EUR/USD Rebound: Fed’s Rate Cut Speculation Puts Pressure on USD as Labor Market Weakens

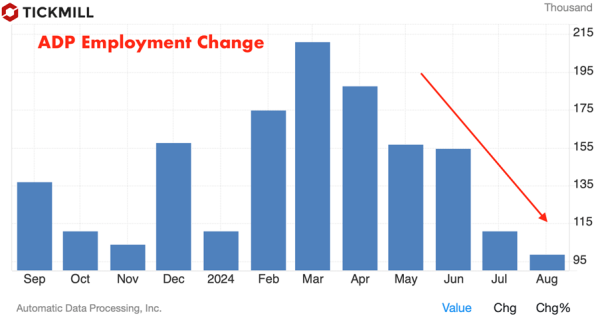

The rebound of EUR/USD above the 1.1100 mark on Thursday highlights the vulnerability of the US Dollar to economic data that hints at a weakening labor market. The release of the ADP Employment Change for August, which showed that only 99K jobs were added versus an expected 145K, is a clear signal that the US labor market might be cooling down faster than anticipated. The weak data has boosted speculation about a 50 bp rate cut in September:

With the US Dollar Index (DXY) already under pressure, the combination of the weaker ADP numbers and the recent disappointing JOLTS Job Openings data for July (which showed lower job vacancies than expected) only adds fuel to the fire. If these labor market concerns persist, the Fed may be forced to act sooner with an aggressive rate cut, which could further weaken the USD in the near term.

For EUR/USD traders, this shift in the Fed’s policy outlook creates opportunities. The market has already priced in a potential rate cut, and this has allowed the Euro to gain ground against the dollar. However, the key risk for traders lies in the upcoming Nonfarm Payrolls data. Should the NFP report surprise to the downside, EUR/USD could rally further as investors double down on expectations of an accelerated rate cut cycle by the Fed. Conversely, if the NFP data comes in stronger than expected, it may temper the current enthusiasm for a weaker USD:

Another important piece of the puzzle is the U.S. ISM Services PMI data, which will be published soon. The services sector has been a key driver of U.S. economic growth, and any slowdown in this area could further cement the narrative of a weakening U.S. economy. The forecast for the PMI is a slight drop to 51.1 from July’s 51.4, which still indicates expansion, but at a slower pace. If this data disappoints as well, it could be the final blow to the dollar for the week.

While the U.S. Dollar faces significant headwinds, the Eurozone is not without its own issues. The HCOB PMI data for the Eurozone revealed that growth is also slowing down. The final estimate came in at 51.0, a slight drop from the flash estimate of 51.2. What’s even more concerning for Euro traders is the continuous contraction in the manufacturing sector. This raises questions about the sustainability of the Euro’s strength against the USD, especially if the ECB remains cautious about further rate hikes given the slowing economic activity.