➡️EURUSD at 1.10 zone ahead of ECB decision

⚡ECB will decide about interest rates at 1:30 PM BST

According to the head of Portugal's central bank, today's decision will be “easy.” This means that ECB interest rates will be cut by 25 basis points. The market is pricing the probability of this decision minimally above 100%. However, the key will be the bank's communication and future forecasts, which may determine the reaction on EURUSD. Of course, one should also keep in mind the impact of other events like the Fed decision next week or the publication of macroeconomic data not only from the Eurozone, but also from the US.

Market expectations

- The consensus among analysts clearly indicates a 25 basis point cut in interest rates.

- This will be the second reduction in the current cycle. The ECB has announced that each decision is made separately, but the ECB may pause for more than one meeting before deciding to cut again

- This suggests that the next cut after the September one will be possible in December. Then we will know the next set of macroeconomic projections

- Most macroeconomic projections are expected to be kept unchanged, with a possible lowering of the economic growth outlook for the current year, based on weak PMI data or limited growth in some economies

- Inflation is expected to return to target in the latter part of 2025 and fall below target in 2026

- Market predictions are that the deposit rate will be cut in the 12-month horizon to 2.5% from the current level of 3.75% (the prospect of a cut at each meeting at the end of the quarter)

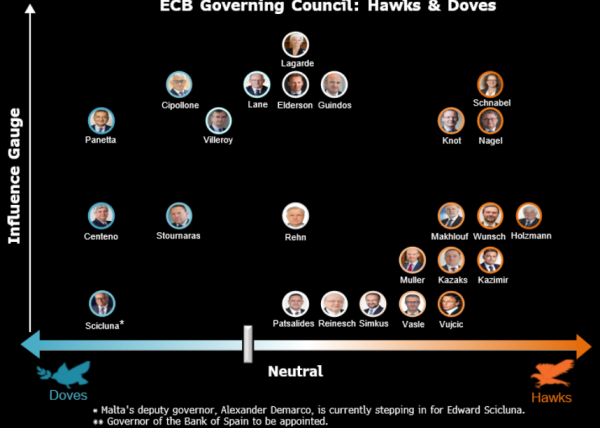

- The vast majority of members at the ECB are more hawkish, but a softening of communication cannot be ruled out given the weak macroeconomic data and the decline in wage growth, which remains key from the ECB's perspective

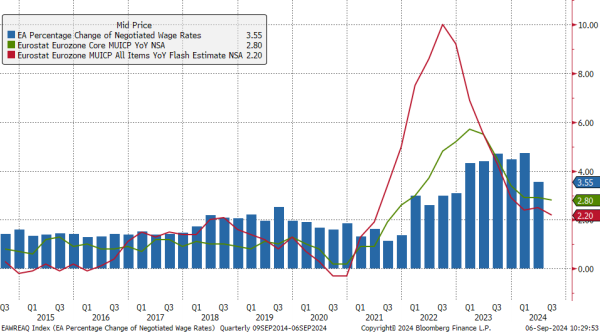

Eurozone inflation fell for August to 2.2%. Core inflation remains slightly elevated at 2.8%. Negotiated wage growth fell quite noticeably, which is an important indicator from the ECB's perspective. On the other hand, the ECB still has a problem with inflation in the services sector, which remains stable above 4%. Source: Bloomberg Finance LP, XTB

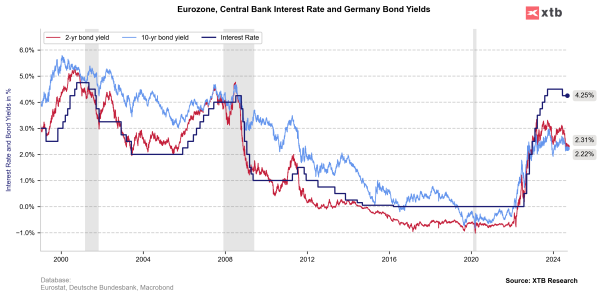

A large portion of ECB members remain hawkish, so the chances of accelerating the pace of cuts are rather slim. Of course, there is room for more reductions, given the stagnation in the European economy. Source: Bloomberg Finance LP Bond yields suggest that the target rate should be around 2.25-2.5%. Source: Bloomberg Finance LP, XTB

Bond yields suggest that the target rate should be around 2.25-2.5%. Source: Bloomberg Finance LP, XTB

How will the market react?

Today's decision is fully priced in by the market. Market participants are expecting a rather balanced communication from Christine Lagarde during the conference, which will start at 1:45 PM BST. Lagarde has maintained a neutral stance at recent meetings, indicating that decisions will be made from meeting to meeting. Maintaining the current tone should support the euro, given the likelihood of faster reductions from the Fed than from the ECB, however the economic situation in the eurozone remains weaker and markets may see this dynamic as even more important.

Any softening of communication from the ECB, however, could clearly weaken the euro, as this could suggest more rate cuts. However, this is not the baseline scenario at the moment. Maintaining the current tone and indicating that rates do not need to be cut soon due to existing inflationary risks (statements about service inflation or insufficient decline in wage growth) could strengthen the euro. In the first scenario, it will be possible to break through the support near 1.10 and fall further towards the support at 1.0950. On the other hand, it seems that the euro should recover, and the pair may test the level of 1.1050, supported also by expected Fed rate cut and better global markets sentiments after yesterday session on Wall Street. Given the high positioning on the euro, support from investors for a rebound remains significant.

Source: xStation5