EUR/USD, USD/JPY and AUD/USD Forecast – US Dollar Moves Back And Forth After NFP

EUR/USD Technical Analysis

The Euro has been all over the place during the course of the session on Friday as the jobs report came out rather disappointing, but at the same time, you have to recognize that the employment numbers in the United States are skewed by the hurricane damages and issues going on, which are still going on in places like North Carolina. So, with all of that being said, I don’t read too much into this other than the market doesn’t really know what to do with this information.

It does look like the 200-day EMA has caused a little bit of resistance, so we’ll have to wait and see if the market breaks back down below the 1.0850 level, because I think that would be a very bad sign. On the other hand, if we do rally from here, then I’ll be looking at the 1.0950 level for any signs of potential exhaustion that I can short.

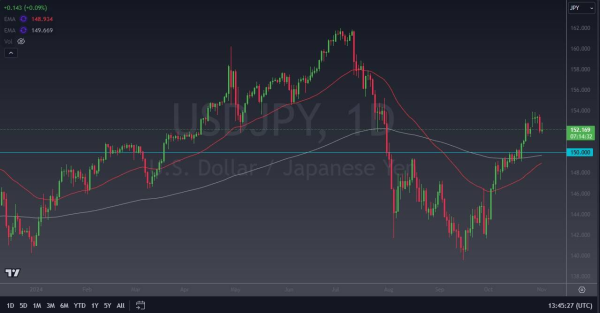

USD/JPY Technical Analysis

The US dollar fell a bit in the early hours on Friday, turned around, rallied, and then fell again as the jobs number of course continues to cause a lot of hectic trading. As things stand right now, this is still a market that I think is going to be a bullish one for a while, but traders are starting to ask questions whether or not the Federal Reserve will have to cut rates by another 25 basis points.

Quite frankly though, it’s probably worth noting that most bond traders don’t seem to care, and they’ve been running rates higher so at the end of the day that’s actually what matters not what the Federal Reserve says. The 200-day EMA currently sits just below the 150 yen level so there’s your floor.

AUD/USD Technical Analysis

The Australian dollar did fall initially during the day but turned around to show signs of life as it looks like the 0.6550 level continues to act as a bit of a floor. Whether or not the Aussie dollar takes off from here remains to be seen, but if it does, then we could go as high as 0.6650 above where the 200 day EMA currently sits. In that area, I think you would have a situation where any signs of weakness would probably have traders selling.

On the other hand, if we turn around and break down below the 0.6550 level on a daily close, that would be very negative, and it could send the Aussie tumbling. I think this is more about risk appetite and the US dollar than it is about the Australian dollar at the moment.

For a look at all of today’s economic events, check out our economic calendar.