EUR/USD, GBP/USD, DXY Price Forecast: DXY Skyrockets to 106.40; Buy Now?

Market Overview

U.S. Core Retail Sales recently outpaced expectations, posting a rise of 1.1% against a forecast of 0.5%. This uptick, alongside a 0.7% increase in overall Retail Sales, suggests strong consumer activity, which may discourage the Federal Reserve from early interest rate cuts.

In Europe, the German Wholesale Price Index (WPI) saw a modest rise to 0.2%, hinting at mild inflationary pressures.

Events Ahead

Upcoming economic reports include the Italian Trade Balance, expected to show a balance of €3.44 billion, and the European Trade Balance projected at €27.3 billion. Additionally, the German ZEW Economic Sentiment is anticipated to improve to 35.9, providing insights into economic sentiment.

In the UK, labor market data released today showed a Claimant Count Change of 10.9K, with the Average Earnings Index holding steady at 5.6% and the Unemployment Rate at 4.2%. The Bank of England Governor’s upcoming speech is eagerly awaited for further indications of monetary policy directions.

For both currency pairs, the following U.S. data will be pivotal:

- USD Building Permits and Housing Starts: Forecasted at 1.51M and 1.48M respectively, these figures will provide a snapshot of the U.S. housing market’s health.

- USD Industrial Production: Expected to increase by 0.4%, with Capacity Utilization Rate projected at 78.5%.

- Fed Chair Powell’s Speech: His insights will be vital for understanding the Fed’s view on economic conditions and interest rate decisions.

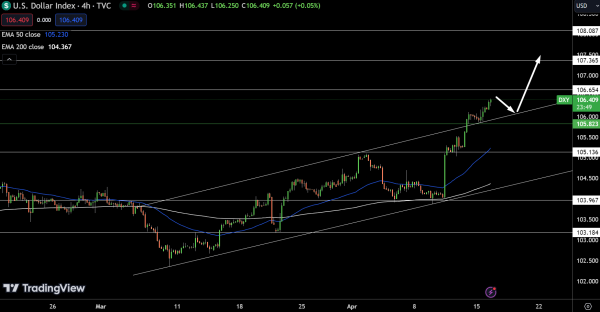

US Dollar Index (DXY)

The Dollar Index today demonstrated modest gains, climbing 0.14% to a level of 106.409. It is currently trading above its pivotal mark at $105.823, which suggests a potential continuation of the upward momentum. Immediate resistance is anticipated at $106.654, with further ceilings at $107.365 and $108.087.

On the flip side, should the index retreat, it might encounter substantial support at $105.136, with additional lower barriers at $103.967 and $103.184. The 50-day and 200-day Exponential Moving Averages, positioned at $105.230 and $104.367 respectively, underpin the bullish sentiment.

Holding above $105.823 could sustain the uptrend, while a descent below this level might signal a shift towards a selling trend.

EUR/USD Technical Forecast

The EUR/USD pair edged down by 0.12%, trading at 1.06090, slightly below its pivotal level at $1.06609. Should the currency pair rise above this pivot, it might encounter resistance at $1.07249, followed by higher thresholds at $1.07946 and $1.08731.

Conversely, support lies at $1.05640, with further safeguards at $1.05160 and $1.04616, which could stabilize declines.

Technical indicators suggest a bearish sentiment as the price is currently below both the 50-day Exponential Moving Average at $1.07321 and the 200-day at $1.08055. A sustained movement above the pivot point may alter the bearish outlook to a more bullish stance.

GBP/USD Technical Forecast

Today, the GBP/USD pair has declined by 0.20%, with the current price at 1.24193, positioning itself below the critical pivot point at $1.24965. If the pair climbs above this level, it could face resistance at $1.25786, with further barriers at $1.27051 and $1.28006.

On the downside, the first line of support is located at $1.23731, with additional support levels at $1.22853 and $1.21924. The 50-day and 200-day Exponential Moving Averages are at $1.25466 and $1.26269 respectively, suggesting underlying bearish pressures. A move above $1.24965 might shift the sentiment to a more bullish outlook.

For a look at all of today’s economic events, check out our economic calendar.