Equity Outlook: Will lower rates lift all boats in equities?

Key points

- No recession and lower rates will lift the broader market: With a soft landing and lower interest rates, defensive sectors like real estate and utilities are expected to outperform, while opportunities are shifting away from tech-heavy indices towards the broader market. Green transformation stocks, although down this year, may rebound under a low-rate environment in 2025.

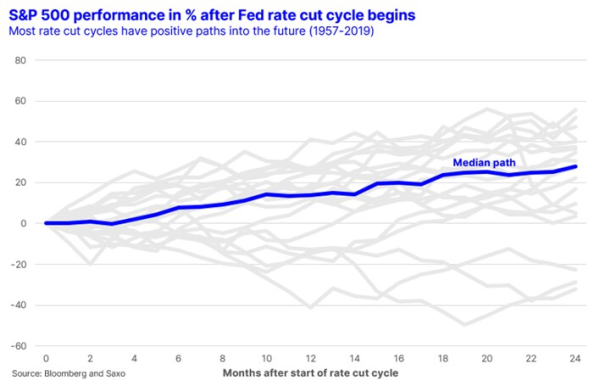

- What we can learn from past rate cut cycles: Historically, the US equity market performs better after the beginning of a rate cut cycle, with only a few exceptions. Rate cuts should be viewed as a positive opportunity for long-term investors to adjust portfolios for falling rates.

- US election outcome and its 2025 impact: A Harris victory with a likely gridlock in Congress could slow fiscal spending but benefit green stocks, emerging markets, and tech. In contrast, a Trump victory might boost European defence stocks while negatively affecting US tech and emerging markets.

No recession and lower rates will lift the broader market

If we look at the global equity market some things have changed in third quarter. There has been a small rotation from cyclical sectors into defensive sectors as some investors took the technology declines in July and volatility hiccup in August as clues that things are about to get worse. The broader US equity market as defined by the equal-weight S&P 500 Index has begun to outperform the S&P 500 Index. This suggests that opportunities may be shifting away from the Magnificent 7 to the broader market. Lower interest rates and a soft landing scenario would point to an everything rally where the rest of the market begins to outperform. The strongest sectors of late have been real estate and utilities as investors are expecting those two sectors to do well with a backdrop of falling interest rates.If we look across our thematic baskets we still observe the same trends. Defence remains the best theme this year with the New Biotech and Mega Caps rounding out the top three. Everything related to the green transformation is down for the year and is the contrarian bet going into 2025 as lower interest rates could help green stocks, but it is worth noting the risks to green stocks should Trump win the US election. The defence theme is by far together with the green transformation theme the two themes with highest sensitivity to the US election outcome in November.

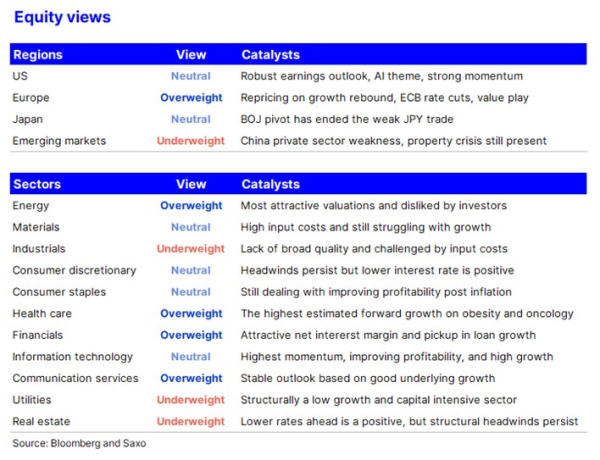

Our long-term equity views, driven by long-term return expectations, across geography and sectors have not changed much from our previous equity outlook. The US equity market is still the strongest, but the European equity market is just more compelling because it is cheaper. At a sector level, the energy sector has seen expected returns rise during the third quarter as oil prices have fallen and looks very attractive despite its low growth outlook. Sectors such as health care, financials, and communication services also come with a positive outlook. Despite the comeback in utilities and real estate, those two sectors still have the weakest fundamentals and are the only two sectors that are raising capital from shareholders on a net basis.

What we can learn from past Fed rate cut cycles?

The Fed decided at the September FOMC rate decision meeting to cut its policy rate by 50 bps, initiating what is the first rate cut cycle since 2019. The intense debate ahead of the decision was whether the Fed should start its rate cutting cycle cautiously as inflationary pressures are still present and the economy is doing fine, or should front load by cutting quickly to pre-empt the lagged impact on the economy from the high Fed policy rate. While an important discussion, it matters more for investors whether a Fed rate cut cycle is negative or positive for equities?It is not an exact science to measure and count rate cutting cycles as there are several ways to choose your cycles, ranging from the number of consecutive cuts, the duration of the cycle, the magnitude of cuts etc. We have isolated 20 rate cut cycles by the Fed since 1957 and measured the subsequent 24-month performance in the S&P 500 Index. We find that the US equity market in general (the median path) performs better than the normal historical performance once a Fed rate cut cycle has begun. There are only three paths that end up with a negative return for investors after 24 months. Two of those were the rate cut cycles that begin in November 2000 and July 2007, respectively. These recent examples might lead many to make wrong assumptions on what a rate cut cycle is all about. For the long-term investor, the rate cut cycle should not be viewed as something negative, but rather an opportunity to see whether the portfolio has the right exposures that can do well when interest rates fall.

US election outcome will have a big impact on 2025

The Fed did not manage to slow the economy much in 2023 despite aggressively hiking its policy rate because of the unprecedented fiscal impulse by the Biden administration, one that was unleashed despite the lack of a recession. The fiscal deficit expanded by 4.7% of GDP, equivalent to almost $1trn from July 2022 to July 2023. US politics find itself in a populistic era, regardless of whether Trump or Harris wins. Only gridlock scenarios (in which either winner does not control both houses of Congress) can prevent fiscal stimulus from continuing at unsustainable levels, whereas a Trump sweep or Harris sweep victory would see a continuation of massive fiscal spending.If Trump wins the election, sweep or gridlock, we expect this outcome to have a large positive effect on European defence companies as a Trump administration would mean less support for Ukraine. In this scenario, the EU would be forced to accelerate defence spending using its own defence industry, a lift to growth expectations for that sector. A Trump administration regardless of whether the Republicans control both houses in the US Congress will mean higher tariffs and potentially weaken sentiment in the US technology sector that depends on long and connected supply chains in Asia. We also expect a more negative sentiment around emerging markets under a Trump administration due to the risks from tariffs and from a stronger US dollar from tariffs.

A Harris victory most likely come with a gridlock scenario where Harris becomes US President but Democrats fail to win the Senate. This scenario could be negative for economic growth in 2025 as fiscal spending will enter a more difficult period. A Harris victory would likely boost stocks linked to the green transformation. We also believe emerging markets and technology stocks could react positively to a Harris administration, in part in a sigh of relief from avoiding new Trump tariffs.