ECB rate decision: How to trade the event

What: ECB rate decision

When: Rate decision and press release on 11 April at 12:15 GMT (14:15 CET) and post-meeting press conference at 13:00 GMT (15:00 CET)

Expectation: Interest rate maintained at 4.5%. Laying the ground at the press conference for a potential rate cut in June.

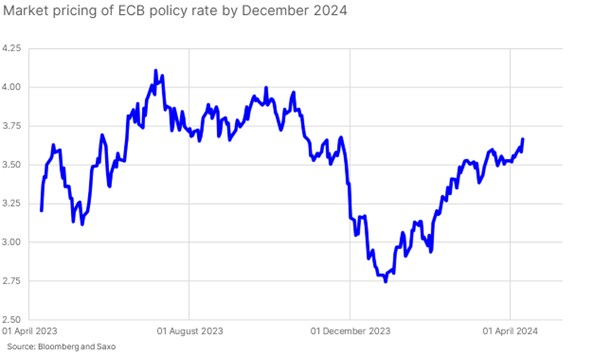

How will the market likely react? The previous ECB rate decision on 7 March delivered the biggest single day rally in European equities since early January as the ECB revised down its inflation forecast for 2024 to 2.3% from 2.7%. It also guided lower economic growth supporting the market’s view that a rate cut could come in June. With yesterday's upside surprise to US March inflation figures showing inflation is entrenched in the US economy, the ECB is put in a difficult position. The market is now pricing the same ECB policy rate by December 2024 as it did in late November 2023. If the ECB leads the Fed in cutting rates, it could weaken the euro and support the export sector of the European economy. The recent ECB Bank Lending Survey showed that loan demand from firms have declined substantially, but the overall message across all credit was still balanced. The market in Europe has set itself up for a June rate cut, so any hawkish lean from the ECB will upset risk sentiment. Read Althea Spinozzi’s, Head of Fixed Income Strategy, ECB preview from this Monday.

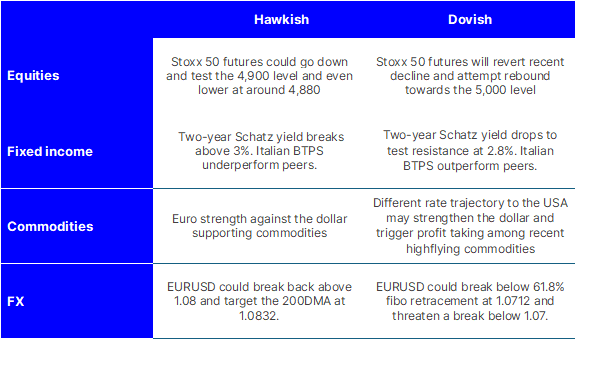

The table below shows our views ahead of the April ECB meeting.

Why does it matter? The ECB meeting is crucial for markets as it sets monetary policy, impacting interest rates and investor sentiment. Decisions made at ECB rate meeting shape economic expectations and influencing asset prices in the euro area. As the global economy and central banks have become less synchronized in their dynamics, these decisions are more important than before. For Southern European countries and their equity markets, the ECB decision is even more important as these economies are weaker and less robust against high interest rate levels.

As the chart below shows, the market pricing of ECB policy rate has changed by almost 100 bps expecting a policy rate of almost 3.75% (three rate cuts from current policy rate) from as low as 2.75% in December 2023.