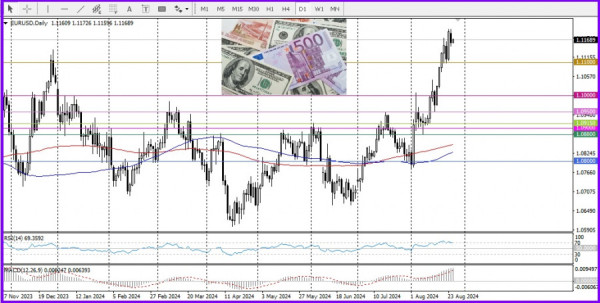

EUR/USD. Overview and Analysis

Today, the EUR/USD pair is attempting to recover recent losses.

Regarding the U.S. dollar, yesterday, San Francisco Federal Reserve President Mary Daly stated in an interview with Bloomberg TV that it is time to begin lowering interest rates, with the first reduction likely to be a quarter of a percentage point. She suggested that if inflation continues to slow gradually and the labor market maintains steady job growth, it would be reasonable to adjust monetary policy to a more conventional approach.

Traders are also assessing how the growing expectations of an upcoming rate cut by the Federal Reserve might affect borrowing costs set by the European Central Bank.

Regarding the euro, according to Bloomberg, ECB Governing Council member Olli Rehn stated last week that slowing inflation, combined with weakness in the Eurozone economy, strengthens the case for a rate cut in September. The subdued growth outlook in Europe, especially in the manufacturing sector, further supports the argument for a rate cut in September.

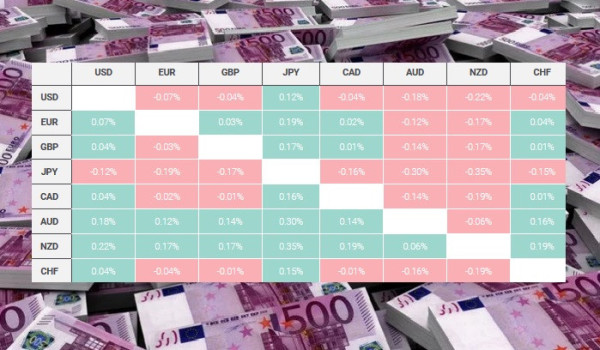

The table below shows the percentage change of the euro against major currencies traded on the exchange as of today's date. The euro showed the most strength against the Japanese yen.