EUR/USD, USD/JPY and AUD/USD Forecast – US Dollar Stable in Early Friday

EUR/USD Technical Analysis

The Euro has been back and forth against the US dollar during the early hours on Friday, but at this point in time, the candlestick that actually catches my attention is Thursday’s, and this is because it was so massively bullish. I think we are possibly looking at a potential bounce, but it’s not a bounce that I’m willing to buy. I would rather see signs of exhaustion than start shorting. This would be especially true near the 1.0875 level, and then again at the 200-day EMA.

I don’t know that that will happen, but it would be a logical place to pick up cheap US dollars if I get the opportunity. If we do break down from here, keep in mind that somewhere around 1.0775, we should see a significant amount of support, and therefore, we have to pay close attention to that as well. If that were to be broken through to the downside, it would be horrific for the euro.

USD/JPY Technical Analysis

The US dollar, of course, is quite against the Japanese yen as well as we continue to dance around the 152 yen level. This is a market that continues to pay you swap at the end of every day, so I think that has a lot to do with what we are watching here. Ultimately, I am a buyer of dips and have no interest in shorting this pair because quite frankly, the Bank of Japan has finally admitted that it cannot do much as far as monetary policy is concerned, due to the heavy debt burden of the Japanese.

With that, the interest rate differential continues to favor the greenback, and we should, at least in theory, continue to see upward momentum. This of course was exacerbated this week as the 10-year yield had spiked a bit in America.

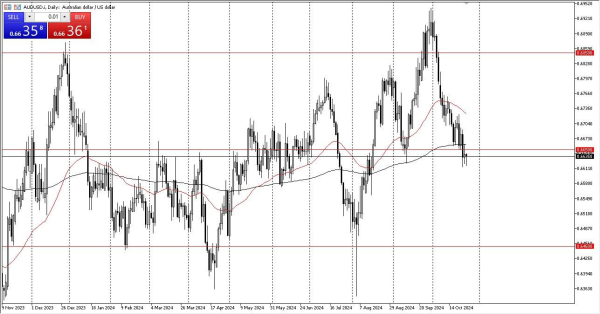

AUD/USD Technical Analysis

The Australian dollar initially fell against the US dollar, but it is trying to put up a fight, as we hang around just below the crucial 0.6650 level. Just above there, we have the 200 day EMA, so I certainly think there is a bit of a ceiling in the short term, but I don’t know that we cannot bounce. I just think that there’s a little bit of technical trouble. Out of the three pairs in this video, the Australian dollar, for me at least, is the least interesting.

Keep in mind that Australia of course is highly influenced by Asia and global trade, so we do have to keep an eye on a lot of moving pieces. All of that being said, if the Aussie did drop below the 0.66 level, then I might be a seller of this pair looking for a move down to the 0.6450 region. As far as the upside, if we could get above the 200 day EMA, I would then focus on the 50 day EMA to see if we get a little bit of exhaustion.