EUR/USD, GBP/USD, DXY Price Forecast: DXY Above $106; Awaiting Central Bank Speeches

Market Overview

Yesterday’s data released from the U.S. highlighted a drop in Unemployment Claims to 212K, improving from the previous 215K, and a surprising jump in the Philly Fed Manufacturing Index to 15.5, which starkly exceeded expectations. However, Existing Home Sales slightly decreased to 4.19M from 4.20M.

In Europe, the German Producer Price Index (PPI) showed a modest increase of 0.2%, signaling mild inflationary pressures in the manufacturing sector. The UK’s Retail Sales remained stagnant, showing no growth and underperforming against modest market expectations.

Events Ahead

Looking ahead, the financial markets are poised to respond to speeches from key central bank figures. The Eurozone’s attention will be on German Bundesbank President Nagel, whose remarks could provide further clues on the monetary policy trajectory.

For the UK, statements from Bank of England’s MPC members Breeden, Ramsden, and Mann will be closely monitored for insights into future interest rate decisions amidst ongoing economic challenges.

US Dollar Index (DXY)

The Dollar Index is observed slightly down by 0.26%, trading at $106.192. The market’s pivot point is stationed at $105.927, around which the immediate market sentiment could pivot. If the index ascends beyond this threshold, resistance levels at $106.536, $107.097, and $107.608 will come into play.

Conversely, should the index fall, support might be found at $105.537, followed by more critical levels at $105.221 and $104.901, signaling potential areas of buyer interest.

The 50-Day Exponential Moving Average (EMA) currently sits at $105.684, suggesting minor bullish momentum, while the 200-Day EMA at $104.656 provides a longer-term baseline.

EUR/USD Technical Forecast

The EUR/USD is trading slightly down by 0.05%, marked at 1.06378. The currency pair’s performance reveals minor fluctuations as it hovers just below the pivot point of $1.0664. Should the euro strengthen past this point, it faces immediate resistance levels at $1.0704, followed by $1.0735, and could extend towards $1.0793 if bullish momentum persists.

Conversely, if downward pressure prevails, support might be found at $1.0603, with further safety nets at $1.0548 and $1.0496. The 50-day and 200-day Exponential Moving Averages are positioned at $1.0689 and $1.0779 respectively, indicating a short-term bearish outlook. Crossing above $1.0664 could shift the market sentiment towards a more bullish scenario.

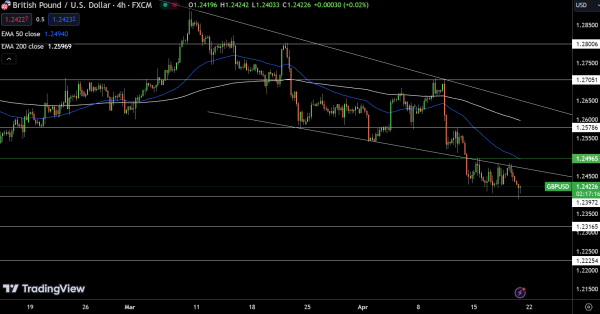

GBP/USD Technical Forecast

Today, the GBP/USD is trading lower at 1.24226, reflecting a decline of 0.13%. This slight downturn positions the currency pair below its pivot point of $1.2497. Looking forward, should the pound strengthen, it will encounter resistance at $1.2579, with further hurdles at $1.2705 and $1.2801.

Conversely, immediate support is established at $1.2397. If bearish trends persist, additional support levels at $1.2317 and $1.2225 may come into play. The 50-day Exponential Moving Average (EMA) at $1.2494 and the 200-day EMA at $1.2597 suggest a cautious market sentiment.

A decisive move above $1.2497 could pivot the trend towards bullishness, while remaining below this threshold might intensify selling pressures.

For a look at all of today’s economic events, check out our economic calendar.