EURUSD tests 1.07 area

EURUSD continues pullback triggered by yesterday's higher-than-expected US CPI reading for March. The pair is down 0.3% on the day and trades at the lowest level in almost 2 months. The main currency pair is now testing the support zone ranging around 1.0700 mark.

- Current plunge on EURUSD reflects growing concerns about the scale of Fed policy easing in 2024. Comments from the Fed's Barkin suggest that the fourth, higher-than-forecast CPI reading is increasing central bankers' uncertainty.

- Looking at today's PPI data, we see that while the headline reading turned out slightly lower than expected, the core PPI turned out higher than suggested by forecasts and significantly higher than in February. Also, initial jobless claims came in lower than expected

- RBC Capital expects only one 25 basis point Fed rate cut this year, in December. Previous forecast called for 75 basis points of easing

- OPEC raised its forecast for US GDP growth to 2.1% in 2024 today, from the previous 1.9%

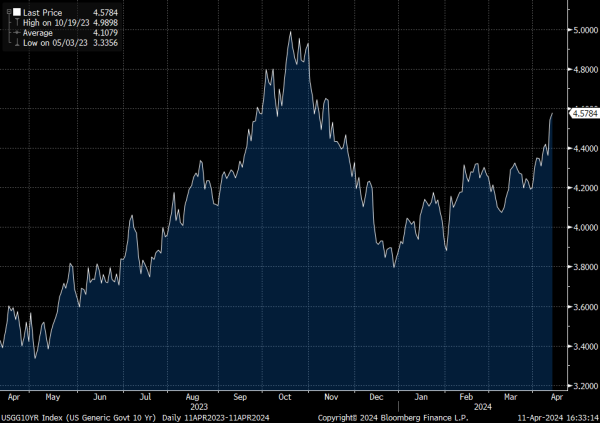

- Yields on 10-year US Treasury bonds have risen to levels not seen since the turn of October and November 2023, when the EURUSD was trading around 1.062

10-year US yield climbed to the highest level since mid-Novemebr 2023. Source: Bloomberg Finance LP

10-year US yield climbed to the highest level since mid-Novemebr 2023. Source: Bloomberg Finance LP

Hawkish comments from Fed Barking

- After rather hawkish remarks from Williams, even more hawkish comments came from Thomas Barkin from Richmond Fed. He conveyed that the inflation data "Raise questions about whether we are seeing a change in the right direction." Barkin emphasized that "We are not where we should be" although he expressed confidence that the Fed is acting appropriately so far. In his view, however, time is needed to assess the current trajectory of price pressures

- According to Barkin, the latest data looks similar to the one from end of 2023, with falling goods prices, while housing is effectively moving sideways, and services are increasing. The recent readings did not increase the belief that deflation is spreading in the economy. IMF Managing Director Georgieva highlighted the strength of the US economy and pointed out that a persistently strong dollar could become a global financial problem. If higher interest rates in the US persist for a longer period, this could become a cause for concern

EURUSD (D1 interval)

EURUSD is deepening the ongoing slide and drops further below 200-session moving average. Local lows from mid-February 2024 in the 1.0700 area are being tested at press time.

Source: xStation5