Disney earnings preview: time to check Mickey Mouse's house inside out

Disney earnings date:

Walt Disney Co (All Sessions) is set to release its fiscal third quarter 2024 financial results on August 7th, before US markets open.

2Q performance review:

In Q2 fiscal 2024, Disney reported:

- Revenue: $22.08 billion

- Earnings per share: $1.21, beating analyst estimates of $1.01

3Q performance expectation:

- Revenue: $23.09 billion, a 3.4% increase year-over-year

- Earnings per share: $1.19, up from $1.04 in Q3 Fiscal 2023

Key areas to watch

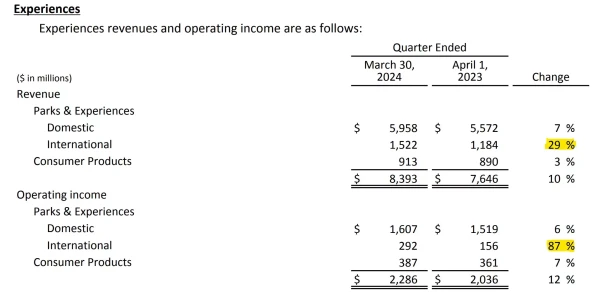

It’s anticipated that revenue from Disney's theme parks (under the “Experiences” division) will continue to show robust momentum, particularly in the international segments. In contrast, its media and entertainment segment might continue to face significant challenges.

Streaming:

Similar to Netflix Inc (All Sessions), Disney+'s subscriber growth and the progress of its ad-supported tier are key areas to watch to assess the entertainment giant’s effort to expand its audience pool and revenue stream. In the past quarter, Disney+ saw strong growth in the US and Canada markets while losing 2% of subscribers in other regions. However, in terms of revenue generation, the trend reversed in the "Average Monthly Revenue per Paid Subscriber" metric, which saw a 13% improvement in international markets and a 2% drop in the domestic market.

Overall, Disney's streaming line still faces challenges in both growing the audience base and improving profitability from paid users. Failing to tackle these challenges will put the company’s goal of turning its streaming division profitable by the end of fiscal 2024 at risk.

Experiences:

Disney’s theme parks, under the “Experiences and Products” segment, have been a bright spot for the entertainment giant. In the previous quarter, the company revealed that the increase in operating income was largely due to the outperformance of Disney World Resort and Disney Cruise Line domestically, along with a notable increase in volume and spending in international markets like Hong Kong Disneyland. Investors will be keen to see if the strength in attendance and guest spending continues into the spring season.

Balancing content strategy with cost-cutting measures

Returning CEO Bob Iger's ambitious plan to reduce costs by $5.5 billion annually remains a key focus for investors and analysts. This comprehensive initiative, announced in February 2023, will be closely examined in each earnings report as investors seek insights into how Disney balances high-quality content development with fiscal health, especially in light of Netflix’s recent aggressive content creation and expansion strategy.

Disney share price

Disney's stock has experienced great volatility in 2024. The stock kicked off the year with a 37% rally to mid-April, but it has since given up all those gains and dipped to the year's low of $87 (as of market close on August 5, 2024).

From a technical perspective, it's clear that the unwind continues, as demonstrated by the descending moving trajectory in recent months and bringing the price trading below all major moving averages at the moment. Since the price breached the major support at $89 before the earnings, the risk of sliding towards $80 has increased substantially. In terms of near-term support, the $89/$90 range is poised to be a major hurdle should the price seek a rebound.

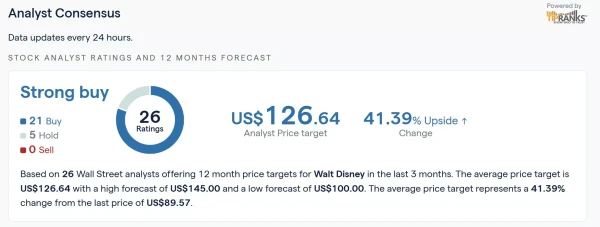

According to TipRanks, the current rating for Disney is "Neutral," with 26 analysts recommending the stock as a "buy" in the past three months.

Overall, the upcoming earnings report could significantly impact Disney's share price and outlook. This earnings release comes at a crucial time for Disney as it navigates the evolving media landscape and aims to balance its cost and investment strategy. Investors will be looking for signs that the company can maintain growth in its core segments while effectively improving its profitability.