European banks: Strong Q2 earnings as rate cuts loom

Key points

- UBS performance and outlook: UBS saw a 3% increase in shares today following Q2 results that surpassed estimates, driven by strong equities trading and investment banking revenues. The bank is on track to achieve pre-merger profitability levels with a target of $1 billion in share buybacks for 2024, despite a 7% decline in underlying revenue year-over-year, which was offset by a 10% reduction in costs leading to improved profitability.

- European banking sector sentiment: UBS's positive results contribute to a renewed positive sentiment among European banks, which have become more attractive investments since the rise in interest rates began in late 2022. This trend has improved net interest margins and increased demand for bank loans, with banks like BNP Paribas reporting their highest return on equity since 2010.

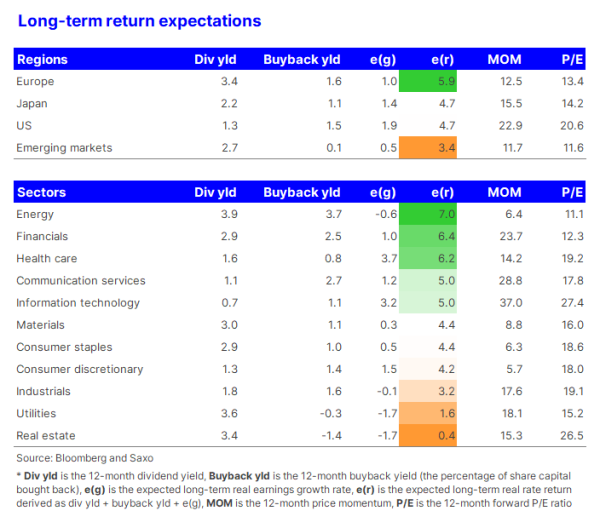

- Investment considerations and risks: The financial sector is currently ranked second on expected returns across sectors, driven by a 2.9% dividend yield and a 2.5% buyback yield. However, potential risks include possible interest rate cuts by the European Central Bank (ECB) and the threat of a recession in Europe. Despite these uncertainties, recent indicators suggest economic growth is improving, making European banking stocks still appealing for long-term investors.

The new UBS under CEO Ermotti is on track

UBS shares are up 3% on Q2 results that are beating estimates and announcing that it is on track to reach the profitability levels before the Credit Suisse merger. In addition, UBS says it is still targeting $1bn of shares buyback in 2024. The key drivers of the beat on net income were strong equities trading and investment banking revenues. The wealth management unit saw client inflows of $27bn, but some of this apparent success has been eaten by rising compensation to advisors.

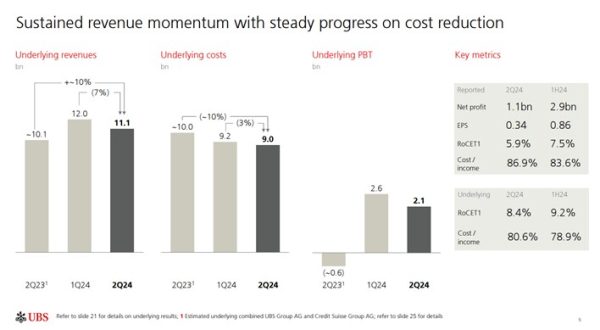

As the slide from the earnings presentation below shows, underlying (meaning stripping out divestments etc.) revenue is down 7% from a year ago but costs are down 10% leading to improved profitability. The first-half return on common equity tier 1 (RoCET1) is 9.2% surpassing the cost of equity, so new UBS has already returned to phase where it is generating positive shareholder value.

UBS results track well with what we have seen in Q2 earnings releases from European banks. The financials sector is the sector with the highest net revenue upside surprise with individual banks such as BBVA, Danske Bank, Mediobanca, and Banco Santander as some of the strong performers on Q2 financials.

Are European banking stocks still something to consider?

The results from UBS today are underpinning sentiment among European banks which for years were a bad investment. But ever since inflation forced central banks to rapidly hike interest rates in late 2022 and 2023 commercial banks have been a good component in any portfolio. Rising interest rates has expanded the net interest margin for many banks and the strong fiscal impulse during the pandemic has kept the economy going increasing the demand for bank loans. As a result, BNP Paribas, the third most valuable bank in Europe, lifted its return on equity in 2023 to the highest level since 2010.

The financials sector is also the second highest ranking sector on expected returns based on 2.9% in dividend yield, 2.5% in buyback yield, and a positive real earnings growth expectation of 1% annualised. This means that based on the current data points financials are still attractive for the long-term investor. Key risks to consider when investing in European banks are primarily the European Central Bank (ECB) potentially lowering the policy rate and the European economy slipping into a recession. Right now there is a lot of uncertainty around structural inflation, but the market is currently pricing an ECB policy rate trajectory of three rate cuts by the December meeting and six rate cuts by the July 2025 meeting. On the European economy and a potential recession, the recent high-frequency indicators are suggesting that economic growth is improving to a 2-year high.

To take the European banking theme one step further going from the sector level to specific stocks there are many ways to highlight some banks. If we look at the return on equity for the fiscal year 2023 in the STOXX Europe 600 Banks Index, then the 10 banks with the highest profitability are listed below for inspiration for the long-term investor.

- Avanza Bank (36.8%)

- FinecoBank (29.7%)

- Sydbank (23.4%)

- Investec (23.0%)

- Banca Monte dei Paschi (23.0%)

- Ringkjøbing Landbobank (21.8%)

- BAWAG Group (18.2%)

- Swedbank (18.2%)

- SEB (17.9%)

- BPER Banca (17.9%)

Previous weekly equity market updates

- Low recession probability, strong earnings, and US inflation (9 August 2024)

- Election drama, Tesla bounce, and earnings kick-off (5 July 2024)

- US election heats up, Alfen rout, and Micron earnings (28 June 2024)

- French election, king Nvidia, and FedEx earnings (21 June 2024)

- Tech rally, inflation surprise, and EU trade war (14 June 2024)

- AI bonanza drives new highs and dangerous index concentration (7 June 2024)

- Chinese setback, AI woes, and ECB decision (31 May 2024)

- Nvidia earnings, electrification boom, and bubbles (24 May 2024)

- New all-time high on speculative stocks comeback (17 May 2024)