👀 EURUSD trades flat ahead of US PPI data

📆 US PPI inflation report for July due at 1:30 pm BST

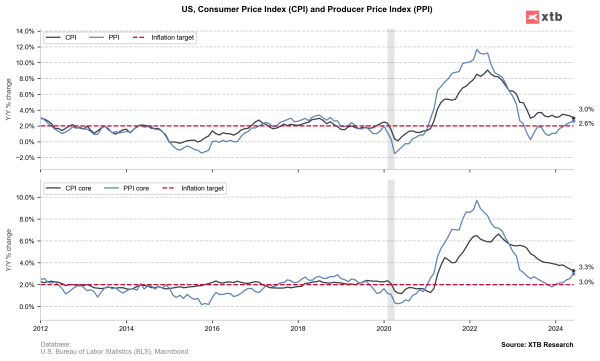

Release of US PPI inflation data for July at 1:30 pm BST is a key macro event of the day. US PPI data is usually overlooked by the markets. However, sometimes it is released ahead of the more important CPI reading and this is the case this week as CPI print will be released tomorrow at 1:30 pm BST.

The increased importance of PPI readings that are released ahead of CPI readings comes from popular opinion that they can be used as hints for the latter. However, is it so? We have taken a look at how correlation between nominal surprises in CPI and PPI data since the beginning of 2022 looks like. Results seem to contradict the popular opinion. In case of headline monthly readings as well as core monthly and core annual readings correlation coefficients range from -0.2 to +0.2, suggesting a weak correlation. Correlation looks stronger in case of annual headline CPI and PPI readings, with a coefficient of 0.4874. This suggests a moderate correlation between nominal surprises in annual headline CPI and PPI readings.

Having said that, whether today's annual headline PPI print beats or miss may be a hint at the outcome of tomorrow's headline CPI reading. Nevertheless, we want to stress again that this correlation is moderate. Taking a look at 6 CPI and PPI reports released so far this year, there were 3 monthly readings when both annual headline measures beat or miss, 1 reading when both came in-line with expectations, and 2 readings when one measure beat and the other missed. Having said that, caution is advised when treating PPI readings as CPI predictor, as correlation analysis results are inconclusive to say the least.

Source: US BLS, Macrobond, XTB Research

Tomorrow's CPI reading will surely draw more attention than today's PPI reading and also has a bigger chance of triggering large market reaction in case actual reading deviates from market expectations. Nevertheless, a market reaction cannot be ruled out today in case or beat or miss. A beat (higher-than-expected print) could trigger a hawkish reaction in the market with USD gaining, while miss (lower-than-expected print) could trigger a weakening on the USD market and further boost dovish Fed bets in money markets.

Taking a look at EURUSD chart at H1 interval, we can see that the main currency pair has been trading mostly sideways in the 1.0905-1.0945 range since the failed attempt at breaking above the 1.10 mark at the beginning of the previous week. Pair is waiting for a catalyst for a breakout from the range and investors hope that this week's US inflation data may offer such catalyst. However, it is more likely that it will be tomorrow's CPI reading rather than today's PPI print. According to technical analysis, a break above the upper limit of the range could push the pair to as high as 1.0985 area, while a break below the lower limit of the range could see the pair slide towards 1.0865 area.

Source: xStation5

Source: xStation5