Eurozone Resilience Meets German Slump: EUR/USD at Crossroads Amid Mixed Data Signals

EUR/USD pair has been showing interesting dynamics amid mixed signals from the Eurozone and the U.S. on Tuesday. The latest data shows that the Eurozone's GDP grew by 0.3% in the second quarter, surpassing market expectations of 0.2%. This steady expansion reflects a resilient economic performance, bolstering the euro's appeal to investors seeking stability in uncertain times. The annualized growth rate also stood at 0.6%, in line with forecasts and an improvement from the previous 0.4%.

However, this optimism is tempered by Germany's unexpected economic contraction. As the Eurozone's largest economy, Germany posted a 0.1% decline in GDP for the same period, contrary to the anticipated 0.2% growth. The annualized figures mirror this disappointment, with a 0.1% contraction versus expectations of no change. The contraction is attributed to weak domestic demand, which has led Finance Minister Christian Lindner to announce a series of tax relief measures aimed at stimulating spending and investment.

Adding to the complexity, the preliminary German Harmonized Index of Consumer Prices (HICP) for July came in hotter than expected, with a monthly increase of 0.5% compared to the previous 0.2%. The annual rate accelerated to 2.6%, exceeding the forecast of 2.4%.

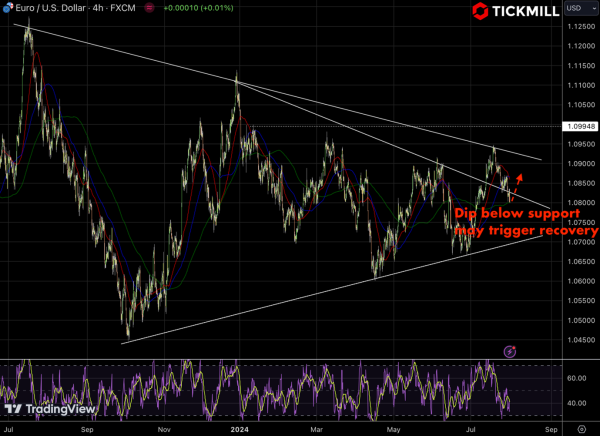

The EUR/USD chart reveals that the pair is trading within a descending triangle pattern, with the upper boundary near 1.09948 acting as resistance. The lower trendline, around 1.0750, serves as a crucial support level. A dip below this support could trigger a recovery, potentially providing a buying opportunity if the pair rebounds off this level. The RSI at the bottom of the chart indicates oversold conditions, suggesting that the downward momentum might be weakening. Traders should watch for a potential bullish divergence on the RSI, which could signal a reversal or a short-term bounce in the pair:

The ECB's policy stance remains a focal point for traders. After initiating a policy-easing cycle in June, the ECB refrained from cutting rates in July, wary of stoking inflation. The upcoming preliminary Eurozone HICP data for July will be crucial in determining whether further rate cuts are on the cards. Expectations are that both headline and core HICP will show a deceleration, but any surprise could lead to significant market movements.

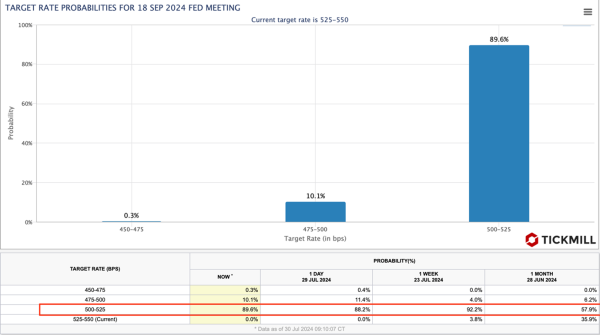

Across the pond the Federal Reserve's policy trajectory also influences the EUR/USD pair. The CME FedWatch tool indicates a strong probability of a 25 basis point rate cut in the September meeting, with potential for further reductions by year-end. This dovish outlook is shaped by the Fed's cautious approach to inflation, which is slowly moving towards the 2% target amidst robust labor market conditions.