Dispelling The Doom & Gloom Around UK Plc.

Those who have read my commentary for some time may notice that it is, perhaps, not always the most optimistic in nature. This is particularly true of my musings on UK Plc, where we haven’t had especially much to shout about of late. That, however, looks to be changing, as recent data bears out.

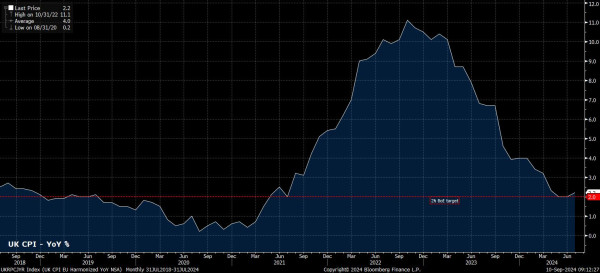

Take inflation.

Headline CPI returned to the 2% target in both May and June, and as near as makes no difference remained there in July, with the base effect stemming from last year’s sizeable energy price decline the only factor pushing the annual inflation rate modestly higher.

Preview

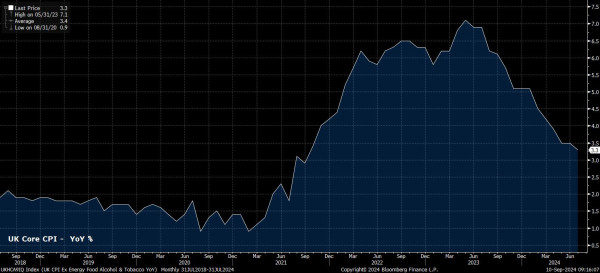

PreviewMeasures of underlying inflationary pressures, meanwhile, continue to decline.

Core CPI, for example, which excludes volatile food and energy prices, fell to a near 3-year low in July.

Preview

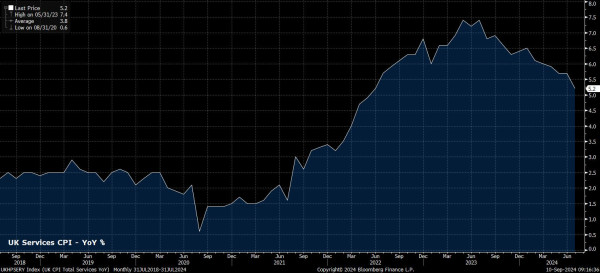

PreviewAt the same time, services prices, a key metric to which policymakers pay close attention as a gauge of inflation persistence, sits at its lowest level in a couple of years, and is now in a firmly embedded disinflationary trend.

Preview

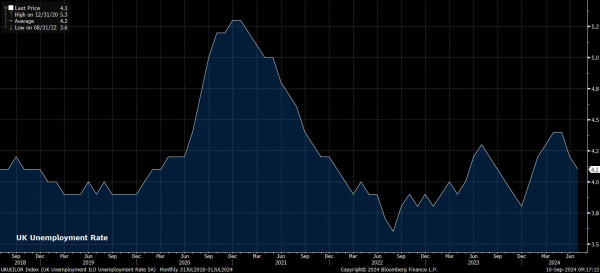

PreviewLet’s turn to the labour market.

Joblessness has continued to decline, with headline unemployment falling to 4.1% in the three months to July, its lowest level since the start of the year.

Preview

PreviewEarnings growth has continued to cool, further diminishing the risk of a wage-price spiral developing. Regular pay rose 5.1% YoY in the three months to July, its slowest pace in two years, while overall pay (including bonuses) rose by 4.0%, the slowest rate since November 2020.

Preview

PreviewThe activity picture is similarly rosy.

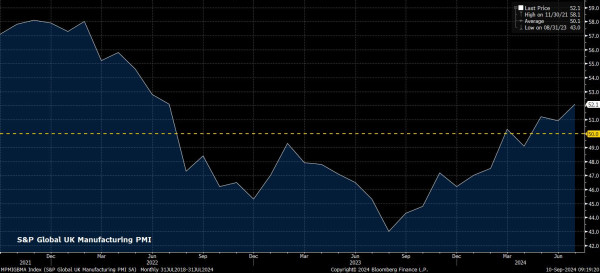

August’s manufacturing PMI survey, for instance, showed the headline index rising to its highest level in more than 2 years, as output, new orders, and employment all showed significant MoM increases.

Preview

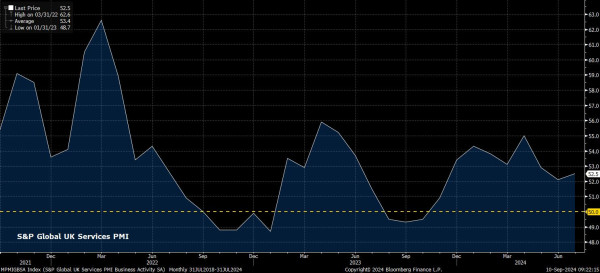

PreviewOn the services side of the ledger, the August PMI figure showed the sector expanding for the tenth consecutive month, with activity expanding at its fastest rate since April.

Preview

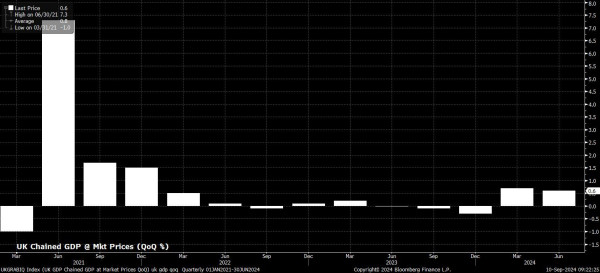

PreviewTogether, these PMI gauges point to the economy likely maintaining the solid momentum seen in the first two quarters of the year, whereby GDP grew 0.7% QoQ in Q1, and by 0.6% QoQ in Q2, both of which are comfortably quicker than any quarterly growth rate seen since the start of 2022.

Preview

PreviewAll of this has allowed the Bank of England’s Monetary Policy Committee to gradually remove the degree of policy restriction. Bank Rate was first cut by 25bp in August, with another such cut likely in November, coinciding with the release of the Bank’s updated economic forecasts.

Preview

PreviewClearly, such an outlook, with the MPC having set a relatively high bar for further easing, is somewhat more hawkish than hat foreseen from the ECB, and from the FOMC, where a 50bp September cut remains a possibility. Consequently, this divergence could help to underpin the GBP over the medium-term, against both the EUR and the USD.

The likely significant fiscal tightening to be delivered in the October Budget, however, remains a key risk for participants to navigate, and could result in the Treasury 'shooting themselves in the foot', and slamming the brakes on the economy's current solid momentum.