Focus on ASML and Netflix as Q3 earnings are unleashed

Key points

- Q3 earnings focus: The technology sector is at the center of Q3 earnings, with high expectations for ASML and Netflix. ASML’s outlook is critical for AI, while Netflix focuses on improving profitability and operating margins.

- Financial and sector outlook: Financials like JPMorgan and Wells Fargo delivered strong earnings, though softness is expected in 2025. Utilities and real estate performed well, but investors may reset expectations without outlook changes.

- US inflation trends: Recent US inflation data indicates potential upticks, leading to fewer expected rate cuts and pushing the 10-year yield above 4%.

- Key events this week: Important earnings releases include Bank of America, ASML, and Netflix, alongside ECB rate cuts, the German ZEW survey, and US jobless claims.

What to expect in the Q3 earnings season

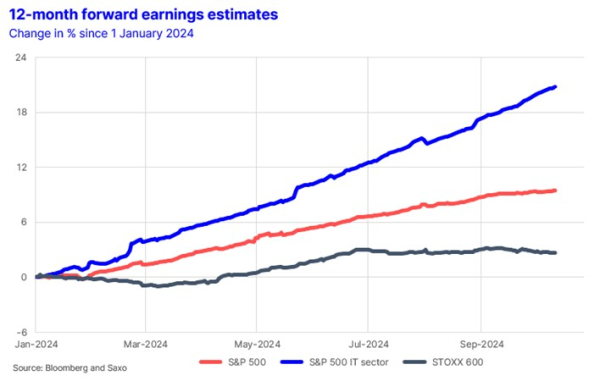

The Q3 earnings season is all about the US technology sector as earnings expectations have risen the most for this sector and carried the indices higher. If technology companies can not deliver against those rising expectations then we are in for setback. The first tests will already come in the week ahead with ASML earnings on Wednesday and Netflix earnings on Thursday. ASML is all about new orders and a positive outlook is critical for the AI theme. Netflix’s earnings are all about improving operating margin and profitability.

Financials are off to a good start with strong earnings and outlook from JPMorgan Chase, but investors should expect some softness during 2025 according to the CFO. Wells Fargo also delivered good Q3 earnings driven by strong performance in its investment banking division offsetting some weakness in its net interest income. Going into the Q3 earnings, the utility and real estate sectors have performed strongly so here investors expect a significant change in the outlook or else we could see a reset of expectations in those two sectors.

The list below highlights all the most important earnings releases in the week ahead:

- Tuesday: PNC Financial Services, Johnson & Johnson, Bank of America, Goldman Sachs, Citigroup, Interactive Brokers, UnitedHealth, Progressive, Charles Schwab, Ericsson

- Wednesday: ASML, Morgan Stanley, CSX, Kinder Morgan, Abbott Laboratories, US Bancorp

- Thursday: ABB, Investor, Elevance Health, Netflix, Intuitive Surgical, Blackstone, Marsh & McLennan, Trust Financial, Travelers, Nordea, Nokia, Schindler

- Friday: CATL, Zijin Mining, Volvo, American Express, Schlumberger, Procter & Gamble

Are we having an US inflation reset?

The recent US inflation report for September showed that the services inflation less energy (also called core services inflation) had its second month of month-to-month gains that are above the 6-month moving average suggesting that inflation is potentially picking up again. This has caused the market to expect fewer rate cuts by June next year and pushed the US 10-year yield above 4% again.

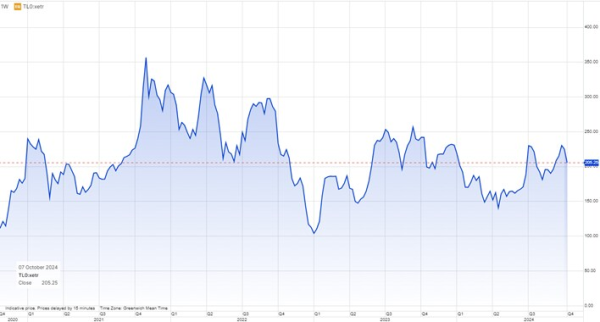

Tesla Robotaxi event flunks

Tesla shares are down 6.5% in German trading as the “Robotaxi” event last night is seen as a distant and unrealistic project. The “Robotaxi” was unveiled as the Cybercab and is expected to cost less than $30,000 with expected production in 2026. Tesla also unveiled a Robovan that can carry 20 people. The production deadline and not least regulatory approval for self-driving cars in the US are big question marks for investors and the reason why for now the verdict is negative.

The week ahead: Q3 earnings, ECB rate decision, ZEW, and US initial jobless claims

- Earnings: In the coming week there will be 70 earnings releases in the earnings universe we track. Out of those, the three most important to watch are Bank of America (Tue), ASML (Wed), and Netflix (Thu). From a surprise perspective, Bank of America will matter less because of earnings from JPMorgan Chase and Wells Fargo are already know. ASML is expected deliver revenue growth of 7.5% YoY as delivered orders are picking up – important earnings release for outlook of semiconductors. Netflix is expected to deliver revenue growth of 14.4% YoY as the streaming service is firing on all cylinders.

- ECB: On Thursday, the ECB is expected to cut its policy rate by 25 basis points and likely maintain that it is data dependent going forward. The market is pricing another 25 basis points cut at the December meeting and then two more cuts by April.

- German ZEW: On Tuesday, the German ZEW survey is expected to show that expectations for the German economy are improving again following some weak months. Fiscal impulse in China could help the German economy going forward.

- US initial jobless claims: The recent figures were surprisingly high and “one is change, and two is a trend” as the saying going, so the upcoming US initial jobless claims on Thursday are quite critical for assessing the temperature in the US labour market. If the number comes back to a low figure then it could lift the US 10-year yield.

Previous weekly equity market updates

- The potential inflation dangers of China stimulus and geopolitics (4 October 2024)

- Is China back, or what? (27 September 2024)

- The Fed’s great balancing act (13 September 2024)

- Nvidia earnings will show another quarter of explosive growth (23 August 2024)

- The big rebound in equities, Palo Alto earnings on tap (16 August 2024)

- European banks: Strong Q2 earnings as rate cuts loom (14 August 2024)

- Low recession probability, strong earnings, and US inflation (9 August 2024)

- Election drama, Tesla bounce, and earnings kick-off (5 July 2024)

- US election heats up, Alfen rout, and Micron earnings (28 June 2024)

- French election, king Nvidia, and FedEx earnings (21 June 2024)

- Tech rally, inflation surprise, and EU trade war (14 June 2024)

- AI bonanza drives new highs and dangerous index concentration (7 June 2024)

- Chinese setback, AI woes, and ECB decision (31 May 2024)

- Nvidia earnings, electrification boom, and bubbles (24 May 2024)

- New all-time high on speculative stocks comeback (17 May 2024)