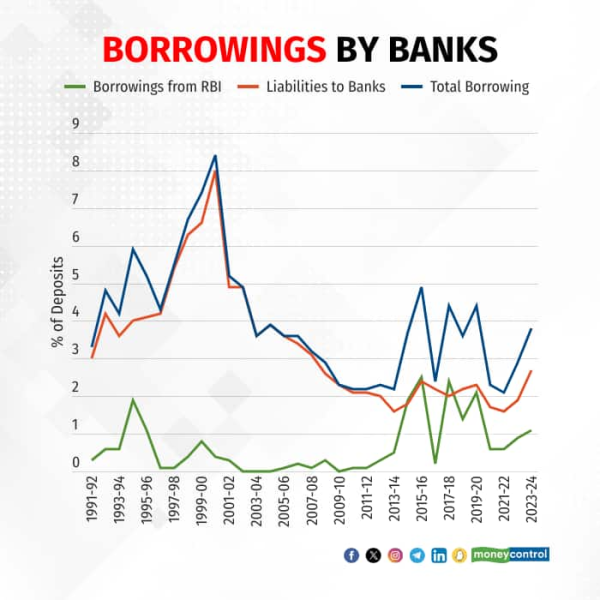

The second explanation is banks are giving loans but not creating equal amounts of deposits. Instead, banks are borrowing from RBI and other banks. In the above example, the Bank A could also decide to create deposits worth Rs 90 and Rs 10 of borrowings. In the data, we do see that banks have increased their borrowings from RBI and other banks. However, the total borrowings as a share of deposits has been higher in earlier years.

Interest rate angle

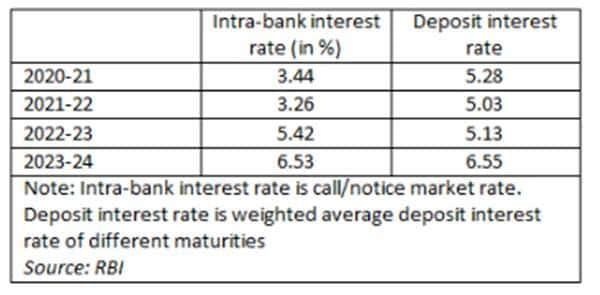

What explains banks choosing to create higher borrowings than create higher deposits? Is it the case that interest rate on deposits is higher than intra-bank rate?

We see that in the pandemic year 2020-21, the intra-bank rates are lower than deposit rate as RBI cut policy rates. The policy rates are transmitted immediately to the intra-bank rate but takes time to be transmitted to the deposit and lending rate. This is because banks cannot immediately change deposit and lending rates. As RBI started raising policy rate in 2022-23 to tackle inflation, both intra-bank and deposit rates increased but intra-banks rates rose faster. Ideally, banks should have borrowed less in 2022-23 given higher rates in intra-bank markets. Maybe they did not as they were not sure about RBI’s policy stance and also it takes time for deposit rates to increase. By 2023-24, we see deposit rates rise marginally higher than intra-bank rates.

Is it worrying that banks are choosing to raise more borrowings? Even with the rise in borrowings they are insignificant compared to overall deposits. Perhaps the government and RBI are worried that higher borrowings make banks unstable as seen during the 2008 crisis.

Summing up, we get three major points from above analysis.

# First, the credit-deposit gap has widened in the last three years but it is not a new development.

# Second, the gap has emerged as banks are preferring to borrow from RBI and other banks and not deposits.

# Third, the bank behaviour seems to be partly explained by difference in interest rates between borrowings and deposits.

Hence, the Finance Minister is urging banks to raise deposits. The analysis also shows how despite many centuries of banking; we still do not understand the functioning of banks. We need more research to understand the maze of money and banking.