Dollar Gains as Trump Trade Returns

Financial markets showed a swift reaction to early U.S. election results, with the U.S. dollar strengthening significantly as EURUSD dropped 1.48%. The initial vote counts from Tuesday's presidential election between Republican Donald Trump and Democrat Kamala Harris triggered what traders are calling a return of the "Trump trade." The EURUSD has broken key support at 1.078. Source: xStation

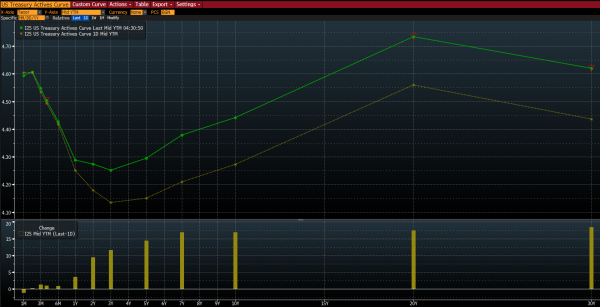

Treasury yields surged across the curve, with short-term rates rising more than 10 basis points and the long end climbing 15-16 basis points. The benchmark 10-year Treasury yield reached a four-month high of 4.418%. The U.S. dollar index gained 1.27%, while Bitcoin was at new ATH above $74,000.

Source: Bloomberg

Market analysts suggest these movements reflect growing conviction in Trump's strong early showing, particularly in key areas like Miami-Dade. While the final outcome remains uncertain with seven crucial swing states still in play, traders are positioning for what they perceive as increasing odds of a Trump victory. The S&P 500futures responded positively, rising 1%.