FOMC Preview: Can Rate Cut Signals Meet the High Dovish Bar?

Key points:

- The FOMC meeting is the key event this week, with the market closely watching for signals of a September rate cut. Recent data shows progress in disinflation and some loosening in the labor market, which has led to expectations for a Fed Put.

- However, the market is currently pricing in a more dovish stance than what was indicated by the June dot plot. This includes expectations for substantial rate cuts, which exceed the 25 basis points projected for 2024.

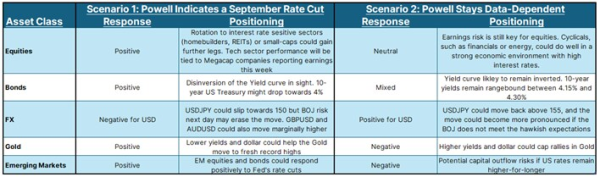

- We analyse how different asset classes react based on whether Fed Chair Powell signals a September rate cut, spurring the market to price in more easing, or his rate cut signals fall short of market expectations.

This week’s FOMC meeting is likely to be pivotal. While the target range for the Fed funds rate is expected to remain unchanged at 5.25-5.50%, markets are closely watching whether Chair Powell will signal a September rate cut. This anticipation is fueled by recent data showing increased confidence in the disinflationary process and emerging signs of weaknesses in the labor market.

Headline CPI rose 3% YoY in June, marking its slowest annual increase in a year. On a MoM basis, inflation fell 0.1% for the first time since May 2020. Core CPI increased by just 3.3% YoY, the slowest rise since April 2021, and ‘supercore’ inflation saw its second straight monthly decline, to 4.7% YoY. Friday’s PCE numbers also showed that price pressures were coming off, and could likely give the FOMC greater confidence that inflation is moving closer to the Fed's 2% target.

On the labor market front, headline nonfarm payrolls rose by 206k in June, slightly above expectations. However, substantial net revisions of -111k to the prior two months' data brought the 3-month average of job gains down to 177k, significantly below the 250k 'breakeven' pace required for employment growth to match labor force growth. Additionally, the unemployment rate rose to 4.1%, the highest since November 2021. Other labor market indicators such as JOLTS job openings and initial jobless claims are also showing signs of loosening in the labor market.

Despite these indicators, the FOMC is unlikely to commit to any specific policy action immediately, given that the September meeting is still seven weeks away. This cautious approach could disappoint the market, which is currently pricing in more than 100% odds of a September rate cut and about 70 basis points of easing by year-end, far more dovish than the 25 basis points suggested by the June dot plot for 2024. This setup highlights significant two-way risks heading into this week’s FOMC meeting.

Scenario 1: Powell Indicates a September Rate Cut

Market will be encouraged to price in more rate cuts if Fed signals that keeping rates too high could jeopardise the desired soft landing. This could be positive for equities, especially interest rate sensitive sectors such as homebuilders, utilities and consumer discretionary. The rotation trade could get more legs, keeping small-caps in favor.

This could also be a positive for short-end bonds, while being a negative for the US dollar. We discussed the Powell Put in this article last week.

Scenario 2: Powell Misses the Market’s High Dovish Bar

If Powell maintains a data-dependent policy framework, that could upset investors who have already positioned for a Powell Put. However, market may find it difficult to shift expectations hawkish given that the data is supportive of rate cuts. There could be knee-jerk reactions in this scenario, which may be negative for equities and positive for the US dollar. However, these are unlikely to erase the long-running Fed put expectation, suggesting that risk-reward could still remain tilted towards positioning for rate cuts.

The below table shows potential market response and positioning under the two scenarios discussed above.

Recent Macro articles and podcasts:

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

- 28 Jun: UK Elections: Markets May Be Too Complacent

- 24 Jun: Macro Podcast: Is it time to diversify your portfolio?

- 12 Jun: France Election Turmoil: European Equities Amidst the Upheaval

- 11 Jun: US CPI and Fed Previews: Delays, but Dovish

- 10 Jun: Macro Podcast: Nonfarm payroll shatters expectations - how will the Fed react?

- 3 Jun: Macro Podcast: It is a rate cut week