EURUSD: Bullish Pullback Looms Large on Strong Technical Signal

The EUR/USD pair has been grappling with persistent downward momentum, maintaining its position around 1.0775 during the European session on Friday. This marks the fourth consecutive day of losses for the Euro against the US Dollar. However, the subdued trading volumes witnessed today can be attributed to the observance of Good Friday across major financial centers.

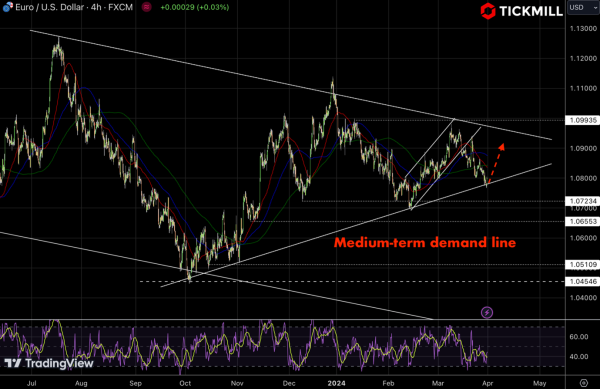

On the technical side, the pair appears to be primed for a rebound as the price tested a key medium-term trend line on the daily timeframe:

The Euro's recent struggles can be primarily attributed to mounting speculation surrounding the European Central Bank's monetary policy. Key ECB officials have been increasingly vocal about the possibility of an interest rate cut in June. Yannis Stoumaras' remarks earlier in the week echoed sentiments of a growing consensus within the ECB for such action. This sentiment was further emphasized by ECB policymaker Francois Villeroy, who highlighted a rapid decrease in core inflation, underscoring the need for proactive measures to stimulate economic activity. Villeroy's comments were echoed by ECB executive board member Fabio Panetta, who emphasized the adverse impact of restrictive policies on demand and inflation dynamics.

Adding to the Euro's woes, Germany, the economic powerhouse of the Eurozone, reported weaker-than-expected Retail Sales data for February. The monthly report revealed a significant 1.9% decline in retail sales, far below market expectations of a 0.3% increase. Moreover, year-over-year Retail Sales plummeted by 2.7%, surpassing the anticipated decline of 0.8%. The disappointing performance of the German retail sector underscores the broader challenges facing the Eurozone economy.

On the other side of the Atlantic, the US Dollar has remained resilient, bolstered by upbeat economic data. The US Bureau of Economic Analysis reported a rise in inflation, as measured by the change in Personal Consumption Expenditures (PCE) Price Index, to 2.5% on a yearly basis in February. This reading, in line with market expectations, underscores the robustness of consumer spending in the United States. Furthermore, the hawkish stance articulated by Federal Reserve Governor Christopher Waller, suggesting a potential delay in interest rate cuts, has further buoyed the Greenback.

Despite the Easter Holiday dampening market activity, the US Dollar Index has strengthened, nearing 104.60. The latest data indicating an annualized economic expansion of 3.4% in the fourth quarter of 2023 in the US, coupled with resilient consumer spending, has contributed to the Dollar's upward trajectory.