📉EURUSD tests mid-August lows ahead of US CPI

💵US CPI report scheduled on 1:30 PM BST may increase US dollar volatility

Today's U.S. consumer price inflation (CPI) report, which will be released at 1:30 PM BST, will be the most important macro reading of the week, shedding more light on whether the really very solid U.S. data seen recently will translate into a higher inflation reading and put more pressure on easing 'dovish' communication from the Fed. Wall Street is trading near historic highs ahead of the report, and bulls were not spooked by a strengthening dollar and 10-year yields, which rose to 4.09%, bouncing nearly 46 bps from September lows.

A report far above forecasts could seriously strengthen the dollar and lead to another wave of rising yields, entitling at most one rate cut this year. In contrast, a CPI below, or in line with, forecasts could reassure the market that the Fed will not be forced to change its communications (at least at this stage), and that price pressures in the economy are subsiding. Will the Fed be forced to back off from its announcement of an 'aggressive cycle' of cuts?

What to expect from today's report?

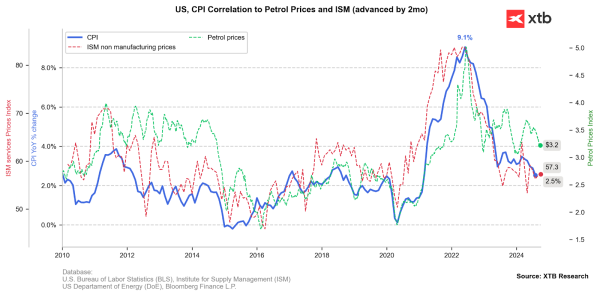

- CPI inflation is expected to fall to 2.3% y/y from the previous level of 2.5% y/y. Lower energy costs are expected to be primarily responsible for the decline

- On a monthly basis, the reading is expected to be 0.1% m/m, against a previous increase of 0.2% m/m

- Core inflation, which is more crucial from the Fed's perspective, is expected to remain at 3.2% y/y, in line with the previous reading

- On a monthly basis, growth is expected to be 0.2% m/m, slightly lower than the previous reading of 0.3% m/m. Growth of 0.2% m/m is consistent with reaching the inflation target within the forecast timeframe

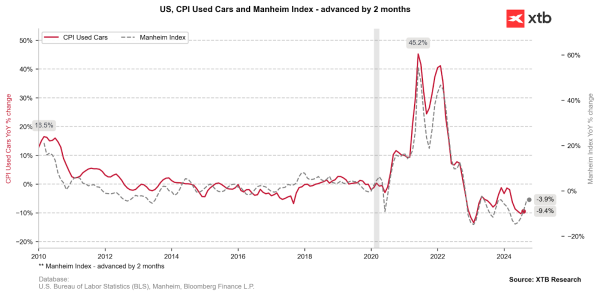

- It is worth noting that the decline in car prices has clearly slowed recently, so the impact of their prices is likely to be marginal. In recent readings, car and parts prices have had a significant impact on curbing inflation

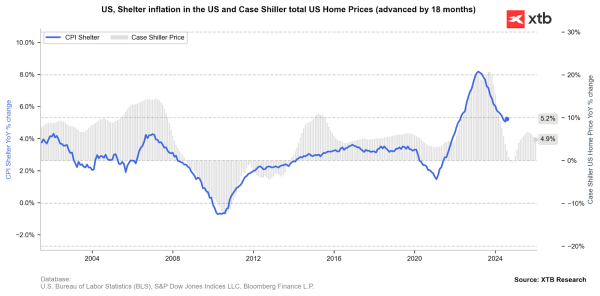

- Rental inflation and increased hotel prices will continue to be one of the main drivers for inflation

- Higher wages are also one factor that points to core inflation remaining high

Fuel prices have fallen noticeably, which is likely to lead to lower inflation. The price sub-index from the service sector remained relatively unchanged in recent readings. Source: Bloomberg Finance LP, XTB

The decline in car prices has clearly slowed. Although disinflation on an annual basis is evident, a monthly increase in prices is not out of the question. This points to continued pressure on underlying prices. Source: Bloomberg Finance LP, XTB

Rent inflation has rebounded recently, although the 18-month advance indicator in the form of Case Shiller prices indicated that rent inflation should continue to decline for several more months. Rent inflation is one of the main factors for overall and core inflation. Source: Bloomberg Finance LP, XTB

Why is inflation important to the Fed?

Recent statements by Fed members suggest that despite the recent rise in oil prices and strong labor market data, the consensus at the Federal Reserve is that price pressures are nonetheless under control and still on track for the 2% target.

- On the other hand, yesterday's minutes showed that the decision to cut 50 bps in September was not obvious, making a potentially higher-than-forecast report likely in the markets' view to almost rule out the prospect of cuts of more than 25 bps this year.

- Still stronger data from the labor market, wages, or GDP are not a 'guarantor' of higher inflation, as consumers' preferred capital allocation may have changed (rebuilding of still relatively low household savings, following the inflation wave)

EURUSD (D1 interval)

The pair weakened and fell below the key long-term support at the EMA200 level, near 1.095. On the other hand, however, the RSI shows a record oversold level, and in recent quarters the Eurodollar has repeatedly slipped below the 200-session exponential average, in response to market indecision. However, the double-peak formation looks worrying about the pair, especially in the context of recent weak publications from the eurozone.

Source: xStation5