Ethereum and Bitcoin loses 3% amid spreading markets risk-aversion📉

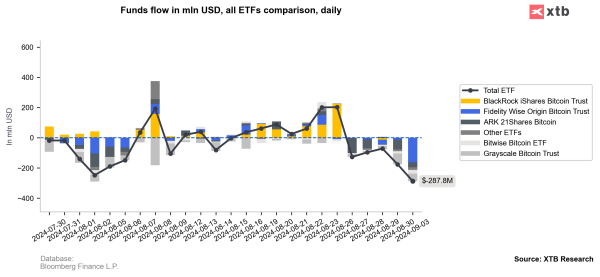

Ethereum is down nearly 3% amid risk aversion and stock market uncertainty, where sentiment is putting pressure on all risky assets. Net outflows from Bitcoin ETFs amounted to approximately -$287 million yesterday; the highest since early August.

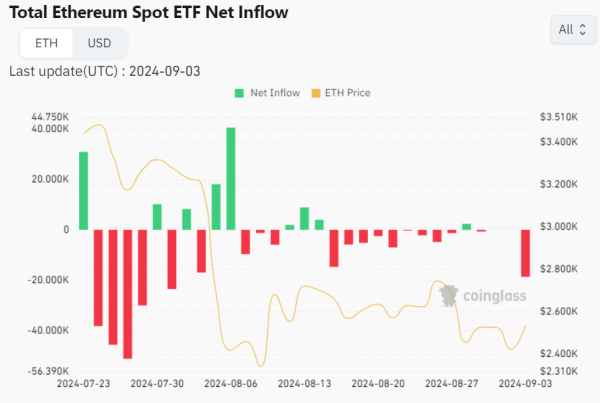

- Yesterday, Ethereum ETFs recorded net outflows, selling nearly 18,000 ETH. We also observe weaker sentiment in the Bitcoin market, which has fallen below $57,000, alongside a weakening dollar and a drop in the yield on 10-year U.S. Treasury bonds to around 3.8%, following weaker-than-expected U.S. ISM manufacturing data for August. Bitfinex analysts expect that the first Fed rate cut in September could trigger a sell-off of Bitcoin by as much as 20%, down to $45,000-$40,000.

- The team believes that such a scenario would suggest a likely 'bottom' for Bitcoin in the still ongoing post-halving 'bull market'. BTC mining difficulty increased by 9% month-on-month in August, potentially putting broader pressure on BTC miners, some of whom are forced to sell reserves. In August, Bitcoin miners' stocks listed on U.S. exchanges lost an average of about -15%. Only three companies' stocks among them performed better than Bitcoin itself during this time. Mining difficulty has increased by 4% since the spring halving.

ETFs have been selling Bitcoins over the last 5 sessions. Source: Bloomberg Finance L.P.

Net outflows for Ethereum have been observed almost continuously since mid-August. Source: CoinGlass

Ethereum (D1 interval)

Source: xStation5