💲Dollar weakens ahead of FOMC minutes

Minutes of the latest Fed meeting will be published at 7 pm GMT🏛️

- The last Fed meeting was received hawkishly as the possibility of an interest rate cut in March was ruled out

- The Fed then indicated that it wanted more signs of inflation falling towards its target

- Since then we have seen higher inflation readings (compared to expectations), very good labour market data, but weaker economic activity data

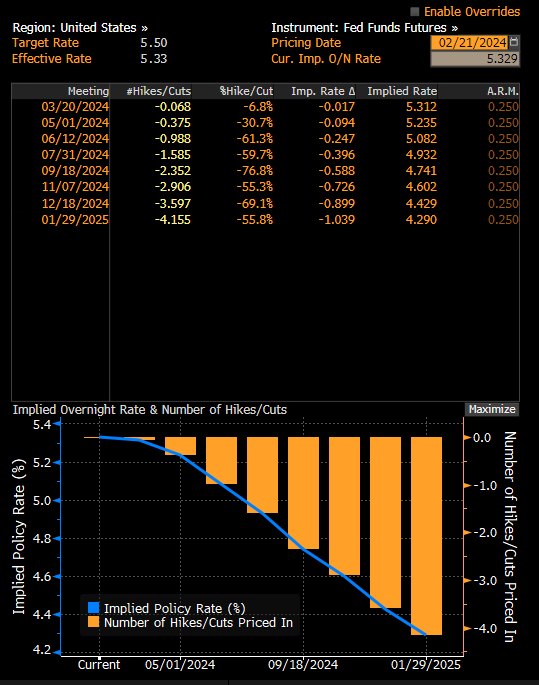

- There is considerable disagreement at the Fed, with the market pricing in a first cut only in June

Fed sees cuts, but later

At a press conference in January, Jerome Powell made it clear that he did not see much chance of an interest rate cut in March. The market reacted with a fairly pronounced strengthening of the dollar. At the same time, Powell indicated that the Fed is increasingly confident of a further decline in inflation, but needs more certainty. Ultimately, however, the Fed sees opportunities for cuts - the latest dot-plot indicates 3 interest rate cuts this year. At the same time, Powell has indicated that weaker labour market data would prompt the Fed to cut more quickly

Since the last meeting at the end of January, however, we have seen a lot of data: very good labour market data, slightly higher CPI inflation than expected, higher PPI inflation and weaker retail sales and industrial production data. Powell himself, during his last speech, indicated that inflation came in line with the Fed's expectations. In view of this, after the recent weak economic activity data, May still seems a likely date for the first interest rate cut, although the market still sees the first full cut only in June.

Market expectations for interest rate movements in the US. Source: Bloomberg Finance LP, XTB

What to watch for?

Powell indicated that the Fed has not yet specifically discussed reducing quantitative tightening (QT). Nevertheless, if there were any comments, this could be perceived dovishly by the market. It is likely that there will be a lot of talk in the minutes that many Fed members see opportunities to keep interest rates higher for longer. If such sentences are repeated frequently in the minutes, this could be perceived hawkishly by the market. Nonetheless, there will be a lot of inflation data to learn by the May meeting, which could give confidence to the Fed that this one is heading in the right direction.

How will the market react?

In view of this, the market's reaction may depend on how the probability is distributed - if the chance for May increases, the dollar may continue today's discount. If, however, the minutes are even more hawkish than Powell's last conference, then the chance of a sizable correction. In the context of Wall Street, the biggest reaction awaits us, of course, after the release of the Nvidia report, although some volatility could take place with the FOMC release. However, there would have to be heavily dovish statements to stop the indices from falling today.

EURUSD continues to break out of the trend channel. A close above 1.0830 today or tomorrow could lead to a test of 1.0850, the area around the 38.2 retracement at the end of this week or early next week. However, if the minutes turn out to be clearly hawkish, a close below 1.0800 could bring the price back below 1.0770 and back inside the downward trend channel. Source: xStation5

EURUSD continues to break out of the trend channel. A close above 1.0830 today or tomorrow could lead to a test of 1.0850, the area around the 38.2 retracement at the end of this week or early next week. However, if the minutes turn out to be clearly hawkish, a close below 1.0800 could bring the price back below 1.0770 and back inside the downward trend channel. Source: xStation5