EUR/USD Under Pressure Amid CPI and ECB Policy Expectations

The EUR/USD is under pressure, staying range-bound between 1.10-1.1050 during the European session. This is not surprising, given the ongoing anticipation of key economic events this week. The two significant upcoming events influencing market sentiment right now are the publication of the US CPI report for August and the ECB policy announcement.

Market participants are eagerly awaiting the release of the US CPI data for August. This data is crucial because it will provide more insights into how the Federal Reserve might approach its own interest rate policy. So far, the Fed has been somewhat cautious about initiating a full-blown rate-cutting cycle, despite mounting evidence of a slowdown in US economic growth, including weaker-than-expected job numbers in the August NFP report.

However, the CPI data could shift the landscape dramatically. A significant drop in inflation would increase the likelihood of the Fed adopting a more dovish stance and initiating rate cuts as early as September. Current consensus estimates point to an annual inflation rate of 2.6%, which would be the lowest since March 2021. A decrease in inflation would also signal that the U.S. economy is cooling, potentially justifying the need for monetary easing to prevent a sharper downturn.

On the flip side, if inflation remains sticky and fails to decrease as expected, the Fed could remain in a holding pattern, opting for a standard 25 bp cut in September. This may strengthen the dollar further, as investors would continue to view US fixed income assets as offering superior returns, especially when compared to Eurozone or Japan.

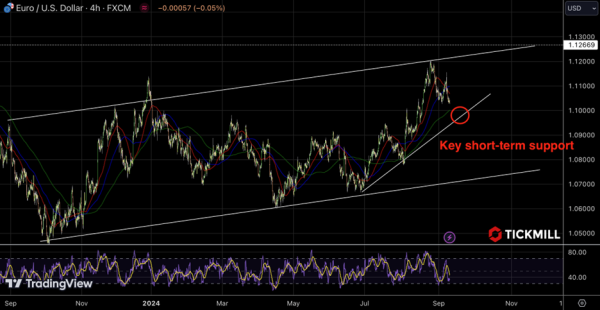

Looking at the EUR/USD 4-hour chart, the pair is currently hovering near key short-term support at the 1.10 level. The pair is in a clear upward channel, with recent price action indicating a pullback after hitting resistance near 1.1270. Given the current momentum, a retest of the 1.10 level seems likely, as it acts as both psychological and technical support. If this level holds, it could provide the base for a bullish reversal, allowing the pair to resume its upward trajectory:

The ECB is expected to cut interest rates by 25 basis points on Thursday, marking the second rate cut in this cycle of monetary easing. This decision follows a June rate cut, with the ECB having opted to keep rates unchanged in July. The timing of this cut is critical, as it comes amidst growing concerns over the Eurozone's economic slowdown. While the ECB’s move is intended to stimulate economic activity, lower interest rates typically put downward pressure on the euro, making it less attractive to investors compared to higher-yielding currencies like its main counterpart, the US Dollar. This is especially true for fixed-income investors, who seek out higher returns and may shift their portfolios away from euro-denominated assets.

There’s a possibility that a deeper bearish trend in EURUSD could unfold if the ECB signals that this is part of a more extended series of cuts. Traders will be closely watching ECB President

Christine Lagarde’s comments for any hints on future monetary policy, including how aggressive the central bank might be in stimulating growth. If the ECB downplays the likelihood of further cuts or adopts a more dovish tone, the euro could stabilize or even recover in the longer term.

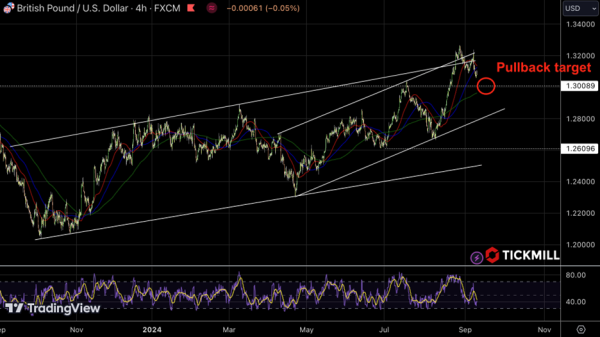

In the UK, the British pound has shown some resilience, buoyed by stronger-than-expected job growth data from the Office for National Statistics:

The labor market remains tight, with unemployment ticking down to 4.1%. However, wage growth appears to be moderating, which could temper the BoE’s appetite for further interest rate hikes. The BoE, much like the ECB and Fed, finds itself in a delicate balancing act, trying to stimulate growth without igniting inflation.

Still, the UK economy faces considerable headwinds, with GDP and factory data due later in the week expected to shed light on how well the economy is holding up in the face of these challenges. If the data disappoints, it could lead to a selloff in the pound, especially if investors begin to price in the possibility of a more dovish BoE.