Did the Fed jump the gun by being too dovish? Will bonds outperform stocks in 2024?

It’s been a rollercoaster ride for US equities recently, but the stock market has corrected course heading into the end of the year. The S&P 500 is trading at the highest level in almost two years whilst the Nasdaq 100 is pushing to an all-time high. Even the Russell 2000, which has had a rockier performance this year, has pushed to a yearly high attempting to break prior resistance.

S&P 500 daily chart

Source: tradingview

Source: tradingview Past performance is not a reliable indicator of future results.

Fed commentary sends markets into a frenzy

The main driver of this renewed bullish appetite is the Fed’s ‘dovish hold’ last Wednesday. The central bank left rates unchanged as anticipated, but the messaging from the meeting resulted in a very unexpected shift in positioning. The whole package – from the statement to the dot plot and the press conference – seemed to suggest the FOMC was preparing markets for rate cuts early next year.

The thing is, with a surprisingly strong economy – much more so than in Europe – the consensus before the meeting was that the Fed would stick to its ‘hawkish’ commentary for the foreseeable future. That is, until it ensured that inflation had successfully returned to the 2% target in an attempt to avoid financing conditions loosening too quickly as bond yields drop. But Powell and his team did quite the opposite, failing to dampen prospects of early rate cuts and just falling short of promising they would happen.

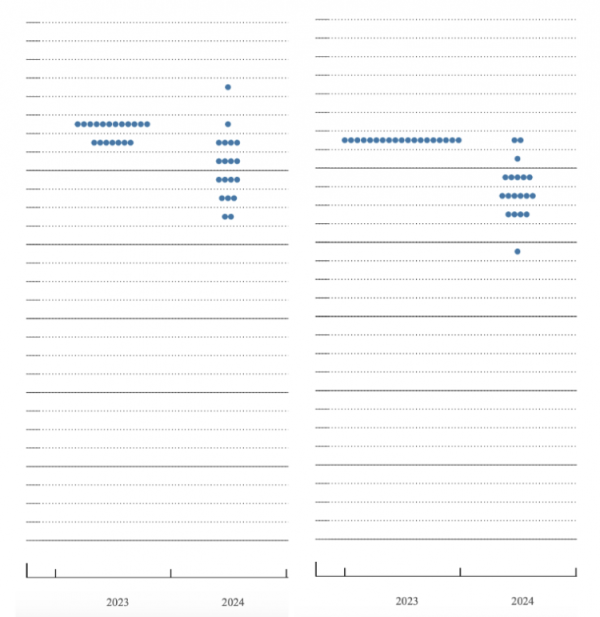

The accompanying dot plot further cemented the conviction that the Fed’s policy has pivoted and is now focused on the descent from its peak. Three months ago, 10 members thought the Fed funds rate would still be above 5% by the end of next year. Now, only three think so, with most members expecting rates to now be around 4.5% by year-end, with one of them believing they would end up below 4%. Powell’s press conference was the final nail in the coffin for hawkish hopefuls, as he dropped most of the previous restrictive messaging, opting to highlight that the Fed was now very much focused on the risks of keeping rates higher for too long.

September vs December dot plot predictions

Source: federalreserve.gov

Source: federalreserve.gov Past performance is not a reliable indicator of future results.

The change in the FOMC’s position seems very sudden, and judging by the market’s reaction many were caught off guard. Yield and the dollar dropped whilst equities and gold shot higher. It seems like concerns about persistent inflation have gone out the window allowing risk sentiment to blossom once again. The funny thing is that the Fed’s dovish shift allowed other central banks, especially the BOE and the ECB, to follow suit without giving off the wrong impression. But despite their economies being in much worse shape than the US they failed to do so, practically pushing back on the notion of rate cuts anytime soon.

So, this begs the question as to whether the Fed was right in changing direction and shifting its focus on cutting rates – or is it a bit drastic and a bit too soon?

Should markets believe that rates will come down that soon?

Since the meeting, various Fed officials have tried to play down expectations of steep cuts next year – with markets pricing in six 25bps rate cuts between March and December next year as per Reuters data. The dot plot suggested just three. But of course, that can change. Chicago Fed President Austan Goolsbee said he was surprised by the outsize market reaction to the Fed’s updated quarterly economic projections last week. Cleveland Fed President Loretta Mester and San Francisco Fed President Mary Daly have also suggested that expectations for rate cuts early next year were premature. They will both be FOMC voters in 2024.

This suggests that the market reaction has gone too far. But whether the Fed is right to have made this shift will depend on how inflation and the labour market evolve over the coming months. At the end of the day, that is their mandate, and that is how they should be judged. The latest data showed that inflation continues to soften but is still elevated and at an uncomfortable level for the central bank. The labour market, whilst cooling, remains tight. But the latest CPI data revealed that whilst goods inflation has proved to be transitory and is now back to zero, services inflation, which covers a greater part of the economy, remains double where it was before the pandemic. This is driven mostly by housing costs and service sector wages. So, after all the efforts made by the Fed in the past few months to tame services inflation, it does seem like the recent shift is slightly out of character. The bottom line is that there are still some very hot areas in the economy and cutting rates may lead to higher inflation further down the line if the Fed doesn’t tread carefully.

Can the stock market keep on rising?

Another important question is where do we go from here? Now that expectations of loosening monetary policy have already been priced in at a time when inflation is still high above the 2% target and rate cuts haven’t started, what comes next?

As mentioned before, US stock indices are making the most of the risk-on sentiment. What has been a very segmented rally with limited breath – dominated by a very few large companies – throughout most of 2023 has now turned into a broad-based move. The S&P 500, which is equally weighted – where each member has a weighting of 0.2% regardless of size – was venturing into negative territory on the year in October, and is now at an almost two-year high. Another good example is the Russell 2000, which is composed of smaller-cap companies, and has pushed to the highs of the year attempting to break above 2,010 for the first time since August last year, as companies within the index will benefit from lower rates as it improves their debt structures.

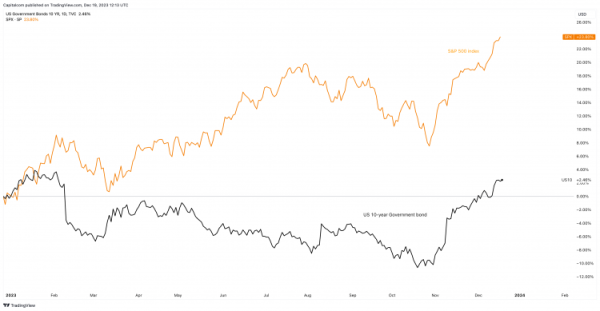

So far this year, stocks have risen more than bonds (as can be seen in the chart below). As the economy showed incredible resilience, yields shot higher as markets were becoming more convinced that the Fed would continue hiking throughout 2023 – and they were right. With the lack of a recession, and yields dropping throughout the last quarter of the year, stocks have managed to outperform bonds. Looking ahead, the notion of whether a recession will take place will determine which asset class outperforms next year. Central to that is US credit. Bulls think it won’t be an issue, bears do. Despite the brief US bank crises earlier this year, defaults have not risen significantly, but they could still do so – proving bears right.

Another significant factor will be how many rate cuts will happen next year. The Fed has suggested three - as per the dot plot - but markets currently expect six - as per Reuters data. The latter could happen, but that would likely entail that some of the worst predictions about the economy become true, which would favour bonds. So, all in all, a soft landing could continue aiding stocks higher, allowing them to outperform bonds once again, whilst a recession would likely favour bonds and lead stocks to retrace some of the recent gains.

Only time will tell whether the Fed’s dovish shift is the right move, but from past experiences cutting rates when inflation is dropping but still high has proven to be disastrous.

US 10-year government bond and S&P500 relative performance in 2023

Source: tradingview

Source: tradingview Past performance is not a reliable indicator of future results.