EURUSD breaks below 1.0750 support zone

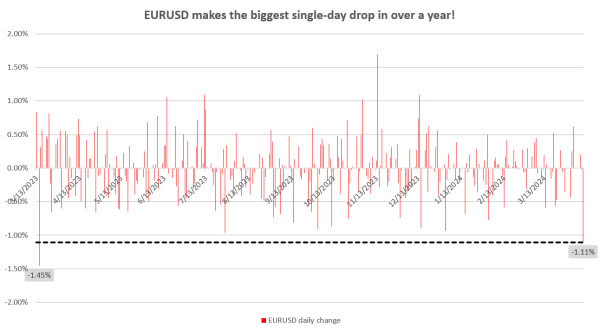

US dollar is the best performing G10 currency today. While USD has been trading rather mixed compared to other major currencies in the first half of the day today, things changed after release of US CPI data for March. Report turned out to be a big hawkish surprise showing a bigger-than-expected acceleration in headline measure as well as core measure staying unchanged, in spite of an expected drop. Both measures showed a 0.4% MoM increase for the third month in a row, while market hoped for and expected a slowdown to 0.3% MoM. Another hawkish surprise in inflation data has cooled market expectations for quick Fed rate cuts. While money markets saw an over-50% chance of US central bank delivering the first 25 basis point rate cut at June meeting, those odds have now dropped to around 20%. According to money markets, there is now more or less even chance of the first rate cut being delivered in July or even September. USD strength is triggering a big plunge on EURUSD market. The pair drops around 1.1% at press time, making the biggest single-day decline since March 15, 2023.

Source: Bloomberg Finance LP, XTB

Source: Bloomberg Finance LP, XTB

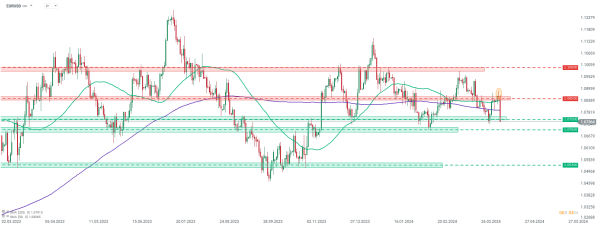

Taking a look at EURUSD chart at D1 interval, we can see that the pair pulled after a failed attempt to break above the 1.0850 resistance zone. EURUSD plunged back below 50- and 200-session moving average and is making a break below the 1.0750 support zone as well. Local lows from the beginning of April 2024 are being tested now and should we see a break below, the 1.0700 area is the next support to watch.

Traders should keep in mind there may be more USD volatility in store for today. FOMC minutes will be released at 7:00 pm BST. The meeting they related to included release of new economic forecasts and traders will look for hints whether rate cuts or exact conditions for them were discussed in any detail.

Source: xStation5

Source: xStation5