Forecast for EUR/USD on August 15, 2024

EUR/USD

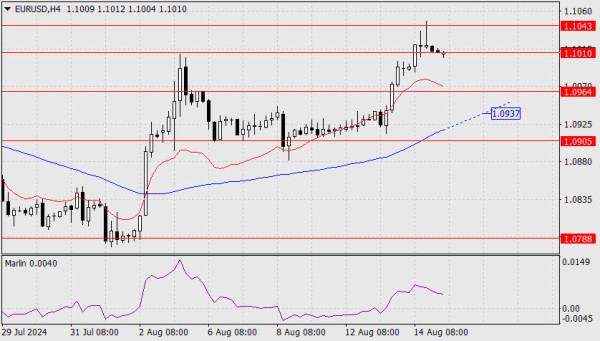

The euro reached the target level of 1.1043 yesterday. Trading volume was average. In general, since August 2nd, when trading volume was the highest in the past two months, it has been decreasing. The Marlin oscillator's signal line is slightly turning down precisely from the upper boundary line. If this isn't a price reversal, it's certainly a correction. In case of a correction, if the price falls below 1.1010, a subsequent consolidation above this level will allow for a sustained rise with a target at 1.1085.

It is still far from stable signs of a downward reversal. A more definitive sign would be if the price falls below the support level of 1.0905. However, around the level of 1.0850, the price will have to struggle with the MACD line.

We believe that a fundamental shift in sentiment will occur in September during the Federal Reserve meeting, where the rate will be cut by 0.25% rather than the 0.50% currently expected by market participants. The Fed has already signaled that such a step might be excessive; for instance, Michelle Bowman mentioned this on Sunday, but investors are still reacting weakly to these warnings. If market participants calmly accept these signals (which will likely be reiterated), the euro may experience a medium-term decline sooner.

In the 4-hour chart, the price is trying to stabilize below the 1.1010 level. The Marlin oscillator is steadily declining. The MACD line is below the 1.0964 level. We will monitor the price behavior at each technical support level.